Oil prices continue to trade in a market defined by structural oversupply, yet recent events in Kazakhstan underscore how temporary supply disruptions can contribute to short-term price support, even when the broader fundamental outlook remains bearish.

Over the past several weeks, crude flows from Kazakhstan were constrained by a combination of upstream outages and midstream bottlenecks. Production at the Tengiz and Korolev fields was disrupted after fires at power-generation facilities forced operators to halt output, while exports were simultaneously limited by operational issues at the Caspian Pipeline Consortium (CPC) terminal on the Black Sea. With only one of three moorings operational, loadings of CPC Blend were repeatedly disrupted by weather and infrastructure damage, tightening near-term supply.

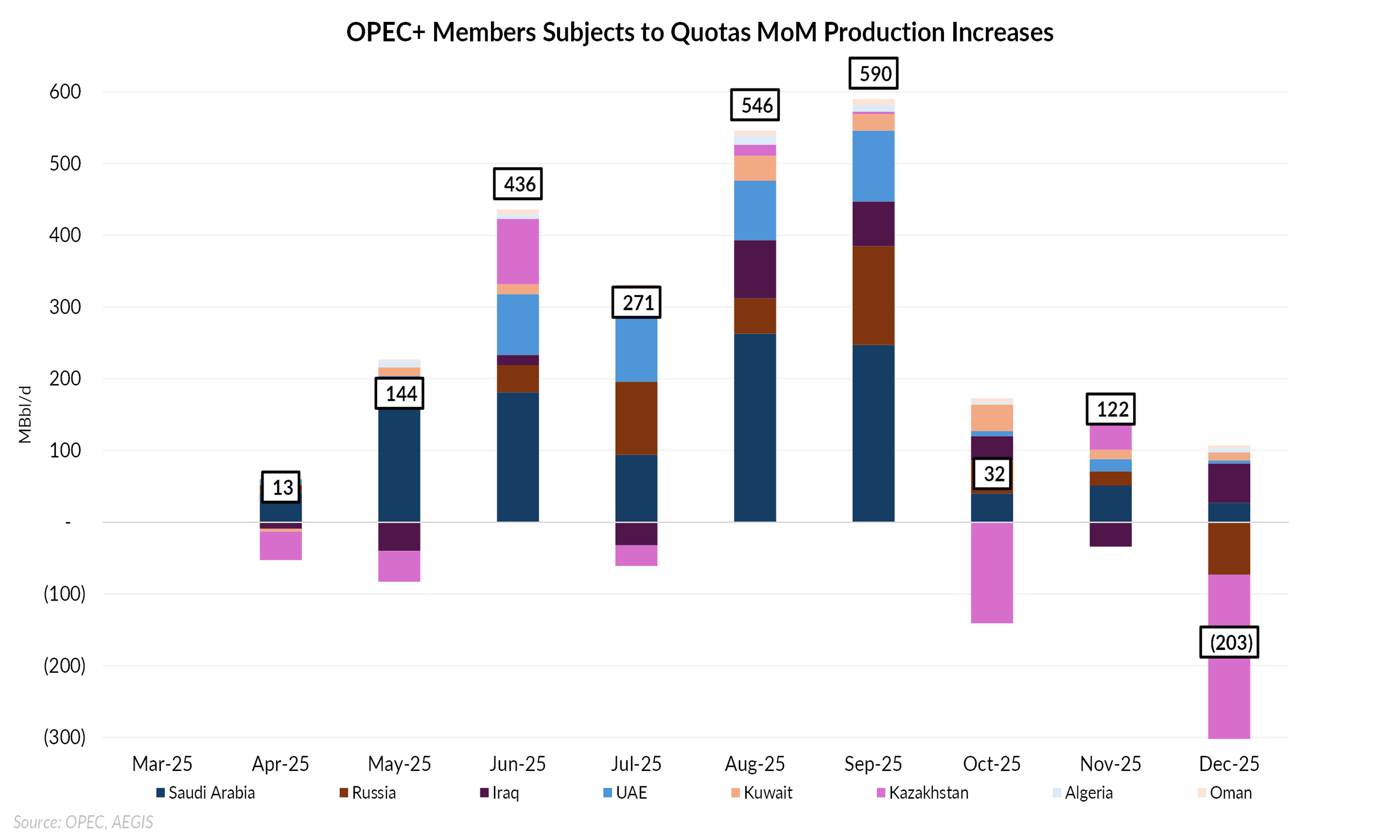

OPEC data confirms the impact on Kazakhstan’s production. According to the latest Monthly Oil Market Report, Kazakhstan’s crude output fell from 1.759 MMBbl/d in November to 1.522 MMBbl/d in December, a decline of roughly 237 MBbl/d month-on-month. This move is reflected in the first chart, which tracks month-over-month production changes among OPEC+ members subject to quotas since April, when OPEC+ began unwinding previously stalled production. Kazakhstan’s output fell sharply in December as disruptions at the CPC export system constrained flows.

