Geopolitical Risk Offsets Fed Cut as Oversupply Fears Dominate

The WTI prompt-month contract fell $0.89 on Friday to settle at $62.68/Bbl, capping a volatile week in which markets weighed renewed geopolitical risk against persistent concerns of oversupply.

Ukrainian drone strikes continued to disrupt Russian refining and export infrastructure, with attacks reported on the Saratov refinery and Baltic port facilities. According to Bloomberg, the strikes have driven product output to wartime lows. President Trump reinforced US pressure on Moscow, warning allies to halt purchases of Russian crude if they expect greater American support in the conflict. He also signaled a willingness to extend US policy on secondary tariffs to China, as already applied to India for its continued purchases of Russian barrels. Still, Trump announced “progress” in a phone call with Chinese President Xi Jinping, noting discussions on trade and the Russia-Ukraine war. The two leaders are expected to meet at the APEC Summit later this year, with Trump planning a visit to China in early 2026.

Macro factors added another layer to the choppiness. The Federal Reserve cut interest rates by 25 basis points and projected further easing in 2025. While looser monetary policy could provide some support to demand, traders remain cautious amid weaker consumption trends and ongoing trade frictions.

Domestically, the EIA reported last week that US crude inventories fell by 9.2 MMBbls, but combined crude and product stockpiles climbed to the highest level in more than a year as distillates rose sharply. The build reinforced oversupply concerns despite the headline crude draw, particularly with refinery runs lagging and exports providing only temporary relief.

The market continues to weigh these factors against a looming oversupply. The IEA raised its 2026 surplus projection, now expecting global supply to outpace consumption by 3.33 MMBbl/d, 360 MBbl/d higher than its August estimate, and warned of a near 4 MMBbl/d glut in 1H 2026. While the IEA has highlighted long-term supply risks from accelerating depletion, the near-term narrative remains one of record surpluses.

This week’s developments highlight the ongoing push and pull between geopolitical shocks and structurally bearish fundamentals. While supply risks tied to Ukraine-Russia conflict may support crude in the short term, the projected 2026 surplus continues to anchor our bearish view heading into 4Q.

Crude Oil Factors

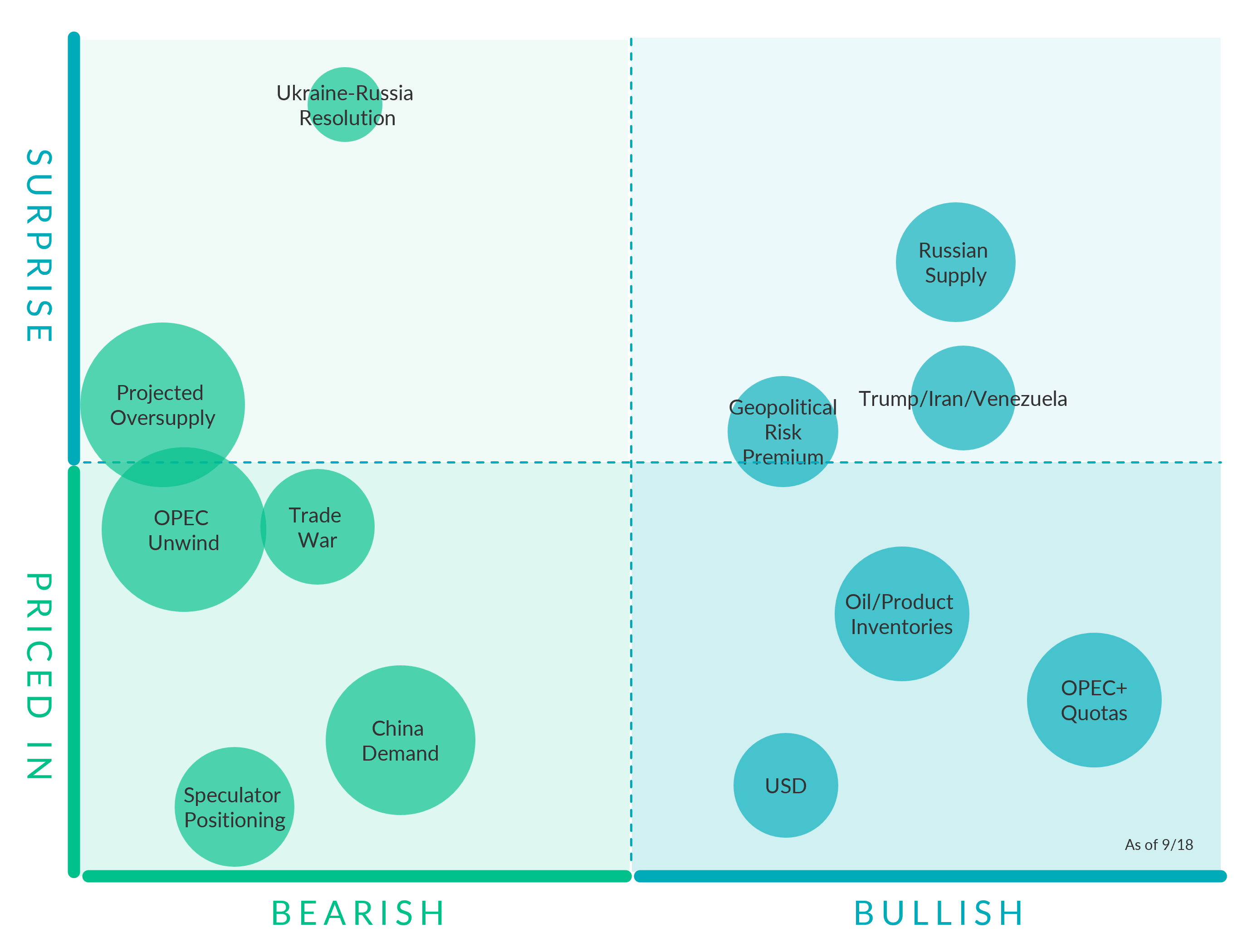

Geopolitical Risk Premium. (Bullish, Mostly Priced In) President Trump is pushing for a summit between Vladimir Putin and Volodymyr Zelensky following a series of high-level talks. Vandana Hari of Vanda Insights said crude “may be in for a holding pattern,” noting that while the path to a resolution has opened, it could take time. A peace deal could eventually ease restrictions on Russian crude exports, though Moscow has largely maintained flows throughout the conflict.

