Looking for something specific? Jump to a section:

Commentary Outlook & Notes Market-Relevant Events Infrastructure Supply Chart Pack

Haynesville basis prices surged in January as a winter storm disrupted supply across the South Central region, although gains were limited to the front of the curve. The forward curve is relatively flat for the next two years, outside of seasonal dynamics. Going forward, prices should remain well-supported by ample pipeline space and strong LNG demand in southern Louisiana.

Commentary

February 3, 2026: The prompt month CG Mainline basis contract reached a multi-year high of $0.01/MMbtu in January, as winter storm Fern impacted the eastern US. However, NGPL TXOK basis fell to a multi-year low of -$1.23/MMbtu. Supply in the region was briefly impacted, with dry gas output falling more than 1 Bcf/d to 13.18 Bcf/d, as gas wells froze off. Over the course of this winter so far, forward prices have traded slighlty lower, despite the strength in near-term prices. It still appears that activity and production growth in the Haynesville may be lagging behind what will be needed to serve new LNG demand this year.

December 29, 2025: NGPL TXOK basis prices have turned sharply lower, with the rolling prompt contract at the lowest level since July. Forward prices have moved lower as well, with the Winter '26/'27 seasonal strip down about 5c from the start of December. Columbia Gulf Mainline basis has also moved lower, but not as much as NGPL TXOK. Gas production in the region has remained stagnant, with output consistently at about 14.3 Bcf/d since November. Haynesville production will likely need to rise throughout 2026 to meet new LNG demand, but the rig count has not yet increased substantially. While Lower-48 natural gas inventories recently fell below the five-year average, South Central region storage remains near the top of the five-year range.

December 1, 2025: Since summer concluded, prompt month CGM basis prices have moved higher, but prompt NGPL TXOK basis has remained relatively flat. Prices for next winter have trended higher slightly but remain near or below year-to-date highs. Spot prices in the region have climbed to the highest level since last winter, driven by an increase in Henry Hub prices, according to data from Bloomberg. LNG demand in Southern Louisiana has continued to climb, reaching new records, as Plaquemines LNG reached 4 Bcf/d. Meanwhile after production fell sharply in October, output has rebounded to levels similar to what was seen over the summer, of around 14.5 Bcf/d.

October 30, 2025: Price action has been relatively muted through the fall 2025 shoulder season, with prompt month CGM continuing to trade in a range between -$0.30/MMbtu and -$0.25/MMbtu. The forward seaosnal strips have also remained broadly in their summer ranges. Meanwhile, gas demand in Southern Louisiana has increased sharply as Plaquemines LNG continues to ramp up. Demand should continue to rise this winter and throughout 2026. After a sharp 1.5-2 Bcf/d increase this summer, Haynesville production has slid to the bottom of this years range, with output in October averaging about 13.5 Bcf/d compared to highs seen in August of 14.9 Bcf/d.

September 23, 2025: Prompt month CG Mainline Basis averaged about -$0.35/MMbtu this summer, but has recently traded as high as -$0.24/MMbtu. Forward prices for Winter '25/'26 have gained 10c from year-to-date lows, nearing the highest level seen so far in 2025. NGPL TXOK has posted similar gains, with prices moving higher over the past few weeks.

Haynesville Basis Outlook and Notes

|

Summer 2025

The pace of Haynesville supply continues to lag what many are calling for to solve the incoming demand surge from LNG.

Production is down about 3 Bcf/d from the 2023 peak. This has opened up pipeline capacity for supply to leave the basin. Local gas basis is trading at expected levels with little stress on egress.

