Looking for something specific? Jump to a section:

Commentary Outlook & Notes Market-Relevant Events Infrastructure Supply Chart Pack

Northeast basis locations, such as TETCO M2, have surged amid Winter Storm Fern in late January. The prompt month TETCO M2 contract briefly traded above Henry Hub as strong local demand and reduced supply tightened Northeast markets. Most price impacts were limited to the prompt month contract and the front of the forward curve.

Commentary

January 27, 2026: Prompt TETCO M2 prices trended higher throughout December and the first half of January, but remained within historical norms. Prices surged to the highest level in years on January 26, with Northeast basis markets trading at a premium to Henry Hub, a rarely seen event. Spot markets have jumped to near record levels, with TETCO M2 spot trading at more than $50/MMbtu on the 26th, according to data from Bloomberg. This was due to incredibly strong demand and reduced supply during Winter Storm Fern. Total consumption in the Northeast climbed to a high of 43 Bcf/d, while production fell to 34 Bcf/d. The Northeast is more insulated to the impacts of freeze-offs due to winterization, but dry gas production has fallen about 2.5 Bcf/d to 34 Bcf/d. While the remainder of the Winter '25/'26 strip has rallied significantly, this is primarily a real time event and the back of the curve has not changed much. However, this will draw down storage in the East region, lending some support to gas prices going forward.

December 9, 2025: TETCO M2 forward prices have gained in the past few weeks, although the recent rally in Henry Hub has led to wider basis prices since then. The Winter '26/'27 seasonal strip hit a new multi-year high of -$0.55/MMbtu in November, while prices for next summer reached a new year-to-date high of -$0.94/MMbtu around the same time. Since the start of December, Henry Hub has rallied significantly, something that often results in weaker basis pricing especially in the Northeast. This has led to prices for next winter falling about 15c from the November peak. With temperatures trending lower, local demand has increased, allowing for producers to ramp up supply, which recently reached the highest level since June at 36.64 Bcf/d. So far this winter, storage withdrawals have matched the five-year average rate, but colder weather in December should result in outsized withdrawals.

October 30, 2025: The TETCO M2 forward curve has seen a decent amount of volatility over the past few months, although basis prices have been on a sustained run since the beginning of October, reaching highs last seen in March 2025. Price action is expected to be driven primarily by weather and regional production changes, with no significant changes to pipeline egress capacity over the next few years. Prices advanced in 2024 as producer curtailments, and the start-up of the Mountain Valley Pipeline led to higher available pipeline capacity. Over the next few years, there will be small increases in egress capacity from pipeline expansions. However, no major long-haul pipes are planned, and given the difficulty in getting MVP finished, they are unlikely.

TETCO M2 Basis Outlook and Notes

|

Winter '25/'26

Production growth could hit the limits of pipeline egress capacity again, weakening basis differentials

Typically, there is an inverse correlation between Henry Hub prices and Northeast basis; we hold a bullish view on NYMEX prices for this period, potentially weakening M2 and Dom South pricing

|

Summer '26

Egress capacity is not anticipated to increase by a material amount until 2028

Spot prices can often suffer during periods of summer maintenance

Henry Hub prices could realize higher in 2026, possibly putting downward pressure on Northeast basis prices

|

Winter '26/'27

We hold a bullish view on NYMEX prices for this period due to LNG demand growth. Typically, there is an inverse correlation between Henry Hub prices and Northeast basis, which could lead to potential weakening of M2 and Dom South pricing

Similar to Winter 25/26, production growth could hit the limits of pipeline egress capacity again, weakening basis differentials

|

|

|

For more discussion on basis price moves and the current forward curves:

For more discussion and charts, jump to our outlook and chart pack. Remember, the local market is influenced by the broader gas market. Consult our Gas Macro Outlook for more.