Speculator Positioning (Bearish, Priced In) The latest CFTC data show that as of August 12, money managers reduced their net long in CME’s flagship NYMEX WTI contract to just 48,865 contracts, the smallest bullish position since April 2009. Meanwhile, trades of WTI done on the ICE exchange show money managers holding a net short of about 53,000 contracts. When the two venues are combined, overall positioning in WTI has slipped into net short territory for the first time on record.

Oil/Product Inventories. (Bullish, Priced In) The latest EIA report leaned bearish as well, showing a surprise build in commercial crude inventories of roughly 600 MBbls and a 2.1 MMBbl increase at Cushing, which pushed stocks at the hub to their highest level since early May and pressured prompt-month spreads. Product demand indicators were softer, with total refined product supplied running nearly 2% below the same week last year, and exports slipped to about 3.55 MMBbl/d after several weeks of strength, signaling a weaker pull from international buyers.

OPEC+ Quotas. (Bullish, Priced In) On June 2, OPEC+ announced its extension of 3.66 MMBbl/d cuts through December 2025. Additionally, the 2.2 MMBbl/d voluntary cuts from eight member countries will continue into Q3 2024 but will start to be reversed in October at a rate of 0.18 MMBbl/d per month. OPEC+ members agreed on September 5 to delay a planned gradual 2.2 MMBbl/d supply hike by two months, shifting the start to December. The group will add 0.19 MMBbl/d in December and 0.21 MMBbl/d from January onwards, with an option to adjust or pause these hikes depending on market conditions. The cartel also reaffirmed its compensation cuts of 0.2 MMBbl/d per month through November 2025, as members such as Iraq, Russia, and Kazakhstan have struggled to meet their original production quotas.

AEGIS notes that the global crude market would quickly build inventories without OPEC's support in reducing supply.

OPEC Unwind. (Bearish, Mostly Priced in) OPEC+ announced it will raise the group’s production quota by 137 MBbl/d for October, marking the start of unwinding 1.66 MMBbl/d of voluntary cuts that were originally planned to stay in place through the end of 2026.

China Demand. (Bearish, Priced In) China’s behavior remains the key wild card. Goldman Sachs expects Beijing to continue filling commercial and strategic tanks through 2026, projecting inventory builds of 500 MBbl/d over the next five quarters. Analysts note that without renewed Chinese stockpiling, OECD inventories could swell noticeably as new OPEC+ and non-OPEC supply hits the market.

USD (Bullish, Priced In) The Federal Reserve cut its benchmark interest rate by 25 basis points, the first cut since December 2024, and signaled that another 50 basis point cut could be coming by then end of 2025. If markets expect rate cuts or looser monetary conditions, the dollar tends to weaken. Oil is priced in dollars, so a weaker dollar lowers the “real” cost of oil for buyers using other currencies. This often boosts demand at the margin and supports prices.

Ukraine-Russia Resolution. (Bearish, Surprise) President Trump is pushing for a summit between Vladimir Putin and Volodymyr Zelensky following a series of high-level talks. Vandana Hari of Vanda Insights said crude “may be in for a holding pattern,” noting that while the path to a resolution has opened, it could take time. A peace deal could eventually ease restrictions on Russian crude exports, though Moscow has largely maintained flows throughout the conflict.

Trade War. (Bearish, Mostly Priced In) A federal appeals court ruled that most of President Trump’s global tariffs were illegal, saying he exceeded his authority. The decision adds uncertainty over the tariffs’ future, and while the Trump administration looks to appeal the decision the ruling is set to take effect on October 14 unless overturned, which has raised hopes for stronger economic growth.

Projected Oversupply. (Bearish, Mostly Surprise) According to the EIA, global oil inventories are expected to rise by an average of 1.7 MMBbl/d in 2025, followed by a slightly slower but still significant 1.6 MMBbl/d increase in 2026. The most aggressive builds are forecast for 4Q 2025 and 1Q 2026, when inventories are projected to swell by 2.3 MMBbl/d on average.

Trump/Iran/Venezuela. (Bullish, Surprise) The US government has sent several ships off the coast of Venezuela prompting speculation that the Trump administration may be seeking to push Venezuelan President Nicolas Maduro from power. Tensions rose after the US sent fighter jets to the Carribean after two Venezuelan military aricraft flew over an American naval vessel in the area.

Russian Supply. (Bullish, Surprise) Ukrainian drone attacks temporarily shut operations at Primorsk and three pumping stations feeding Russia’s Ust-Luga terminal. Kyiv has intensified its campaign against Russian energy assets in recent weeks to restrict Moscow’s fuel supply to the front lines and reduce export revenues. The U.S. is also expected to press G7 allies to impose tariffs of up to 100% on Russian oil purchases by China and India, further heightening the geopolitical backdrop.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.