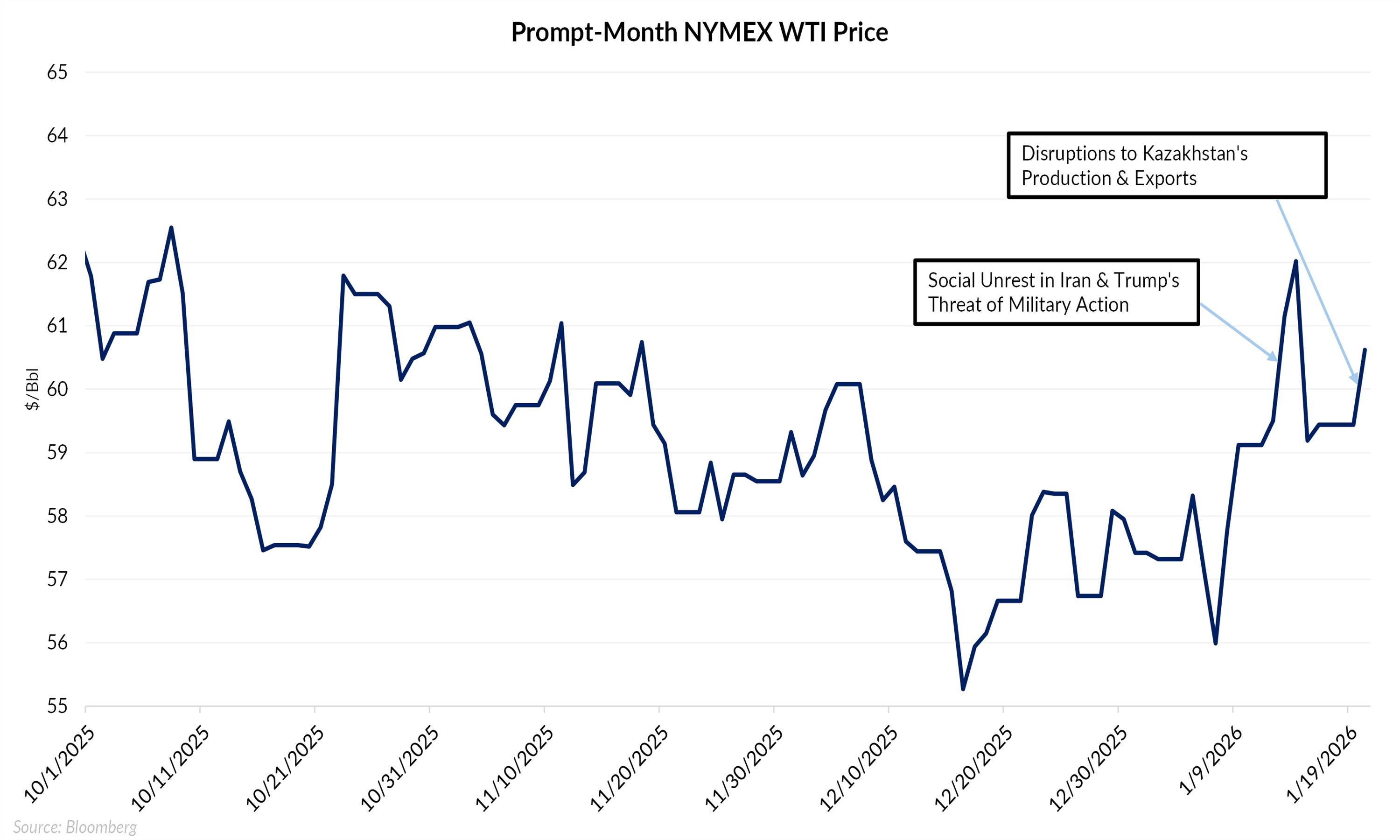

Early in the week, crude prices rose as the market repriced near-term physical availability, with disruptions in Kazakhstan supporting prices. As shown in the second chart, last week’s price spike was driven primarily by heightened geopolitical risk tied to tensions around Iran and U.S. rhetoric regarding potential military action, while this week’s rally was likely more closely linked to Kazakhstan-related supply disruptions.

Although the triggers differed, the underlying dynamic was similar. Prices reacted quickly to perceived near-term supply risk, even as the longer-term supply and demand outlook remained largely unchanged. As concerns around Kazakhstan’s export disruptions ease and CPC operations move toward normalization, prices retreated from weekly highs.

