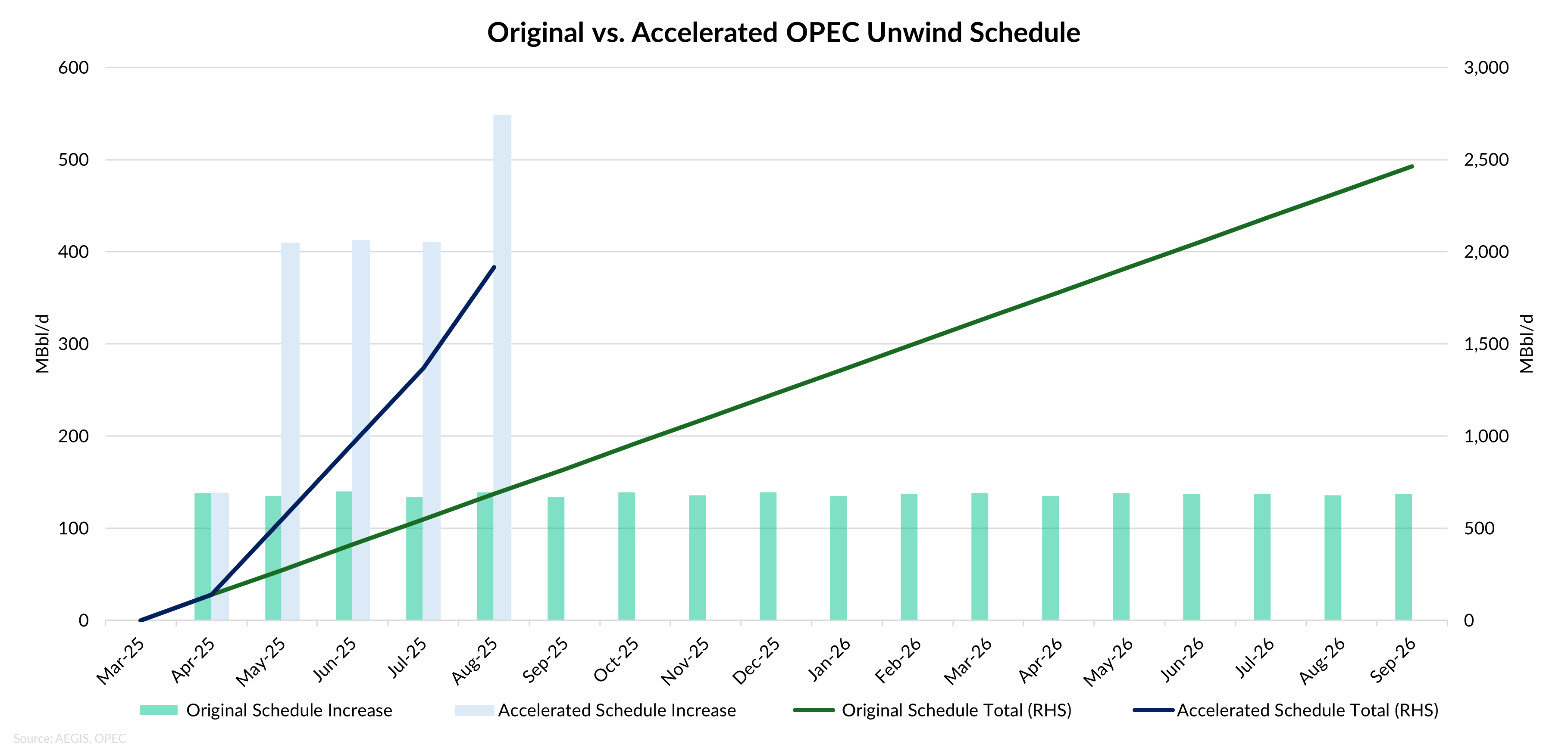

At its latest meeting, OPEC+ announced a larger-than-expected production quota hike of 548 MBbl/d for August, surpassing the market’s expectation of ~411 MBbl/d, in line with the pace of increases over the past three months. The group is now on pace to unwind 1.9 MMBbl/d of the 2.2 MMBbl/d in cuts introduced in 2023 by the end of August.

According to Goldman Sachs, OPEC+ is likely to approve in September a similar quota, which would fully restore the original cuts, including the UAE's special quota increase (300 MBbl/d). This would complete the unwind a full year ahead of schedule.

The chart above highlights how OPEC+ has front-loaded supply increases compared to its original plan, with the chart reflecting data through the most recent announcement as of the July 6 meeting.

Prices Rise Despite Headline Hike

Despite the supersized quota increase, oil prices settled higher on Monday. The market had largely anticipated a larger hike, softening the impact of the announcement. In addition, physical markets remain tight in the near term, underscored by Saudi Arabia’s decision to raise official selling prices for its flagship crude grade. The muted price response reflects the broader market view that headline quotas don’t tell the whole story.