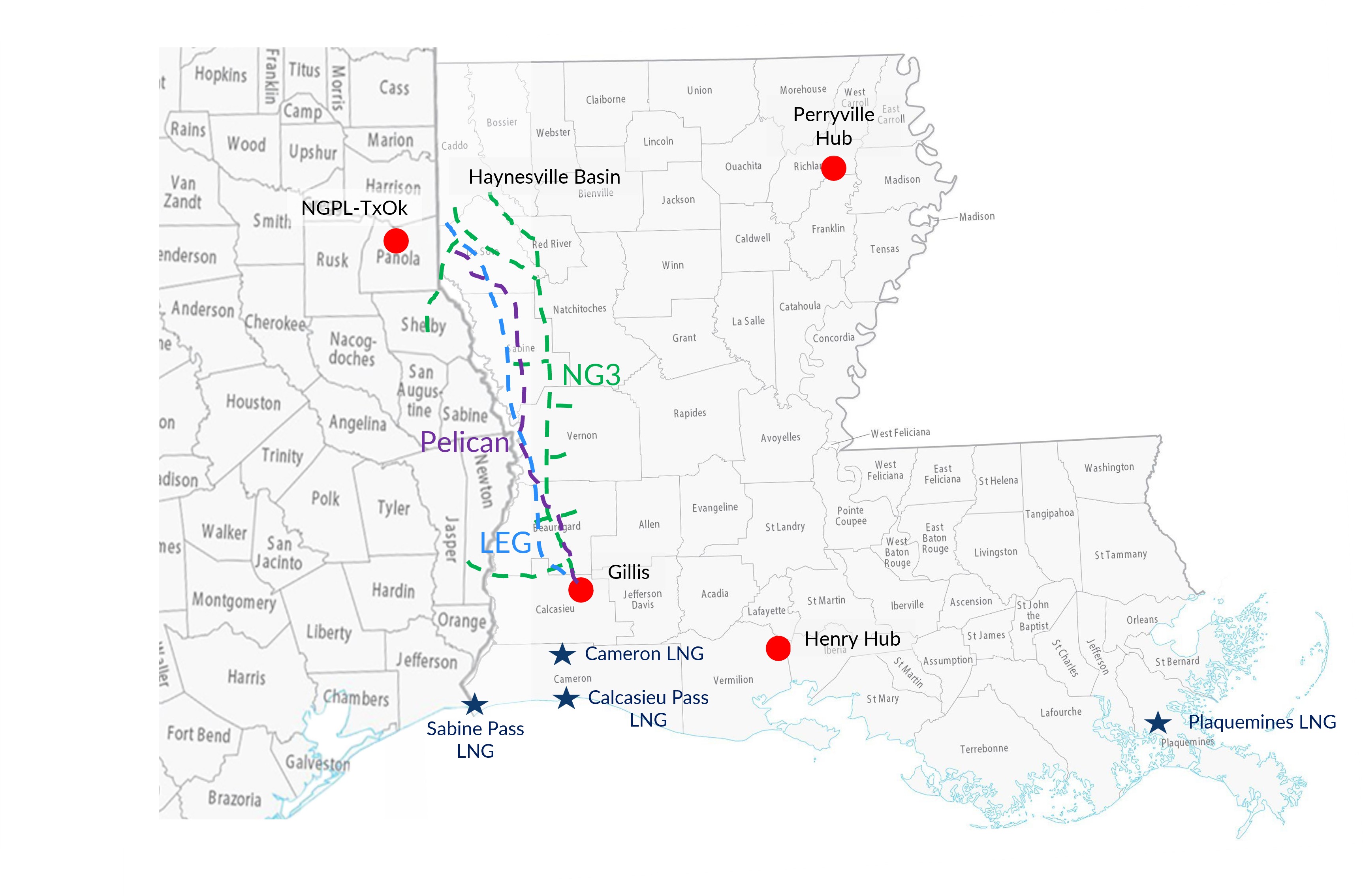

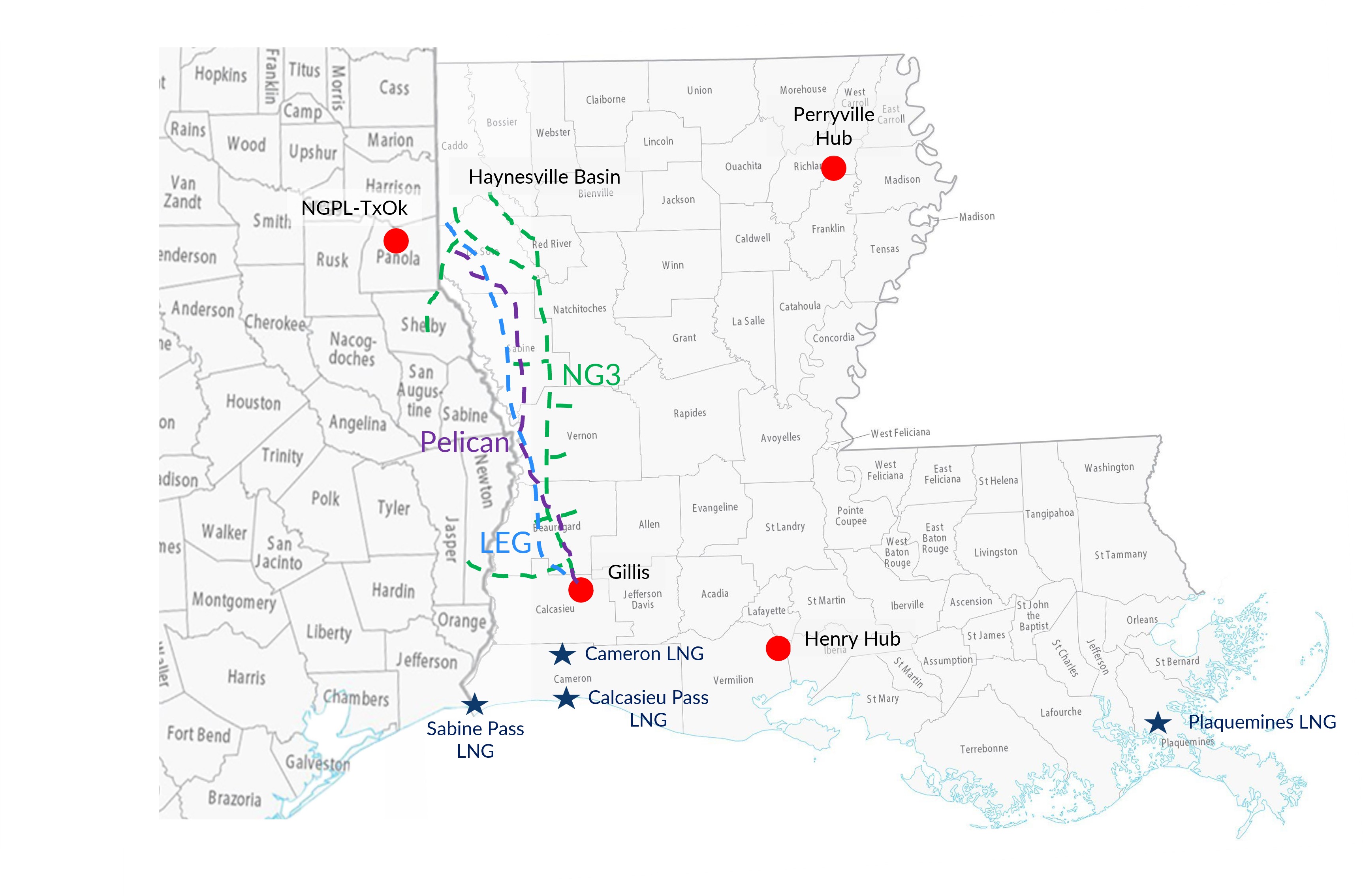

New pipeline capacity comes online later this year with LEG and NG3. These new pipelines will provide additional takeaway capacity in the preferred north-to-south route from Haynesville to Gillis area.

|

Winter 2025-2026

The forward curve shows attractive pricing for basis in winter. The Jan and Feb contract were only -$0.14/MMBtu and -$0.11/MMbtu from Hub as of June 10.

There is a sizable "call-on-supply" coming out of the Haynesville by 2026. LNG demand south of Gillis is on the rise this year and next. Based on the latest quarterly calls from local producers, we see the amount of growth needed by year-end and into 2026 as more than what has been guided by the areas leading producers. The region will likely tap DUCs and DTILs to grow production. We may see production edge higher without a significant increase in rig count.

|

Summer 2026

All eyes will be on what Haynesville supply is able to do by middle of 2026. There are doubts that production will be enough to meet the LNG demand. If this is true, Henry Hub prices will rise as there would be an imbalance between demand growth from LNG and what the Haynesville would be able to provide.

This could mean that in order to get producers in the region to grow enough, Henry Hub gas prices need to rise further. Even if the Haynesville grows, new pipes that will enter service in late 2025 should provide ample egress capacity for some time.

|

|

|

For more discussion on basis price moves and the current forward curves:

For more discussion and charts, jump to our outlook and chart pack. Remember, the local market is influenced by the broader gas market. Consult our Gas Macro Outlook (note hyperlink to another article) for more.

