The buildout of renewables is continuing its rapid pace in 2025, with solar installations leading the way. In past years, developers had focused more on building out wind power, but lately, more solar has been built. Tax credits and government incentives from the Inflation Reduction Act and other legislation helped to further fuel the buildout of these resources.

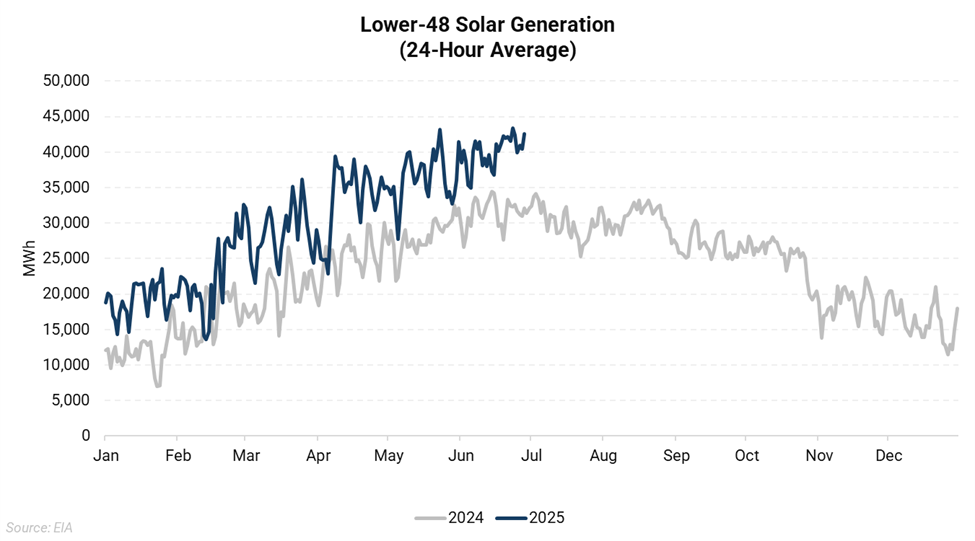

Lower-48 solar generation has hit multiple records this year, with output nearing 45k MWh. The next several years should see this trend continue, as more solar assets are brought online. This poses a bearish risk to gas prices as solar steals market share away from natural gas peaker plants. This is especially true during peak summer when both power demand and solar generation is highest.

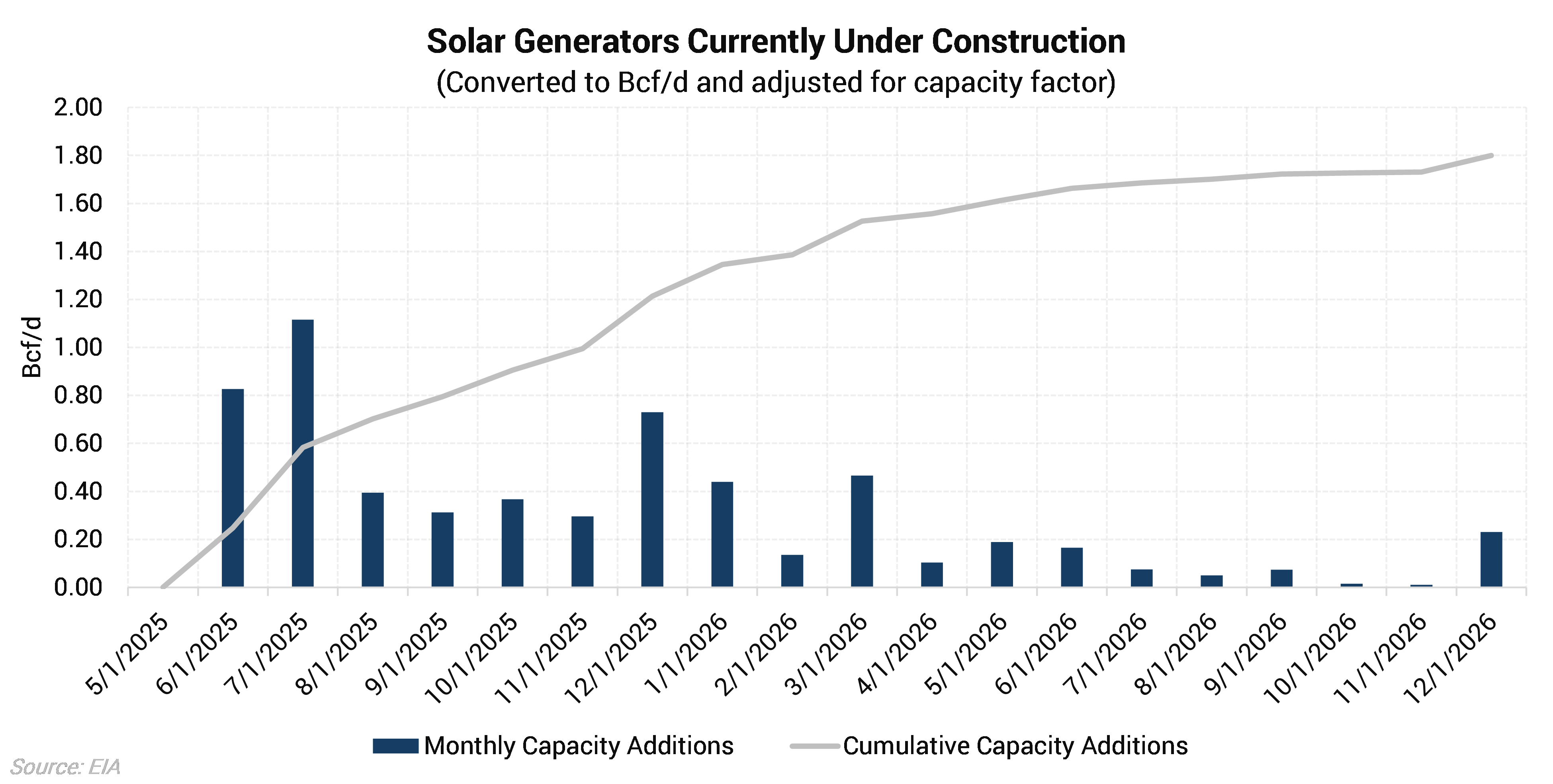

Over the next 1.5 years nearly 2 Bcf/d of gas demand could be displaced by new solar additions alone. This assumes that 100% of the new capacity replaces gas generation and that load growth is flat, both of which will not be true, but it does provide a decent representation of the kind of impact that could be seen. When you factor in batteries, which are often built in conjunction with or linked to the solar farms, the effect is even greater. While utility-scale batteries are currently a small part of the total electricity supply stack, they can have an outsized impact. The batteries charge during the day with cheap solar power, then deploy in the evening and morning hours when solar ramps down and power prices are often highest. This directly competes with the most inefficient gas power plants.

There is much debate over where electricity demand and power sector natural gas demand will be over the next several years. While demand for electricity is expected to rise sharply driven by electrification trends and data centers, if the buildout of renewables continues at the same pace as we have seen in past years it could result in a flatter trajectory for power sector gas demand. Most risk to gas prices from this factor should materialize during the summer months, which could be exacerbated by any periods of weak weather driven demand.