Short-term geopolitical risk lifts crude, structural pressures remain

Crude markets experienced a volatile week as geopolitical risk premiums resurfaced, driven primarily by escalating tensions surrounding Iran. Despite pulling back from earlier three-month highs, WTI settled higher on Friday, closing up $0.25 at $59.44/Bbl, above last week’s $59.12/Bbl close. Prices oscillated sharply throughout the week as traders reacted to rapidly changing headlines tied to potential US responses, rather than any material change in the global supply-demand balance.

Early in the week, oil prices climbed as markets priced in heightened geopolitical risk following President Trump’s comments signaling a tougher stance on Iran. WTI futures briefly rose above $61/Bbl, its highest level since October, as traders focused on potential disruptions to Iran’s ~3.3 MMBbl/d of crude output. Options markets echoed this sentiment, with call skew and implied volatility rising to their most bullish levels since mid-2025.

However, that risk premium proved fragile. Later in the week, prices reversed sharply after President Trump signaled a softer stance on Tehran, easing immediate supply disruption fears and triggering the largest single-day decline since October.

Structural supply dynamics remained largely unchanged. The latest EIA STEO reinforces that these geopolitical episodes are occurring against a backdrop of persistent oversupply. The STEO forecasts global oil inventories will continue to build through 2026, with implied stock builds averaging roughly 2.8 MMBbl/d, as global production growth outpaces demand.

On the supply side, global liquids production is expected to increase by 1.4 MMBbl/d in 2026, driven primarily by OPEC+ and non-OPEC growth in South America, even as US production begins to plateau and gradually decline under sustained price pressure. Importantly, the STEO assumes Venezuelan sanctions remain in place. Any relaxation would introduce additional downside risk to prices rather than alleviate it.

This week’s price action highlights a familiar pattern where geopolitical risk injects short-lived volatility into crude markets but ultimately fails to alter the broader structural outlook. While tensions between the US and Iran temporarily supported prices, the underlying fundamentals remain dominated by rising global inventories and excess supply projected well into 2026. The market continues to grapple with surplus barrels, leaving crude prices vulnerable once geopolitical risk premiums fade. AEGIS maintains a bearish view as attention refocuses on the growing imbalance between supply and demand.