|

Recent Market-Relevant Events

7.3.2025

Delfin LNG secures contract ahead of FID

|

7.29.2025

Louisiana Energy Gateway begins shipping gas

|

7.29.2025

NG3 set to boost Haynesville gas egress

|

|

|

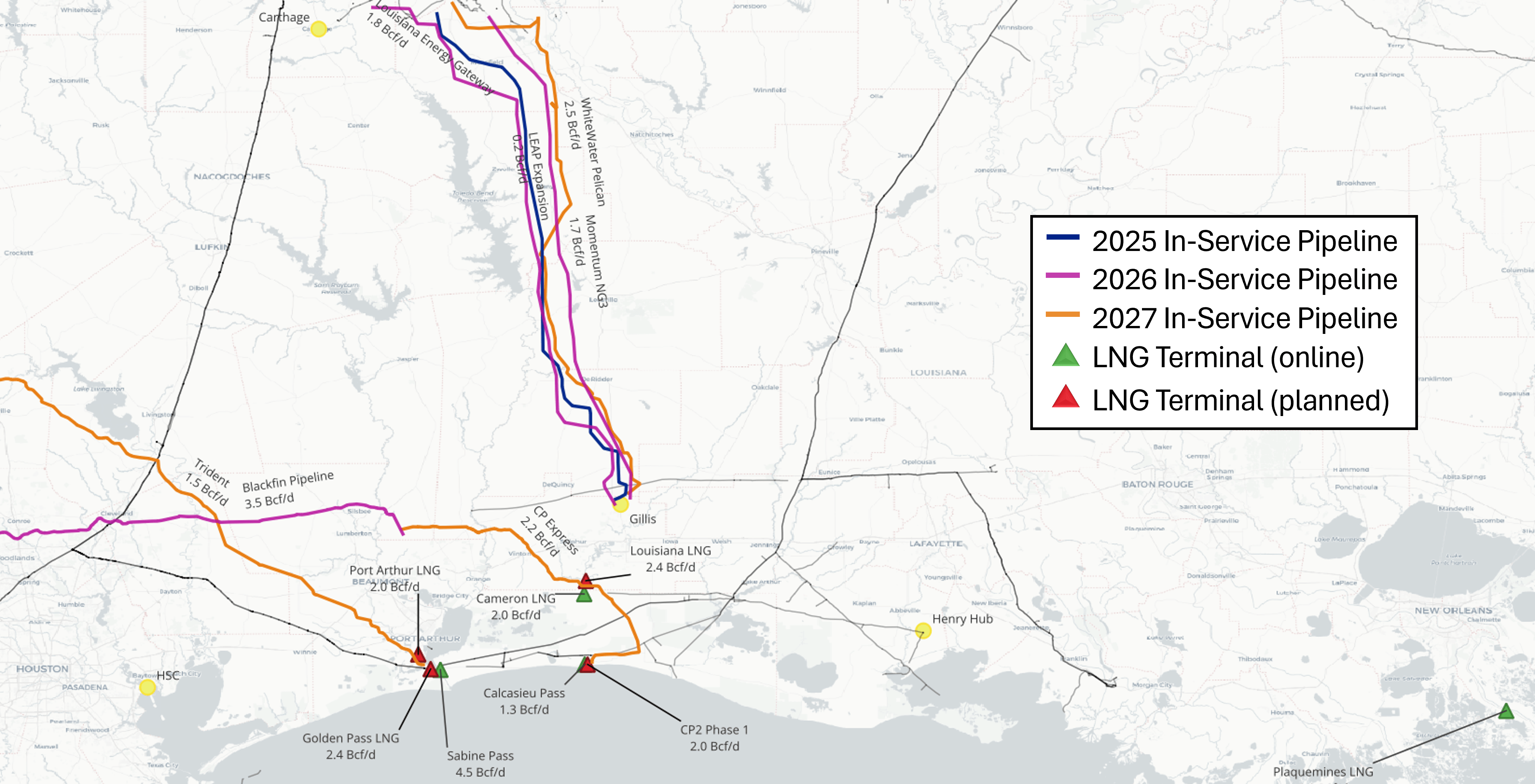

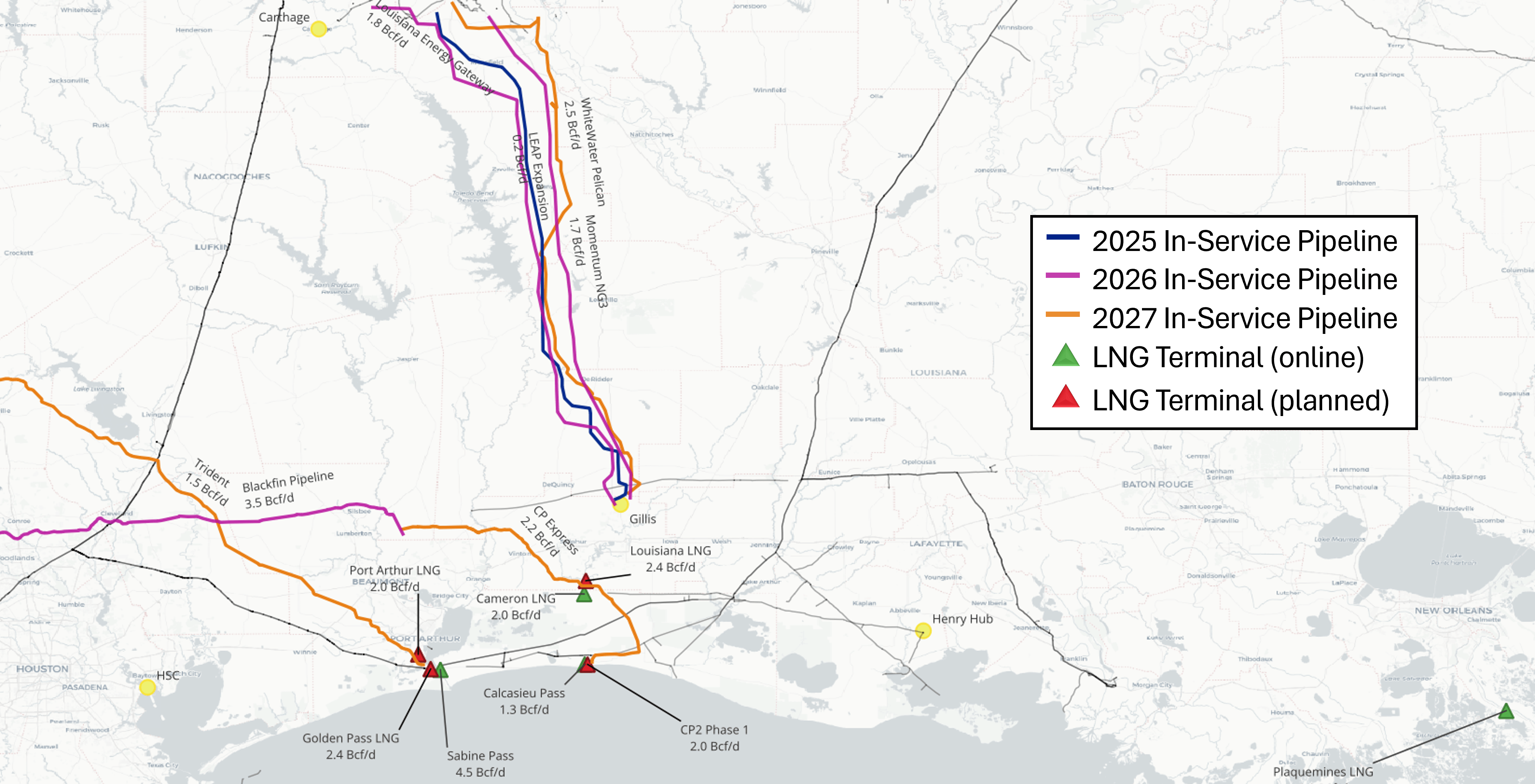

There is currently ample pipeline space available from the Haynesville into Southern Louisiana, due to the buildout in recent years and drop in production in 2024. Infrastructure and pipeline development will continue as supply grows sharply and more LNG export facilities are built. There are not expected to be any major constraints to getting gas out of the production area in the near-term.

|

For a discussion of production outlook:

Below are the most market-relevant infrastructure projects that appear to be funded and going forward. The projects that offer intra-region capacity (egress) are also shown in the chart above.