|

Recent Market-Relevant Events

7.24.2025

EQT advancing over 1 Bcf/d in MVP expansion

|

7.16.2025

EQT secures deal to supply 4.4 GW in Pennsylvania

|

5.30.2025

Williams pursues revival of Constitution Pipeline and NESE

|

|

|

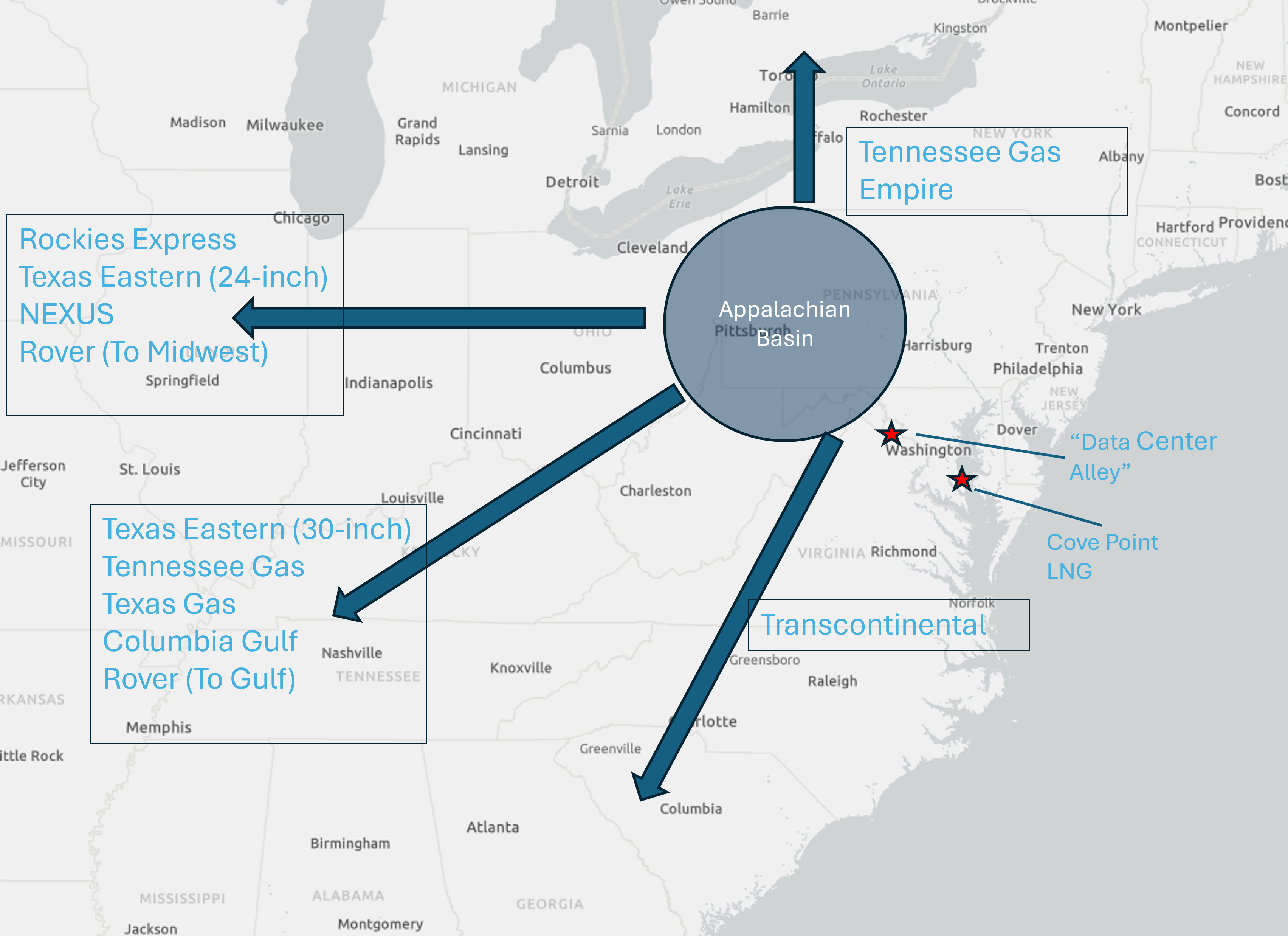

The Appalachian Basin has suffered from a lack of pipeline egress capacity in the past several years as pipeline projects were delayed by permitting issues and court proceedings. After multiple years of delays, the Mountain Valley Pipeline finally entered service in 2024 after a Congressional deal. Downstream constraints on the Transcontinental pipeline materialized during MVPs construction, preventing the 2 Bcf/d pipe from flowing at full capacity. Expansions on Transco to resolve these constraints are planned for the next few years. A smaller project, Regional Energy Access, recently entered service (Fall 2024), increasing access to demand centers in the Northeast.

|

For a discussion of production outlook:

Below are the most market-relevant infrastructure projects that appear to be funded and going forward. The projects that offer intra-region capacity (egress) are also shown in the chart above.

