The Haynesville remains in the spotlight because it’s seen as a key source for future U.S. gas supply. More on activity here and here. Yet, its biggest operator is signaling no production growth for the rest of the year—a potential concern for meeting demand.

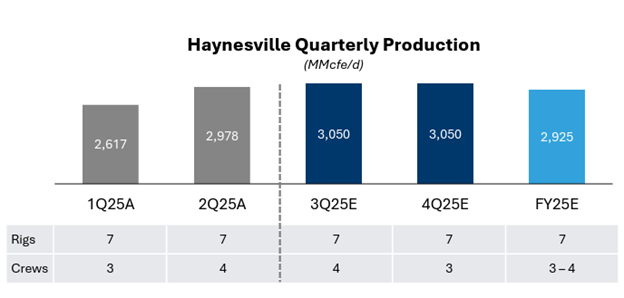

On Expand Energy's (EXE) 2Q earnings call, the company announced a 3.05 Bcf/d production rate for its Haynesville assets for the 2H of 2025. This is only 0.072 Bcf/d higher than what Expand produced for 2Q 2025. They will achieve 3.05 Bcf/d by running 7 rigs in both 3Q and 4Q with four frac crews in 3Q and three in 4Q.

The company also mentioned that it tapped 59 TILs in 2Q with much of that production showing up in the Haynesville, according to their production breakout. EXE emphasized additional capex spending will help build up to 300 MMcf/d of flexible production capacity for 2026.

While there are still more quarterly calls to come from Haynesville operators, the fact that the largest producer isn’t growing Haynesville supply for the rest of the year leans bullish for Henry Hub heading into winter.