Note: Deeper discussion included below the map.

|

Gas Pipeline Projects

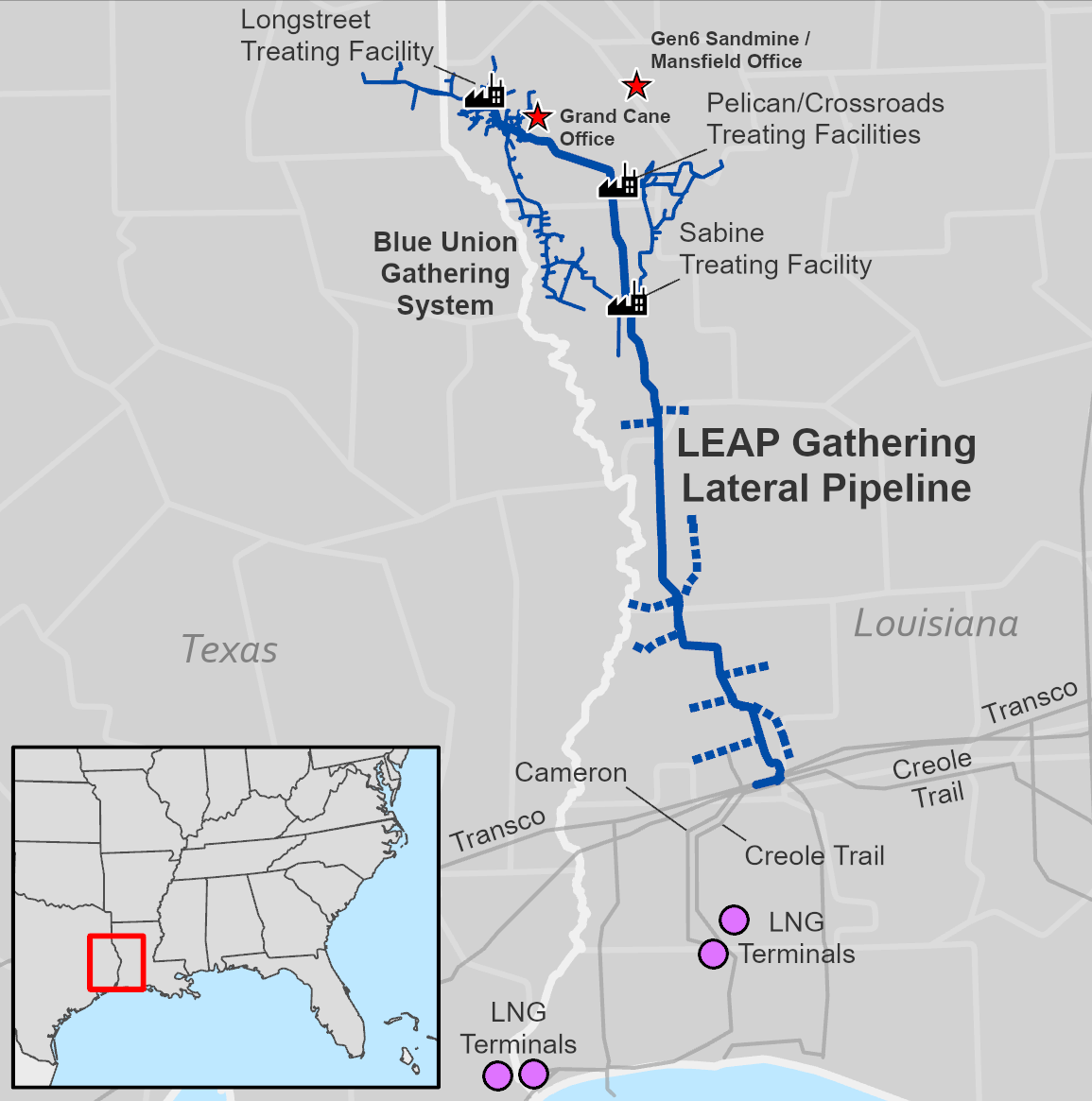

LEAP Expansion Phase 4

In-service date: Q1 2026

Capacity: 0.2 Bcf/d

|

Source: DT Midstream

|

|

|

LEAP Expansion Phase 4 - Pipeline operator DT Midstream announced a final investment decision on another 200 MMcf/d expansion of its Louisiana Energy Access Pipeline gathering system, giving the project an in-service target of 2026 in line with projections of a wave of new LNG feedgas demand along the Gulf Coast.