Note: Deeper discussion included below the map.

|

Major Pipeline Exits From Appalachian Basin

Gas Pipeline Flows

Gas Pipeline Projects

Borealis Pipeline Project

In-service date: TBA

Capacity: 2 Bcf/d

|

Source: S&P, AEGIS

|

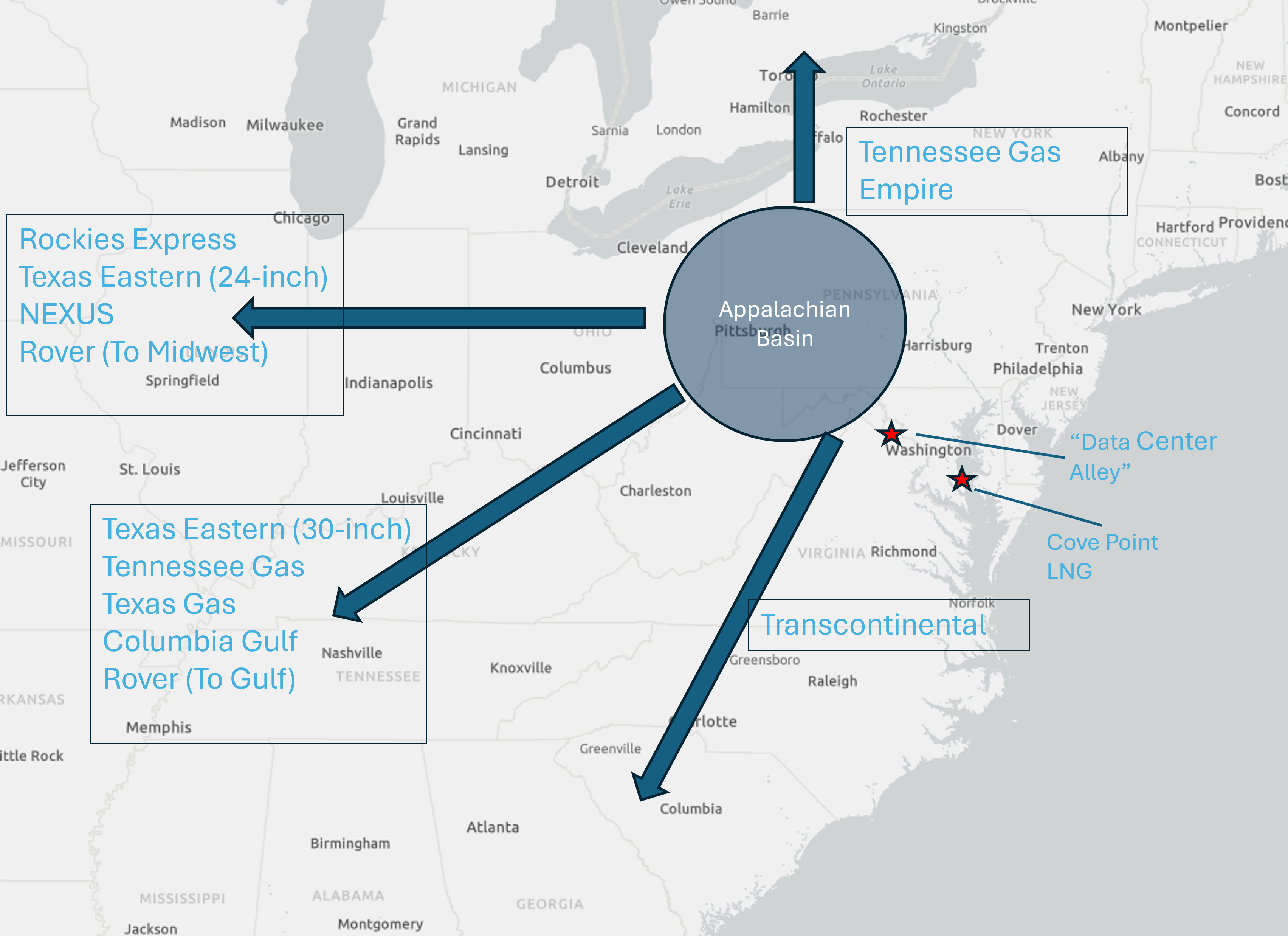

| TGT Borealis Project—On April 1, 2025, Boardwalk Pipelines announced a new Texas Gas Transmission pipeline expansion. The project involves a 2 Bcf/d greenfield line running from existing infrastructure in Lebanon, Ohio, to Clarington in eastern Ohio. No timeline has been given yet, but it's estimated that the line should enter service by the end of the decade. The project should result in higher productive capacity in the Marcellus and Utica. |