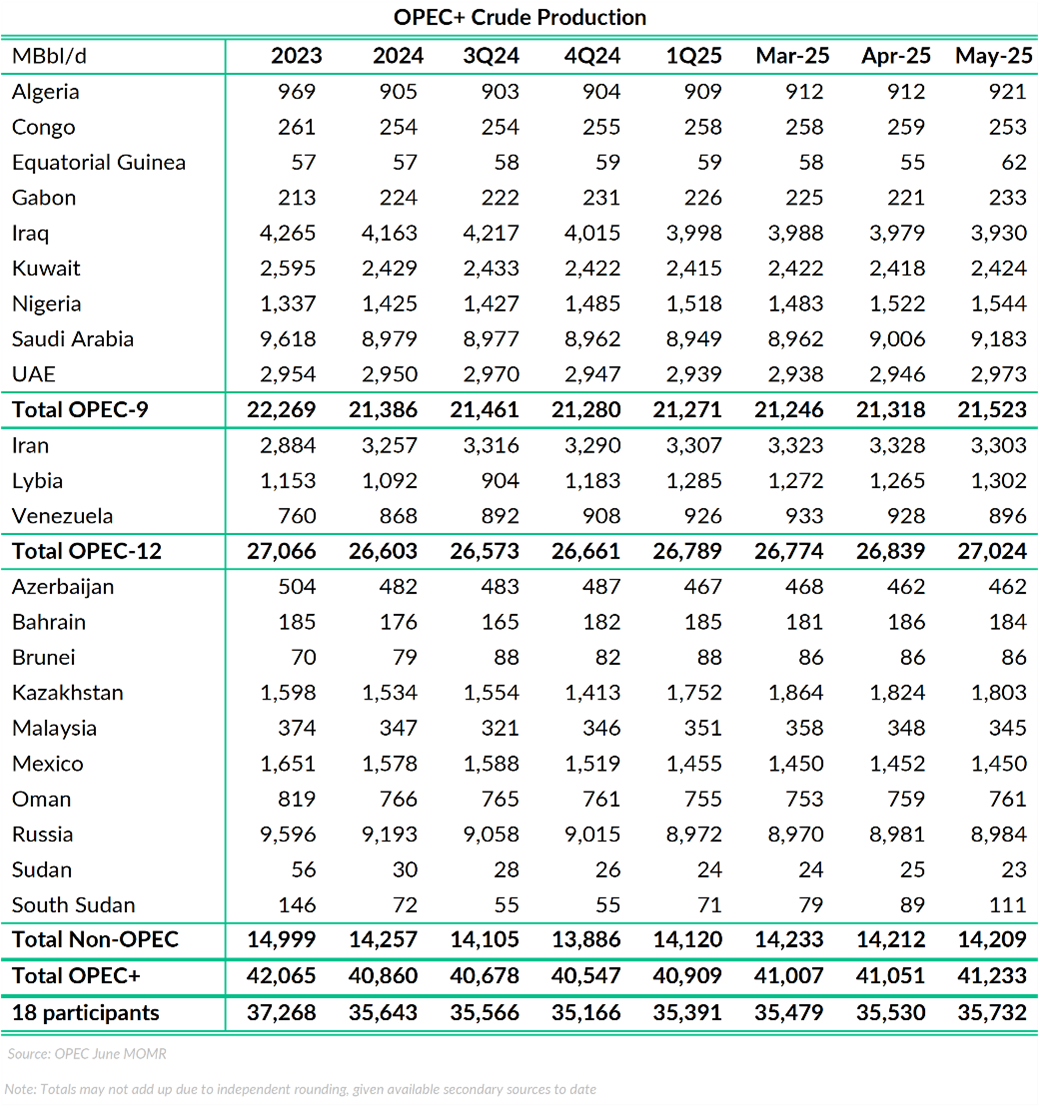

Quota Hikes vs. Actual Supply

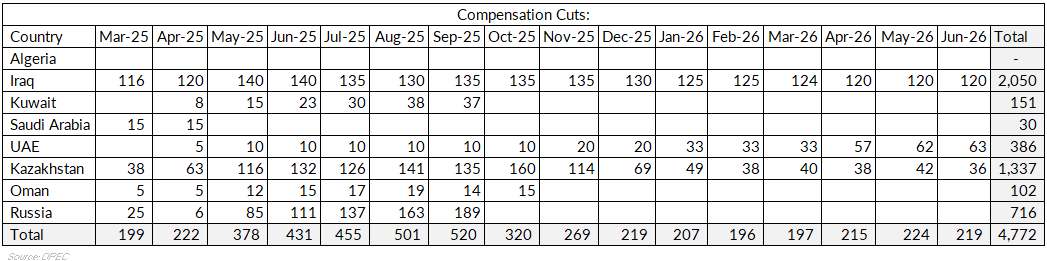

Despite the aggressive increase in production quotas, the volume of oil reaching the market could be far less due to two key reasons:

Conclusion

OPEC+ has made a decisive pivot toward restoring supply faster than previously scheduled, with a renewed focus on reclaiming market share. However, the actual volume of crude entering the market may fall short of quota increases due to operational constraints and offsetting compensations cuts. With physical markets still tight and demand seasonally strong, the next few months will test the market’s ability to absorb returning barrels.