|

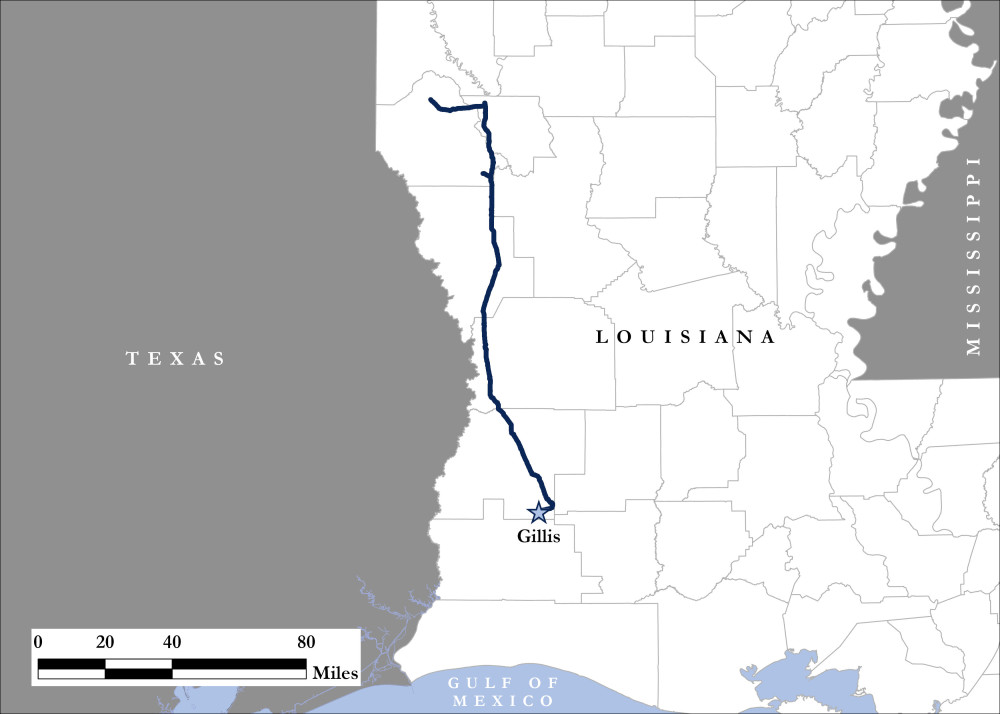

Pelican Pipeline

In-service date: H1 2027

Capacity: 1.7 Bcf/d

|

Source: WhiteWater

|

|

|

Pelican Pipeline - The WhiteWater Pelican Pipeline will transport up to 1.75 Bcf/d through approximately 170 miles of 36-inch pipeline from Williams, Louisiana, to the Gillis Hub near Ragley, Louisiana. Expected to be operational in the first half of 2027, the pipeline project is currently pending necessary regulatory approvals.

|

Other Projects

|

|

Blackfin Pipeline - The WhiteWater Blackfin Pipeline is a 193-mile, 42-inch intrastate natural gas pipeline that will deliver up to 3.5 Bcf/d from the Houston Ship Channel to Jasper County in East Texas. From there, it will interconnect with Venture Global’s CP Express Pipeline, delivering feedgas to the CP2 LNG terminal in Cameron Parish, Louisiana. With CP2 expected to eventually draw more than 4 Bcf/d of gas, Blackfin will serve as a critical Permian-to-LNG corridor. Construction is underway, and the pipeline is expected to enter service in the third quarter of 2025.

NGPL TX-LA Expansion Project - The project will increase NGPL's capacity by approximately 0.3 Bcf/d. The project will primarily involve additional compression to increase natural gas deliveries from existing system receipts, the growing Haynesville and South Texas supply to growing LNG markets. The project is targeted to be in service by July 1, 2026.

Trident Pipeline - Kinder Morgan’s Trident Pipeline is a 216-mile, 2.0 Bcf/d intrastate system moving Permian gas from Katy, Texas, to the Port Arthur LNG corridor near the Louisiana border. By targeting demand from Gulf Coast export terminals like Golden Pass LNG, Trident introduces direct competition to Haynesville producers supplying the same markets. Trident is expected to enter service in early 2027, with capacity expandable to 2.8 Bcf/d.

|

Local Supply

|

Supply in the Haynesville should grow sharply over the next few years, with the region needed to serve the vast majority of new LNG export demand. Gas output fell during 2024 as a weak price environment forced producers to curtail production and reduce activity. Output has essentially been flat since this time, one year ago, but activity will need to ramp up soon if the new demand showing up this winter is to be served. The Haynesville rig count has ticked slightly higher in 2025, but drilling activity may need to pick up significantly.

|

|

Operator Guidance

Comstock Resources (Q4 2025 EC)

|

02/12/2026

|

|

2026 Guidance

1Q 2026 Production: 1,075-1,150 MMcfe/d

FY 2026 Production: 1,250-1,400 MMcfe/d (2025 Production was ~1,214 MMcfe/d average)

2026 CapEx: $1.4-$1.5B

Strategic & Infrastructure Highlights

Western Haynesville Expansion:

4 operated rigs currently running in Western Haynesville

Focused on delineating and scaling the newer, higher-IP play

Data Center Partnershp (NextEra):

Behind-the-meter power generation project in Western Haynesville

Initial 2 GW potential, expandable to 8 GW

Expected commercialization in 2026

Drilling & Basin Activity

2026 Rig Program:

Western Hayneville:

4 opearted rigs

19 wells drilled

24 wells turned to sales

Legacy Haynesville:

5 operated rigs

47 wells drilled

48 wells turned to sales

Hedging Activity

2026 Hedges:

~780 MMcf/d hedged per quarter

~320 MMcf/d swaps

~460 MMcf/d collars

Collar structureL $3.50 floor / ~3.45 ceiling

2027 Hedges:

~160 MMcf/d per quarter

SImilar $3.50 x ~$4.37 structure

Analyst Q& Takeaways

Western Haynesville remains the primary capital allocation focus

Management expects drilling efficiencies to continue lowering D&C costs

2026 growth is front-loaded into Legacy while Western continues delineation

Data center commercialization is expected to progress in 2026

Production growth in 2027 expected as full rig program impacts volumes

|

|

Expand Energy

(Q4 2025 EC)

|

02/18/2026

|

|

2026 Guidance

2026 Production Guidance: 7.4-7.6 Bcfe/d

2026 Haynesville Production: ~3.2 Bcf/d

2026 CapEx: $2.25-$2.35B

Allocation of D&C spend: Haynesville ~52%, NE App ~23%, SW App ~25%

Strategic & Infrastructure Highlights

Gulf Coast market connectivity (term sales):

Added ~0.35 Bcf/d of incremental term sales to Gulf coast end-users

This is critical because it reduces "Appalachia-only" exposure and leans into LNG/power growth corridors

Storage optionality expanded:

Storage now ~5 Bcf

Demand theis: Louisiana is teh gravity well

Company frames ~11 Bcf/d of demand growth by 2030, largely LNG plus > 2 Bcf/d power/industrial

Highlights improved connectivity after NG3 in-service (0ct 2025)

Portfolio takeaway referenced at ~2.5 Bcf/d to Gillis and ~2.0 Bcf/d to Perryville

Drilling & Basin Activity

2026 rig Plan:

Haynesville: 7 rigs

NE Appalachia: 3 rigs

SW Appalachia: 1-2 rigs

Hedging Activity

Management explicitly states ~66% hedged in 2026

Quarterly hedged volumes:

1Q26: ~4,178 MMcf/d

2Q26: ~3,352 MMcf/d

3Q26: ~3,011 MMcf/d

4Q26: ~2,500 MMcf/d

Analysts Q&A Takeaways

Capital flexibility by basin:

Management emphasized they can dial activity up/down, and called out the Haynesville's shorter cycle time as the most responsive lever

Western Haynesville appraisal spend = semi-fixed:

They framed appraisal spend as ~$75MM "fairly fixed," up to ~(90MM if they choose to accelerate based on learnings

Commercial actions are the hedge:

The company repeatedly points to term sales additions and storage optionality as tools to reduce earnings/basis volatility

|

|

|

| |

Local Demand

|

While gas consumption in Northern Louisiana, where most production is located, averages only 500 MMcf/d per month, the source of almost all US gas demand growth is directly to the south. LNG buildout in Southern Louisiana should drive growth in gas demand for the next few years. In addition, the Southeast region as a whole should see continued electricity demand growth, supporting gas-fired power burns.

