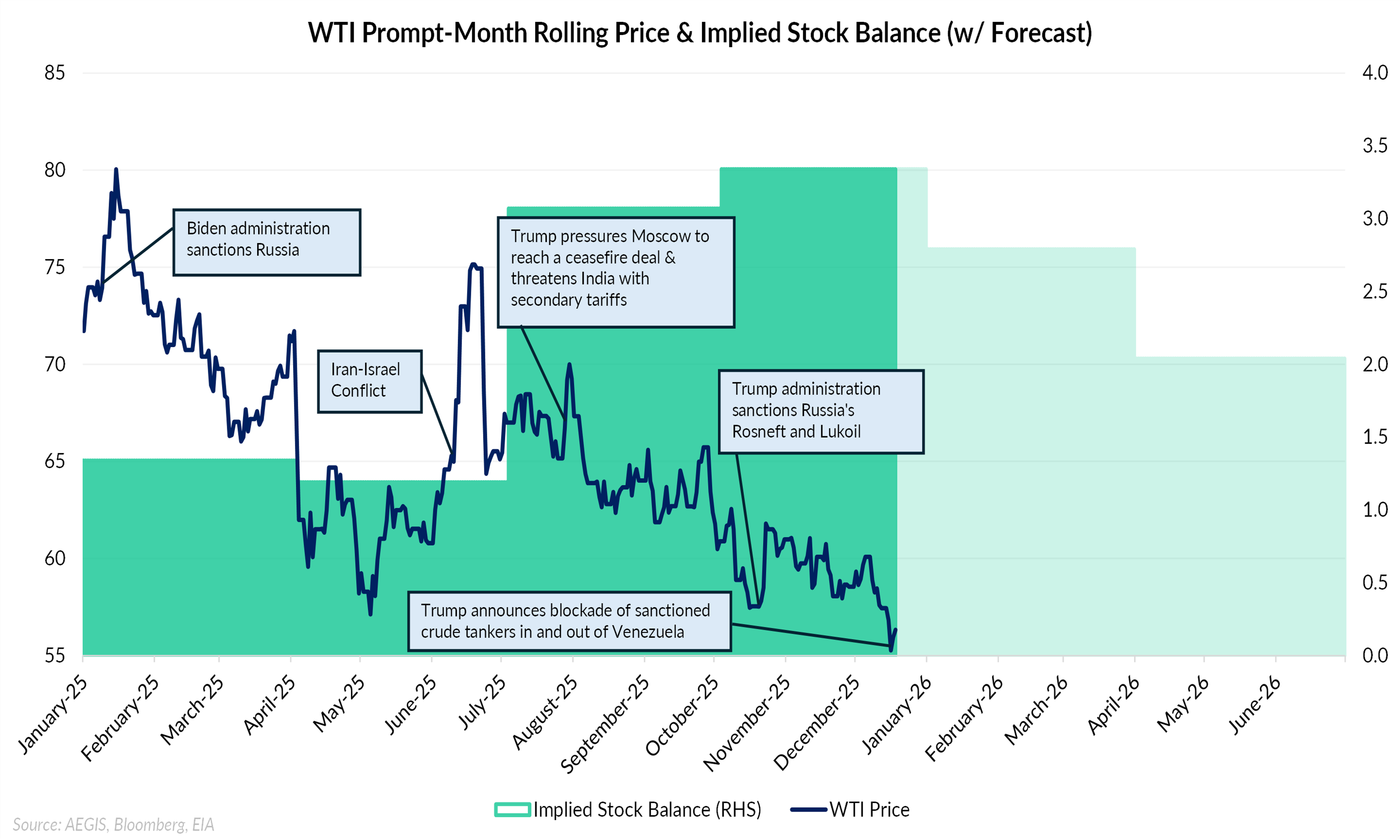

Geopolitical risk is often associated with upward pressure on oil prices, with conflicts, sanctions, and supply disruptions contributing to risk premiums in crude markets. In 2025, that relationship remained visible but increasingly short-lived. Major geopolitical events continued to trigger sharp price reactions, in some cases amplified by short covering in a heavily positioned market, yet these moves struggled to persist as underlying physical balances remained loose. As the year progressed, oil prices appeared to respond less to headline risk and more to underlying supply-demand fundamentals, highlighting a growing divergence between financial market reactions and physical market realities.

