See our Haynesville Reference post for more

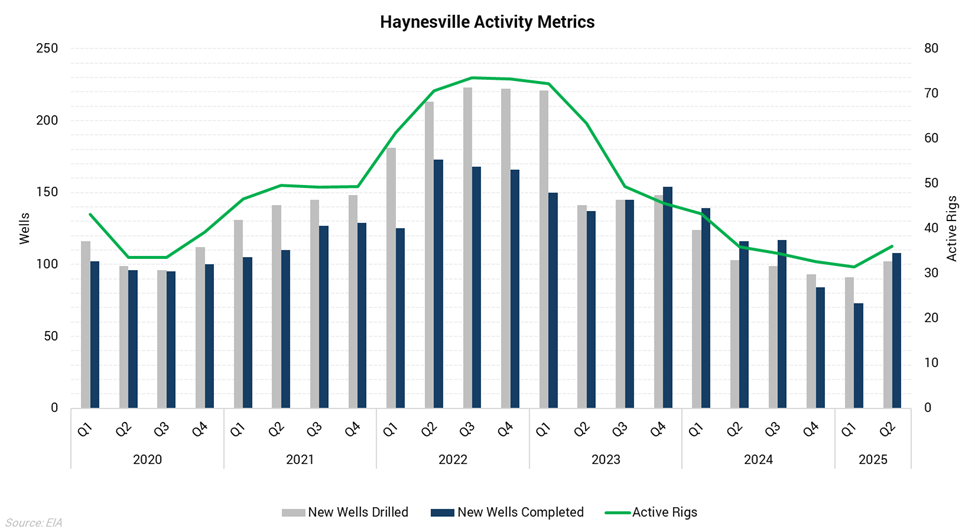

After ten quarters of contraction, Haynesville drilling activity has begun to recover. As of July 18, Baker Hughes reported 41 active gas-directed rigs in the basin—up from a February low of 28—marking the first sustained uptrend since early 2022. EIA data show 2Q 2025 as a recovery from Q1 2025, the period of lowest development activity in five years.

LNG capacity additions are likely to drive large increases in gas demand in the next two years, per AEGIS analysis. However, many analysts think current activity is still insufficient to create enough supply. In April, KeyBanc’s Tim Rezvan stated, “Unless you get a rig count to 45 or higher…the Haynesville is going to fall short.”

Year-to-date (Jan 1–July 18), Henry Hub has averaged $3.66/MMBtu—up $1.25 versus the same period last year. Based on AEGIS conversations with customers, the substantial increase in prices has led to higher activity, and hedging. There was a flurry of hedge activity down the Nymex Henry Hub curve in 1H 2025. Producers were/are locking-in attractive pricing in every tenor with plenty of $4.00/MMBtu floors in 2026. The surge in hedging activity can lead to growth plans.

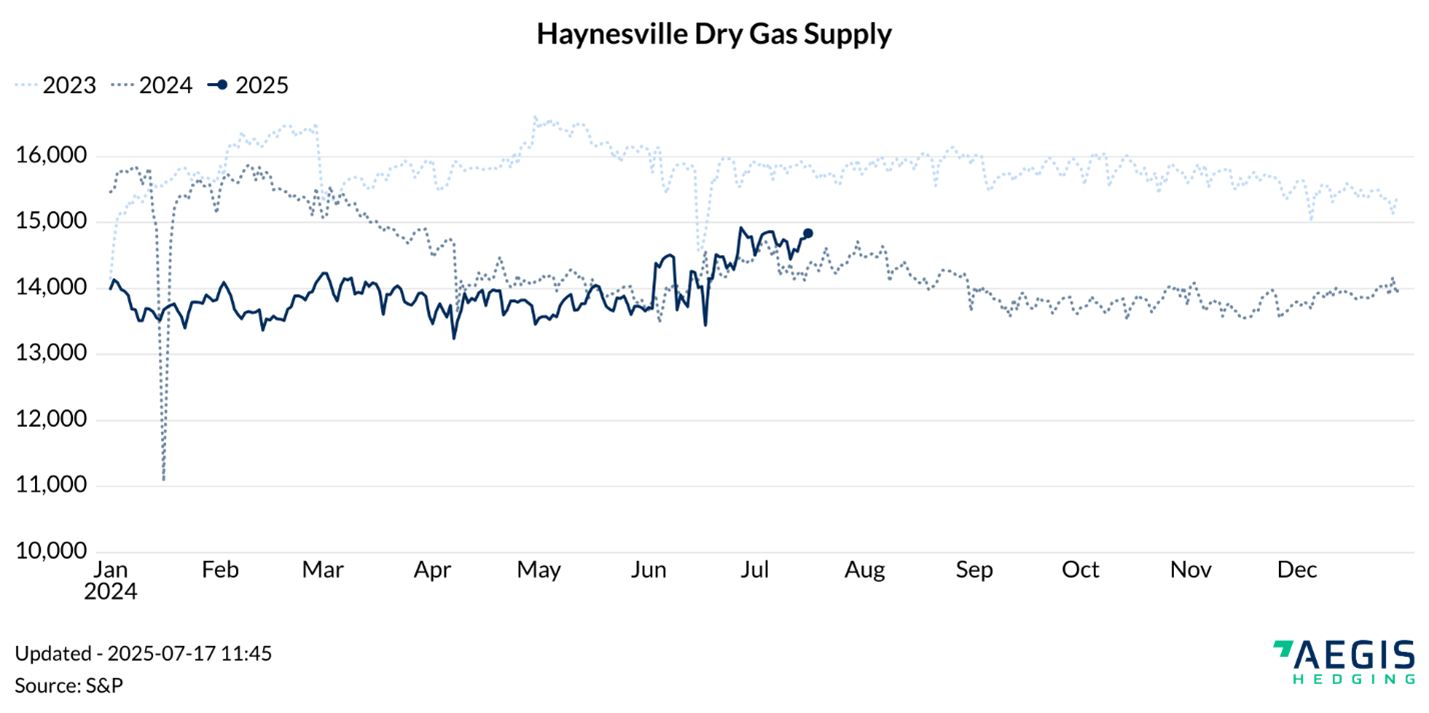

Higher prices have led to additional rig activity that is starting to show up in production numbers. There are also some elements of DUC or DTIL drawdowns that have helped boost production. Expand Energy mentioned is their 1Q earnings that they were adding a fourth frac crew in the Haynesville for a short period of time to help draw down duck inventory that they built up last year.

Recent activity gains have translated into a modeled dry gas production increase of about 1 Bcf/d, bringing basin output to around15 Bcf/d as of mid-July, according to S&P Global data. Supply moving higher is a step forward in Haynesville’s effort to supply growing LNG demand.

Public producers have guided, or communicated to investors, minimal growth, reinforcing concerns around the basin’s responsiveness. Expand Energy, the largest U.S. gas producer, forecast 2025 Haynesville output of 2.9 Bcf/d—up modestly from its 1Q average of 2.61 Bcf/d. Similarly, Aethon Energy signaled a “maintenance mode” posture during its 1Q earnings, citing the need for $5/MMBtu gas to justify development beyond 2026. At the time of those remarks, Cal ’26 Henry Hub strip prices were about $4.45/MMBtu.

Other operators have echoed this cautious stance, with few indicating material growth. The disconnect between demand growth expectations and supply-side guidance raises the risk of undershooting domestic balance requirements as new LNG export terminals begin to ramp.

Second quarter guidance is right around the corner, market observers should get more up-to-date details on this important shale play and the direction of supply from publics.