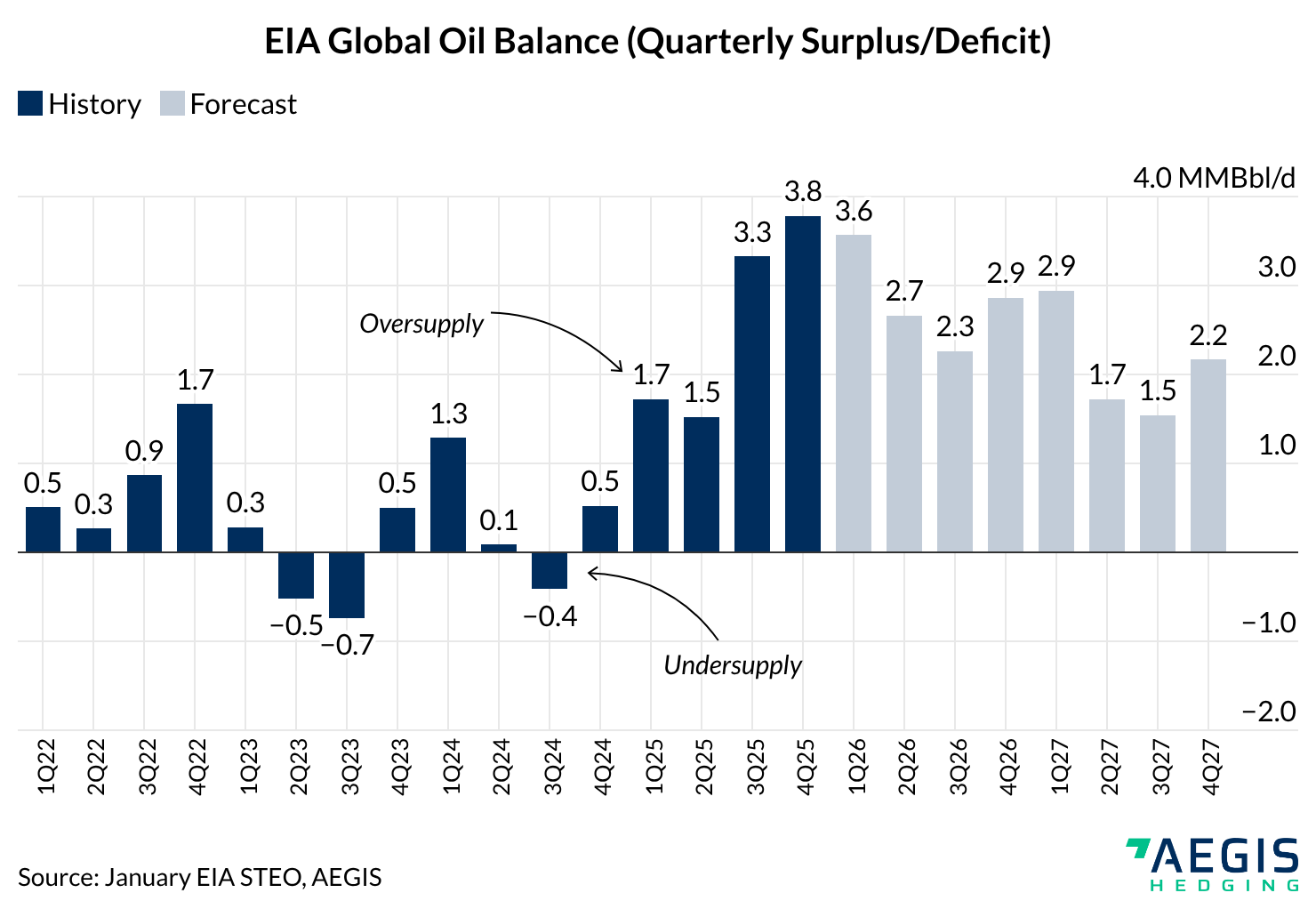

The latest EIA Short-Term Energy Outlook reinforces that these episodic disruptions are unfolding against a backdrop of persistent oversupply. As shown in the third chart, the STEO forecasts continued global inventory builds through 2026, with implied stock increases averaging roughly 2.8 MMBbl/d as production growth continues to outpace demand.

In this context, Kazakhstan’s disruptions represent temporary supply shocks rather than structural shifts in the global balance. While short-term disruptions can still drive meaningful price reactions, they rarely sustain momentum without lasting supply losses. In an oversupplied market, rallies driven by outages or geopolitical risk tend to fade quickly, leaving prices ultimately anchored by the broader surplus in global oil fundamentals.