The impact of hurricanes across the Gulf of America (GOA) and the Gulf Coast is an increasing bearish risk for natural gas prices. At the same time that the US is becoming less reliant on offshore natural gas production, the market is becoming more reliant on demand growth from LNG along the Gulf Coast.

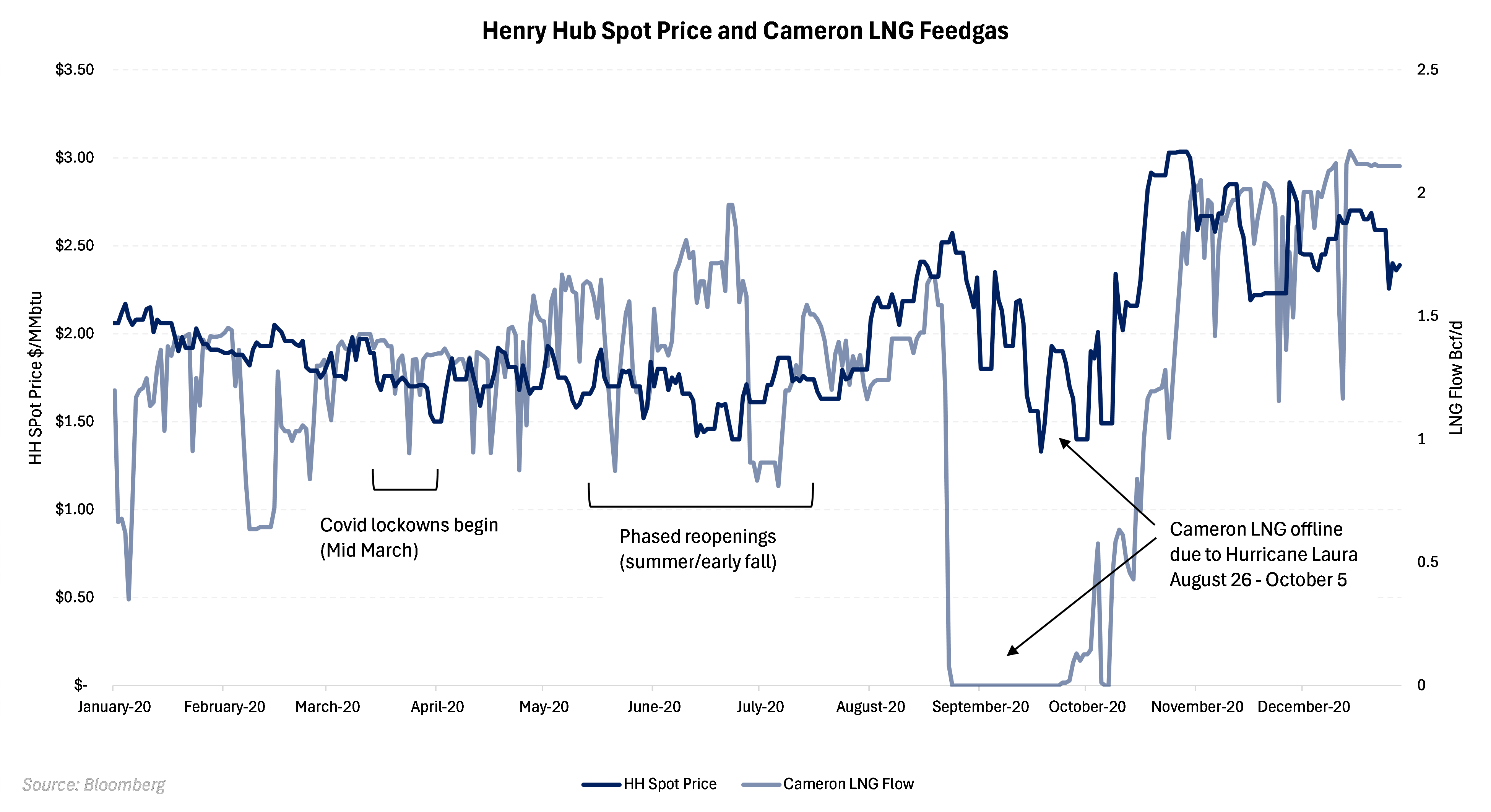

The market experienced how daily spot price can be affected by a major LNG disruption during September 2020. Due to Hurricane Laura, Cameron LNG went completely offline from August 26 through September 27. Sabine Pass was also temporarily affected by the storm but was back online by September 