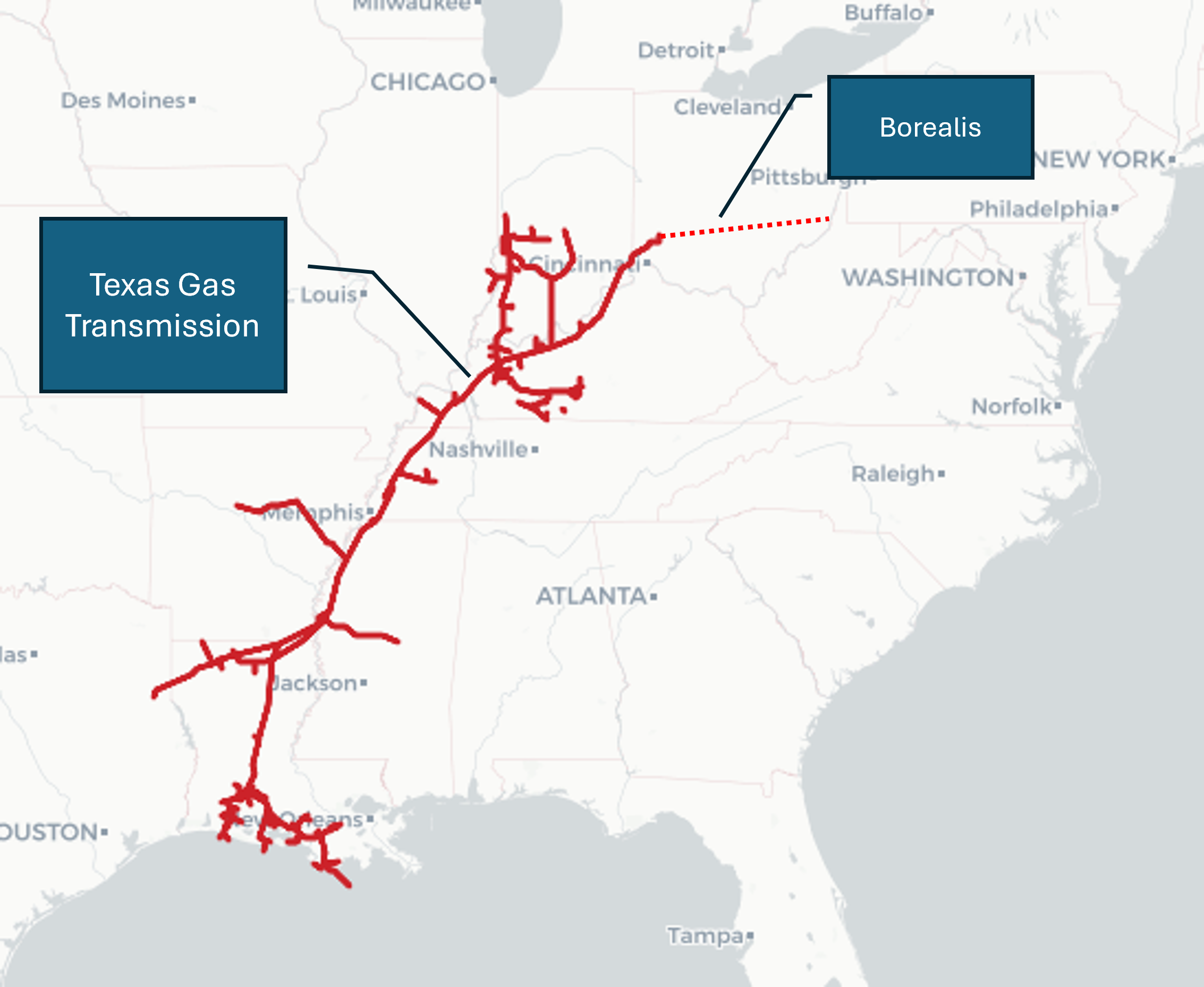

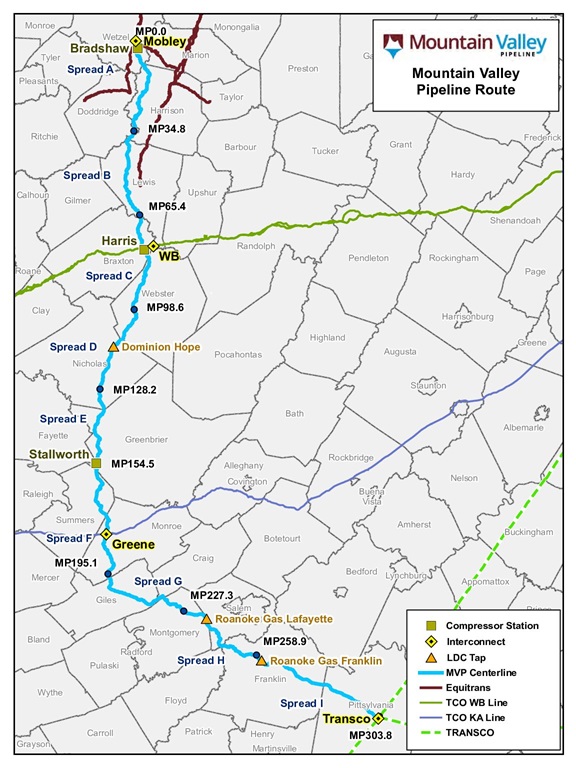

Mountain Valley Pipeline

In-service date: 2Q 2024

Capacity: 2.0 Bcf/d

|

Source: Equitrans

|

|

|

Mountain Valley Pipeline - MVP began flowing gas in June 2024, with a capacity of up to 2 Bcf/d. The pipeline ships gas from Equitrans' transmission and storage system in Wetzel County, West Virginia to Transco Station 165 in Pittsylvania County, Virginia.

|

Regional Energy Access

In-service date: 4Q 2024

Capacity: 0.83 Bcf/d

|

Source: Williams

|

|

|

Regional Energy Access - Williams developed the Regional Energy Access project to enhance gas supply in the Northeast region. The project involves increasing compression, which should allow for an additional 829 MMcf/d to be shipped to New Jersey from Pennsylvania on the existing Transco pipeline. Opposition to the project is continuing in court despite the expansion already being placed into service.