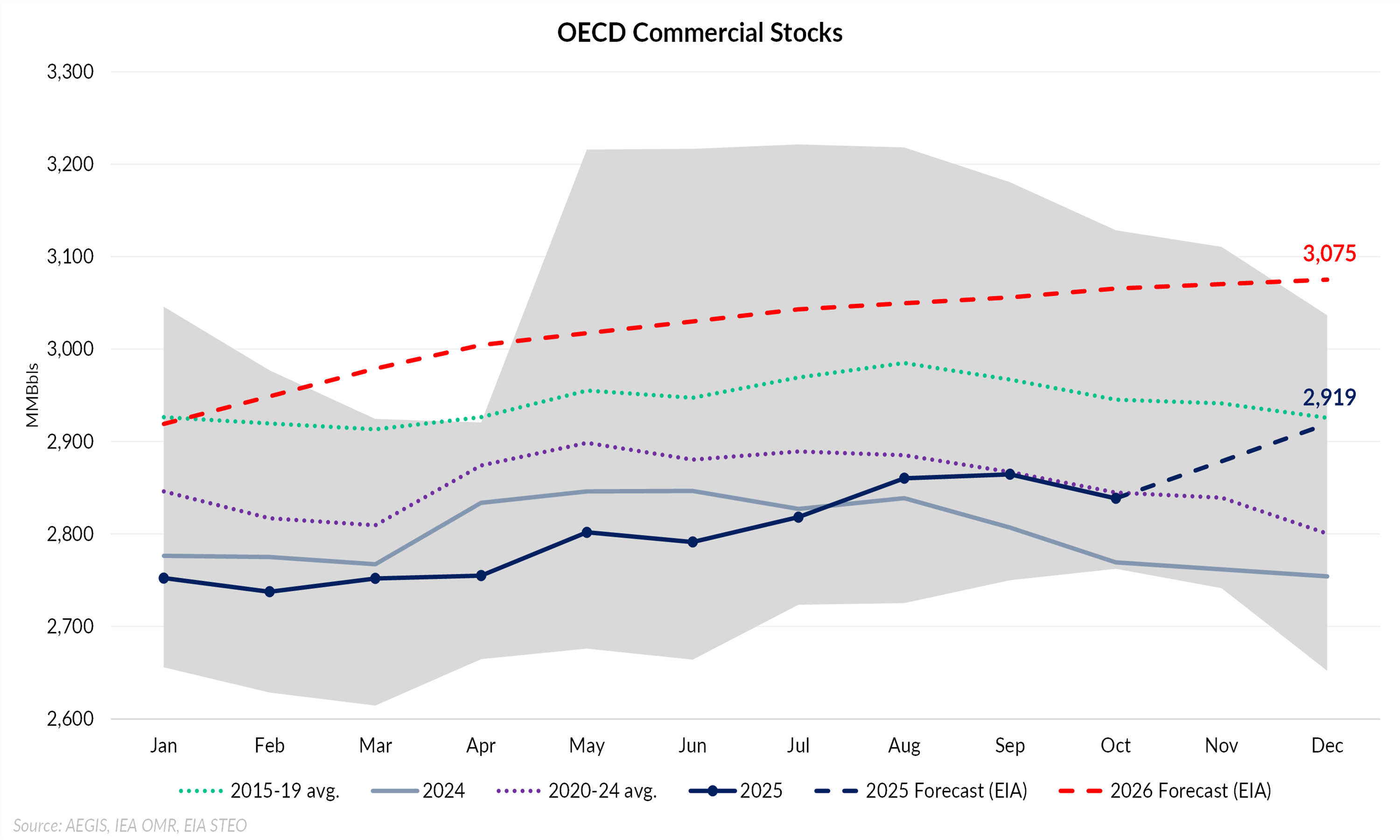

A key reason geopolitical events have struggled to sustain higher prices in 2025 has been the emergence of a persistent global supply surplus. Strong production from non-OPEC producers, most notably the US, Canada, Brazil, and Guyana, combined with the return of previously stalled OPEC+ production, began to consistently outpace global demand this year. According to the EIA, inventories are forecast to move above the upper end of the prior ten-year range by the end of 2026. In this context, geopolitical disruptions have tended to generate sharp but short-lived price responses rather than lasting shifts in market direction.

Market behavior also suggests a shift in risk assessment over the course of the year. Traders increasingly appear to require clearer evidence of sustained, measurable production losses before repricing geopolitical risk. Isolated attacks, temporary logistical disruptions, or rhetorical escalations were often met with muted responses. This likely reflects a market that is increasingly confident in its ability to absorb shocks given expectations for continued oversupply heading into 2026.

As illustrated in the chart below, global supply-demand balances shifted decisively into surplus during the second half of 2025, with supply exceeding demand by more than 3 MMBbl/d. The forward balance underscores that surplus conditions are not only a backward-looking feature of the market, but are also expected to persist into 2026, with the EIA forecasting supply to outpace demand by more than 2 MMBbl/d through the second half of next year. Against this backdrop of both realized and perceived oversupply, several major geopolitical events highlighted in the chart coincided with only brief price responses that faded quickly. Rather than tightening prompt fundamentals, these events unfolded alongside a market increasingly anchored to expectations of continued stock builds.

In conclusion, 2025 suggests a shift in how geopolitical risk has been reflected in oil prices. Geopolitical events continued to drive short-term volatility, but strong supply growth and elevated inventories limited the persistence of price responses. As a result, oil prices appeared increasingly anchored to underlying supply-demand expectations, with geopolitical risk influencing markets primarily through short-term volatility rather than sustained price direction.