11. The chart below compares the spot HH price throughout 2020 along with LNG feed gas flow into Cameron LNG. We highlight that during the outage to Cameron; there was a sharp decline in Henry Hub spot price between August 26 and September 21 with prices dropping 48% in 26 calendar days.

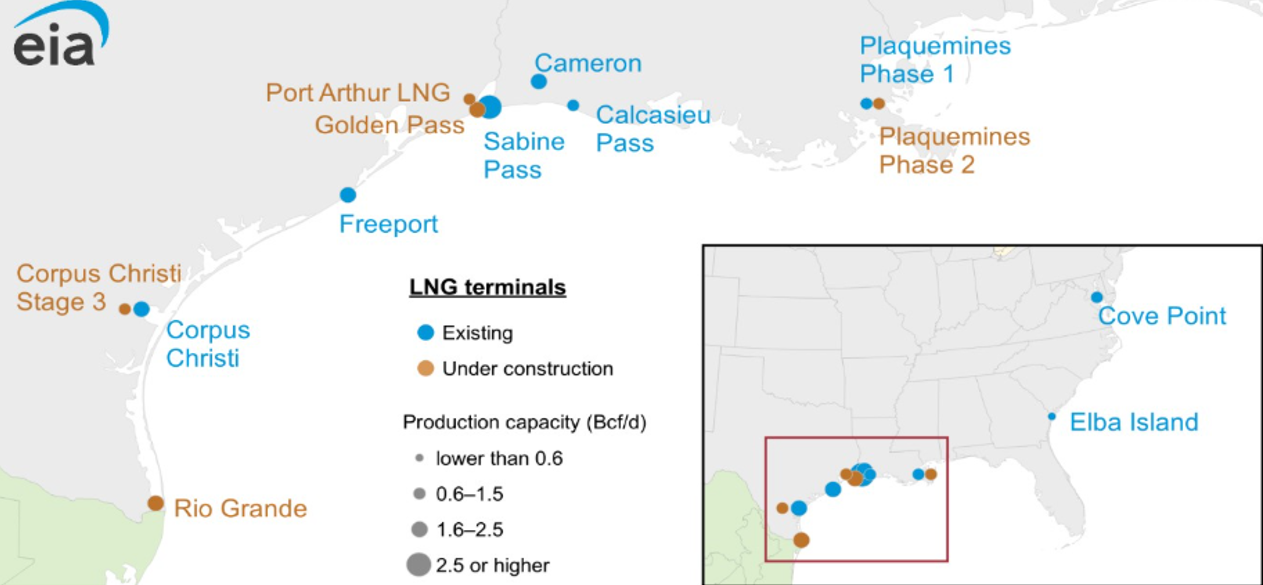

Currently the US operates roughly 14.7 Bcf/d of LNG export capacity along the Texas and Louisiana Gulf Coast. Current projects should take that total to near 20 Bcf/d by early 2027. Barring a few smaller export terminals along the Atlantic Coast, all the LNG capacity is situated along the Gulf Coast as shown below.