|

|

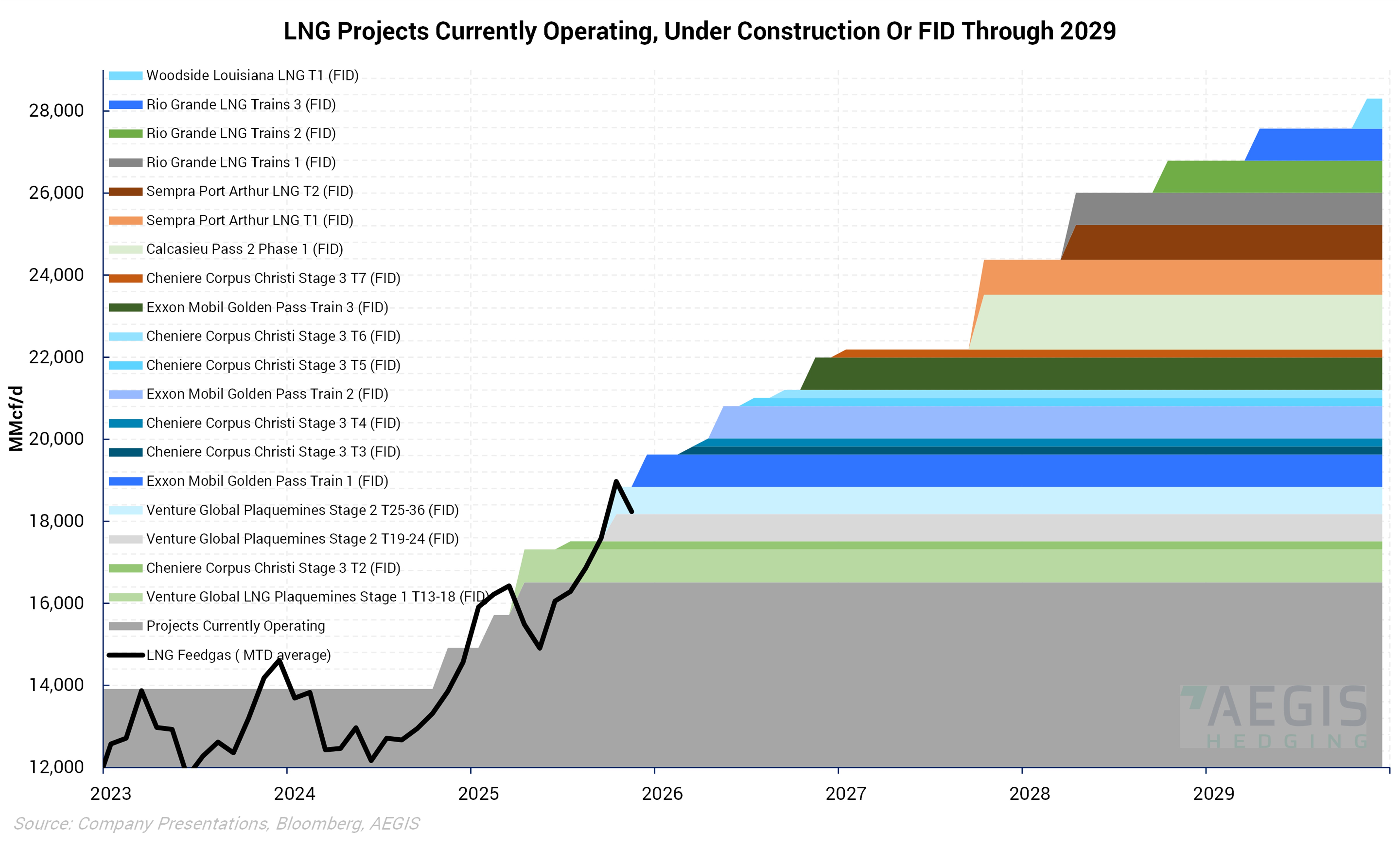

LNG

LNG feedgas will drive demand growth in Southern Louisiana going forward, and has already led to significant changes in gas flows and pricing. The majority of constructed and planned LNG export plants are situated near the border of Texas and Louisiana, in close proximity to Haynesville supply. Venture Global's Plaquemines LNG is the latest facility to enter service, with the plant ramping up to its full capacity over the next several months. Feedgas flows into the four currently operating Louisiana export plants can be seen in the charts below, in addition to the planned facilities.

|

|

|

Chart Packet

|

Recent Market-Relevant Events

NG3 Pipeline Begins Flows, Boosting Haynesville Gas Egress to South Louisiana

(September 4, 2025)

Market Impact: The 1.7 Bcf/d New Generation Gas Gathering (NG3) pipeline has begun flowing gas south from the Haynesville, connecting into TC Louisiana’s intrastate system at Beauregard near Gillis

-

Initial volumes started at 100 MMcf/d on Aug. 27 and climbed to ~300 MMcf/d in early September, slightly ahead of schedule

-

NG3 adds to new egress capacity from Williams’ 1.8 Bcf/d Louisiana Energy Gateway (LEG), which began service in July, both targeting Gulf Coast LNG markets

-

NG3 is jointly developed by Momentum Midstream and Expand Energy, which owns a 35% stake

|

Louisiana Energy Gateway Begins Gas Flows

(July 29, 2025)

Market Impact: Delfin Midstream has secured key agreements with Siemens Energy, and others as it prepares for a final investment decision (FID) this fall on its first floating LNG (FLNG) export project, located 40 nautical miles offshore Cameron Parish, Louisiana

-

The pipeline has a total capacity of 1.8 Bcf/d, with data from S&P showing about 250 MMcf/d flowing off of Transco onto the pipe on July 29

-

The in-service date for the pipeline had been delayed previously, due to a legal dispute over

-

Flows should increase over the next year as production in the Haynesville ramps up and demand in southern Lousiana continues to climb

|

Delfin LNG Secures Contractor Deals Ahead of Fall FID for First Floating LNG Vessel

(July 3, 2025)

Market Impact: Delfin Midstream has secured key agreements with Siemens Energy, and others as it prepares for a final investment decision (FID) this fall on its first floating LNG (FLNG) export project, located 40 nautical miles offshore Cameron Parish, Louisiana

-

The first FLNG unit would have a capacity of 4.4 million mtpa/year, part of a broader 3-vessel plan totaling 13.2 million mtpa/year

-

2029 delivery timeline for the first FLNG vessel

-

Delfin locked in gas turbine manufacturing capacity and launched early design work, anchoring a 2029 in-service timeline

-

Delfin is the first U.S. FLNG developer to near FID, signaling potential for modular, offshore LNG growth, a new export architecture compared to traditional Gulf Coast mega-terminals

|

|

|

Don’t stop here.

See how other regions are performing right now:

|