|

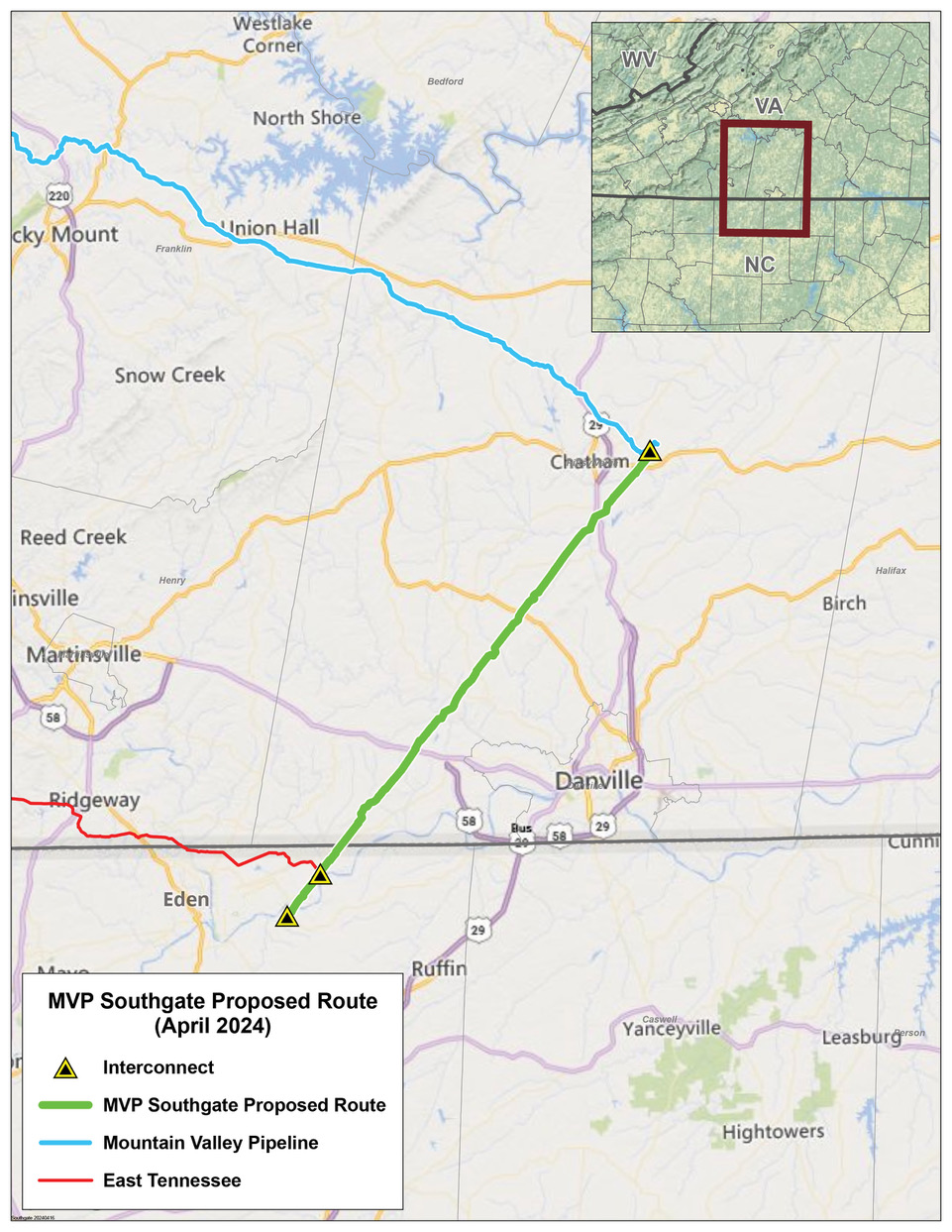

Mountain Valley Pipeline Southgate

In-service date: mid-2028

Capacity: 0.55 Bcf/d

|

Source: Equitrans

|

|

|

Mountain Valley Pipeline Southgate - The MVP Southgate extension initially proposed in 2018, abandoned, and now resurrected is a proposed project to connect MVP to demand centers in the Mid-Atlantic region. The line would extend 75 miles from the MVP terminus in Virginia to delivery points in Rockingham and Alamance Counties, North Carolina.

|

Other Projects

|

|

Transco Expansions - Numerous smaller expansions to the Transcontinental pipeline are planned for the next few years through 2028. While many of these projects are in the Southeast US, they will help alleviate downstream constraints, allowing for additional Appalachian production to flow, especially on the recently started Mountain Valley Pipeline.

MVP Expansion - EQT is advancing two major expansions of the Mountain Valley Pipeline, totaling 1.05 Bcf/d of new takeaway for Appalachian natural gas. The MVP Boost expansion is expected to increase capacity on the pipeline to 2.5 Bcf/d with an in-service date of 2028. EQT is also advancing the MVP Southgate Project, which would add another 550 MMcf/d to the system by 2028

|

Local Supply

|

Production growth should remain limited in the next few years. The Appalachian basin has long been constrained by a lack of pipeline egress, with this likely continuing into the future. As expansions on Transco are completed, Mountain Valley Pipeline can flow at full capacity, with this new capacity likely being filled by production relatively quickly. Output in the region fell sharply in 2024 as low prices forced producer curtailments. Gas production in the area can flex during times of higher demand, such as peak winter months when increased consumption allows for higher pipeline egress, while the yearly Cove Point LNG maintenance often coincides with a drop in production.

|

|

Operator Guidance

EQT (Q3 2025 EC)

|

10/22/2025

|

|

2025 Guidance

Q3 2025 Production: 634 Bcfe

+9% year-over-year (Q3 2024: 581 Bcfe)

Flat quarter-over-quarter (Q2 2025: 634 Bcfe)

Realized Price: $2.76/Mcfe

Operating Costs: $1.00/Mcfe (record low)

Free Cash Flow: $484M attributable to EQT

Capex: $618M (↓10% vs. midpoint guidance)

Hedging Overview

Q4 2025: 3.6 MMDth/d hedged via swaps, calls, and puts

Avg. swap price: $3.28/Dth

Avg. call strike: $5.34/Dth

Avg. put strike: $3.35/Dth

2026:

Hedge volumes taper significantly: ~0.9 MMDth/d in Q1, ~0.3 MMDth/d in Q2–Q4

EQT is tactically reducing hedge coverage to retain upside exposure

Going forward, basis hedging will be reduced; EQT now uses tactical curtailments and marketing optimization as a hedge alternative

Olympus Integration & Operational Efficiency

Olympus integration completed in 34 days (fastest in EQT history)

Two deep Utica wells drilled ~30% faster than prior operator; ~$2M saved per well

Record-setting completion pace and lateral footage drilled

Water infrastructure investments driving ~$105M in annual LOE savings

Power & Data Center Demand

Homer City & Shippingport Redevelopment:

Combined 8 GW of gas-fired generation

1.5 Bcf/d supply; 20-year index-plus contracts

Multi-phase development through 2027–2028

West Virginia Power Project:

610 MW facility; 10-year midstream term

In-service: 2028

Data Center Opportunity:

~55 GW under development in EQT’s core area

EQT positioned as sole large-scale integrated gas supplier in Appalachia

|

|

Expand (Q3 2025 EC)

|

10/29/2025

|

|

2025 Guidance

Northeast Appalachia:

Q3 2025: 2,556 MMcfe/d

Q2 2025: 2,662 MMcfe/d → ↓106 MMcfe/d quarter-over-quarter

Southwest Appalachia:

Q3 2025: 1,571 MMcfe/d

Q2 2025: 1,562 MMcfe/d → ↑9 MMcfe/d quarter-over-quarter

Total Appalachian Production (NE + SW): 4,127 MMcfe/d in Q3 2025

Note: Voluntary curtailments were prioritized in the Northeast due to weak in-basin pricing. Curtailments continued into Q4.

Appalachia Capex (Q3 2025):

Northeast: $175M total ($150M D&C)

Southwest: $144M total ($114M D&C)

Efficiency Gains:

$25M Capex reduction in Northeast driven by curtailments and timing

Acquisition of 7,500 acres in Monroe County, OH and Marshall County, WV for $57M

Adds ~425,000 lateral feet and >40 locations

Lateral extensions more than double existing lengths on 24 wells

Hedging Overview

Q4 2025:

59% of gas volumes hedged

Hedge mix includes:

Swaps: 81.7 Bcf @ $3.61/Mcf

Collars: 240.6 Bcf with $3.37 floor / $4.70 ceiling

Three-way collars: 40.5 Bcf with $3.66 floor / $5.88 ceiling / $2.59 sold put

2026:

47% hedged as of October 22, 2025

Strategy: Rolling 8-quarter hedge program focused on downside protection with upside participation

FY 2026 hedge volumes:

Swaps: 339.8 Bcf @ $3.95/Mcf

Collars: 839.3 Bcf with $3.46 floor / $4.94 ceiling

|

|

CNX (Q3 2025 EC)

|

10/30/2025

|

|

2025 Guidance

Q3 2025 Free Cash Flow: $226 million

Includes $68 million from asset sales

2025 FCF guidance raised to ~$640 million (from ~$575 million)

Cash Operating Margin: 62% in Q3; 2025E: 63%

Fully Burdened Cash Costs: $1.09/Mcfe in Q3; 2025E: ~$1.12/Mcfe

Adjusted EBITDAX Guidance: $1.200–$1.225 billion for 2025

Capital Expenditures (2025E):

D&C: $310–$330 million

Non-D&C: $160–$165 million

Total: $475–$500 million

Drilling & Basin Activity

Production Guidance (2025E): 620–625 Bcfe

Liquids: ~7–8% of total volumes

Utica Development:

Apex acquisition added ~30,000 Marcellus acres and 8,000 Utica acres

CNX acquired remaining Utica rights in Q3 2025

Drilling cost reduced ~20% YoY: from ~$2,200/ft to ~$1,750/ft

Efficiency gains driven by repeatable pad development and improved drilling days

No new rig required for Utica; existing rig fleet is sufficient

Development plan includes 3–4 well pads with 1,300–1,500 ft spacing

Marcellus Divestiture:

Sold acreage in Ohio where Utica has already been developed

Analyst Q&A Highlights

Well Performance:

Outperformance driven by Apex pad and recent conversions

Focus remains on flat production and maximizing free cash flow

In-Basin Demand Outlook:

Management bullish on AI-driven power demand growth in Appalachia

Pipeline infrastructure remains a gating factor for broader market access

|

|

|

| |

Local Demand

|

The Appalachian basin is located in close proximity to Northeast US demand centers, with the Northeast being one of the largest gas-consuming regions in the country during the winter months. Demand in Appalachia specifically reached about 13.5 Bcf/d in February 2025, while the Northeast region as a whole saw consumption hit 29.8 Bcf/d.

|

|

|

Coal-to-Gas Switching: The Northeast US still utilizes a significant amount of coal in its power sector. Among all the US balancing authorities, PJM has the second-largest operating coal fleet, after its neighbor MISO. When gas prices rise, more coal generation can be called up, helping to balance the market.

Coal Retirements: Out of PJM's nearly 40 GW of coal generation capacity, about 7.5 GW is scheduled to retire over the next three years. This should reduce coal-to-gas switching capability and support gas demand.

Renewables: According to the EIA, PJM plans to install about 16 GW of renewables over the next three years. While the actual generating capacity is likely to be about one-third of the nameplate capacity, the continued expansion of renewables threatens to erode natural gas's market share.

|

Data Centers and Electrification: The rise of data centers and electrification of oilfield operations (e.g., electric drilling rigs) also adds to power demand. The Northern Virginia region is currently the largest market for data centers, and power demand will likely increase over the next several years. This could support regional power demand and, thus, natural gas prices.

LNG: The Cove Point LNG export plant in Maryland is the only LNG export facility in the Northeast. The relatively small 0.9 Bcf/d facility typically shuts down for maintenance for about a month every Fall, coinciding with a weakening of Northeast cash prices and a decline in production as pipeline egress capacity tightens due to the drop in demand.

Environmental Concerns: There is often opposition to pipeline projects and energy infrastructure in the region from Environmental groups. This opposition contributed to the multi-year delay in Mountain Valley Pipeline.

|

|

|

|

In this area, there are multiple basis locations affected by similar market conditions. Many AEGIS customers hedge Eastern Gas South Basis, formerly known as Dominion South.

The reader will notice that Eastern Gas South and Tetco M2 have very similar forward curves. AEGIS notes that historically the Tetco pipeline has had many more instances of emergency outages that have caused cash-price discrepancies between M2 and other nearby prices.

|

|

|

|

|

|

|

|

|

Recent Market-Relevant events

|

Tioga Pathway Gets Final Permits

(December 1, 2025)

National Fuel Gas has received the final permits needed for the Tioga Pathway project.

-

The project will add 190 MMcf/d of new capacity in Pennsylvania

-

All new capacity has been leased by National Fuel's E&P unit, Seneca Resources

-

The project should enter service in November 2026

|

EQT Advances Over 1 Bcf/d in MVP Expansions for Appalachian Natural Gas

(July 24, 2025)

EQT is advancing two major expansions of the Mountain Valley Pipeline (MVP), totaling 1.05 Bcf/d of new takeaway for Appalachian natural gas.

-

MVP Boost: +500 MMcf/d by 2028 via 180,000 hp compression addition

-

MVP Southgate: +550 MMcf/d by 2029, serving Carolinas utilities

-

The expansions aim to relieve Appalachian basis pressure by opening access to higher-priced Southeast markets

-

New regional gas demand (e.g., AI campuses, data centers) allows EQT to sell more gas at local premium prices without competing for Gulf Coast pipe space

|

EQT Secures Major Gas Deals to Supply 4.4 GW AI Campus and 1 GW Data Center in Pennsylvania

(July 16, 2025)

EQT Corp. signed two major gas supply agreements, including one with Homer City Redevelopment (HCR) to fuel a 4.4 GW gas-fired AI computing campus in Homer City, PA, slated to begin operations in 2027.

-

EQT will supply up to 665,000 MMBtu/d (~.6 Bcf/d) to HCR, potentially making it one of the 40 largest U.S. gas purchasers and one of the largest single-site gas supply agreements in North American history

-

EQT also struck a separate agreement with Frontier Group of Companies to supply the planned 1+ GW Shipping port Power Station at the former Bruce Mansfield site in Beaver County, PA, which includes a co-located data center and up to 800 MMcf/d of demand

|

|

|

Don’t stop here.

See how other regions are performing right now:

|