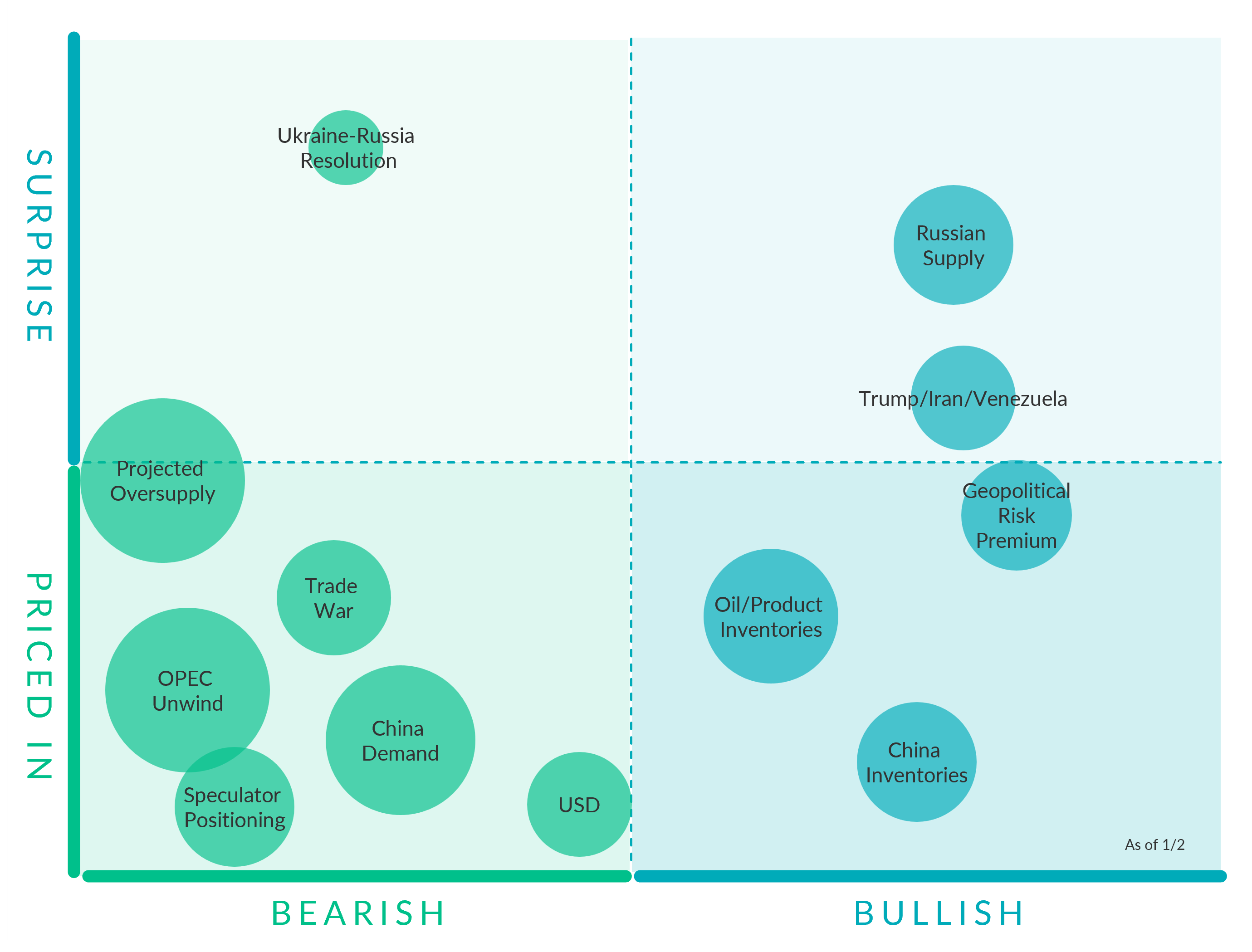

Crude Oil Factors

Geopolitical Risk Premium. (Bullish, Slightly Priced In)While the likelihood of an immediate United States strike has diminished, an expanded US military presence in the region has kept a residual risk premium in place heading into the weekend. However, absent a direct disruption, markets continue to fade geopolitical support and refocus on bearish supply fundamentals.

Speculator Positioning (Bearish, Priced In) The latest CFTC data show hedge funds increasing bullish exposure to NYMEX WTI, with money managers lifting gross long positions to roughly 151,000 contracts as of early January, the largest bullish stance since August. Positioning has firmed alongside heightened geopolitical risk tied to Iran and Venezuela, marking a notable rebuild in speculative length after last year’s capitulation.

Oil/Product Inventories. (Bullish, Priced In) The EIA reported a build of +3,391 MBbls in U.S. crude-oil inventories. The build was larger than the average estimate of +600 as reported by Bloomberg. Inventories for the U.S. are now at a deicit of 18.00 MMBbls (-4.2%) to last year, and a deficit of 26.90 MMBbls (-6.1%) to the five-year average.

OPEC+ Quotas. (Bullish, Priced In) OPEC+ has paused planned oil production increases through Q1 2026, keeping output targets unchanged for January–March after raising quotas by about 2.9 m b/d through late 2025. Eight key producers, including Saudi Arabia and Russia, reaffirmed the freeze at their early January meeting, emphasizing market stability amid a looming surplus and seasonal demand patterns.

OPEC Unwind. (Bearish, Mostly Priced in) OPEC+ confirmed in early January that it will keep oil production steady through the first quarter of 2026, as eight key producers reaffirmed their commitment to market stability amid a steady global economic outlook and what they described as healthy oil market fundamentals.

China Demand. (Bearish, Priced In) China’s onshore crude inventories declined to 1.17 billion barrels this week, down from a record 1.20 billion barrels in mid-August, according to data from Kayrros. The draws came from commercial stockpiles, partially reversing the country’s earlier stockpiling surge, a key factor that has supported global oil prices even as the broader market faces record oversupply.

USD (Bearish, Priced In) The Federal Reserve influenced the broader market backdrop after lowering its benchmark lending rate by 25 basis points to a range 3.5-3.75%. The move was widely expected and may slightly ease financial conditions while putting some downward pressure on the dollar, which is typically supportive for crude. Even so, the oil market remains driven by fundamentals.

Ukraine-Russia Resolution. (Bearish, Surprise) Ukrainian President Volodymyr Zelensky said he agreed to work on a peace plan drafted by the US and Russia aimed at ending the war in Ukraine. A peace deal, if followed by the elimination of sanctions on Russian oil over its invasion of Ukraine, could unleash supply from the world's third largest producer.

Trade War. (Bearish, Mostly Priced In) There has been an increase in tit-for-tat trade tension between the US and China, with China sanctioning the US unit of Hanwha Ocean Co., a South Korean shipping major, and warned of additional retaliatory actions against the industry. However, President Trump said high tariffs on China were “not viable,” suggesting potential for de-escalation even as broader tensions remain elevated.

Projected Oversupply. (Bearish, Mostly Surprise) The latest EIA STEO reinforces that these geopolitical episodes are occurring against a backdrop of persistent oversupply. The STEO forecasts global oil inventories will continue to build through 2026, with implied stock builds averaging roughly 2.8 MMBbl/d, as global production growth outpaces demand.

Trump/Iran/Venezuela. (Bullish, Slight Surprise) Crude markets continue to price a residual risk premium tied to US rhetoric toward Iran and Venezuela under Donald Trump, even as immediate escalation risks have eased. Recent price action suggests traders are still cautious about potential supply or shipping disruptions, but without concrete follow-through, headline-driven support has begun to fade back into a structurally oversupplied backdrop.

Russian Supply. (Bullish, Slight Surprise) Russian exports also faced growing logistical friction as US sanctions pushed more barrels into shadow-fleet channels. Strikes on refineries and export facilities have slowed transit and increased reliance on intermediaries, lifting Russian oil-on-water above 180 MMBbl.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.