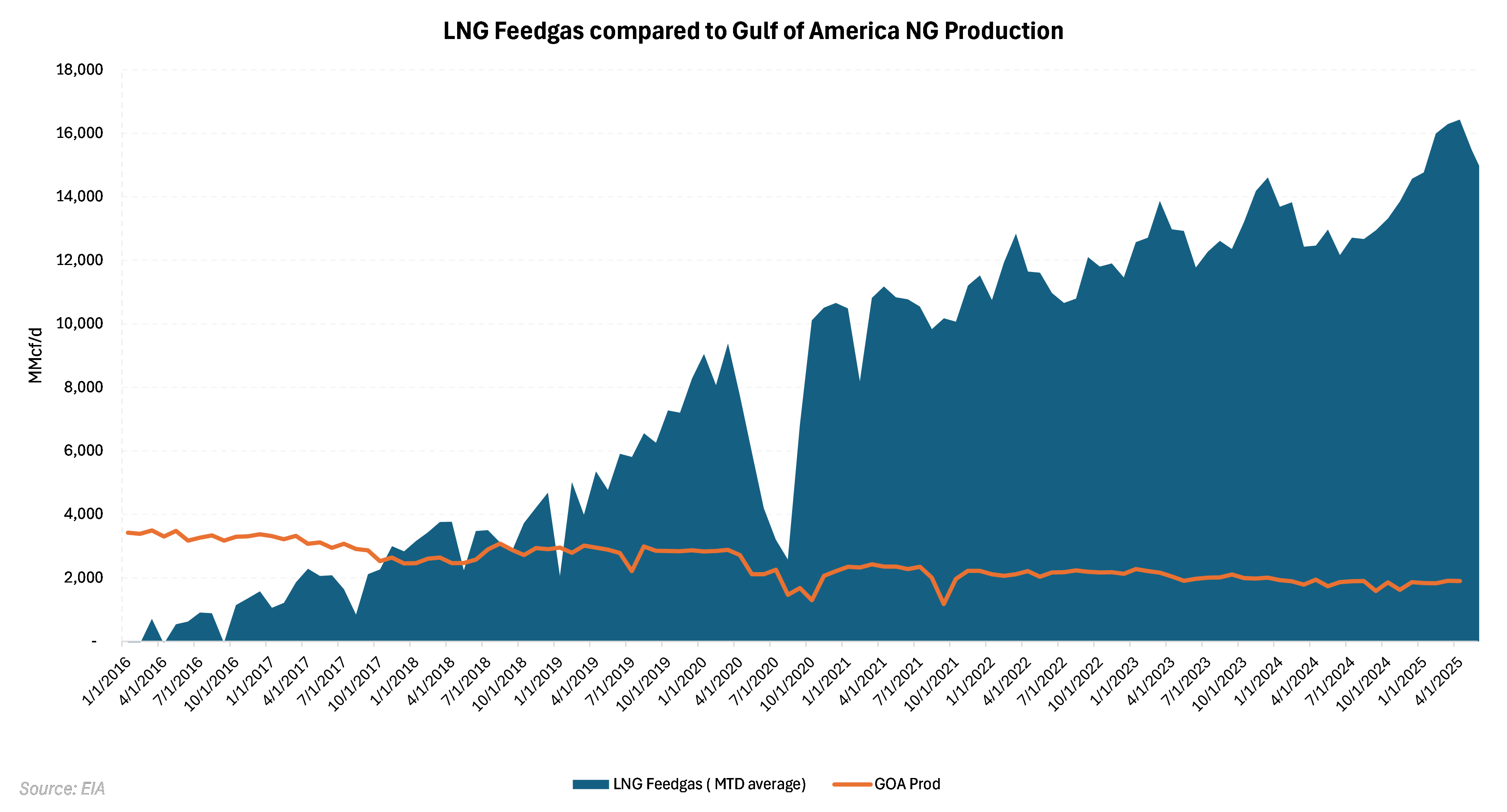

Total natural gas supply in the Gulf of America has been steadily declining for the past 20 years. Since the beginning of 2005, gross production in the Gulf of America has fallen from 10 Bcf/d to 1.9 Bcf/d. At the same time, total lower 48 gross production has risen from 55 Bcf/d to 120 Bcf/d according to the EIA. In the chart below we’ve shown the ramp of LNG capacity, almost all of which is along the Texas and Louisiana gulf coast, compared to the Gulf of America production. As recently as 2017, the LNG demand eclipsed the total GOA production.

Any outage of LNG export capacity is likely to have a material impact on natural gas prices in the short term. While physical damage to a facility or facilities would be worst case scenario, even a disruption to loadings could put pressure on price. The sheer size and concentration of LNG demand make the potential for disruption greater than we’ve seen in the past.