Kinder’s recent 2Q earnings call provided key natural gas project updates. The company is in the process of planning or developing natural gas infrastructure that will change flow dynamics and affect future gas prices.

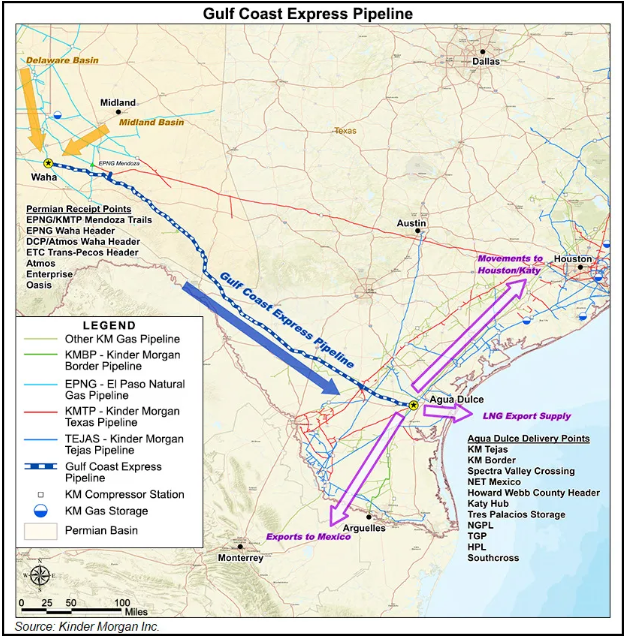

Gulf Coast Express Expansion

|

The expansion is on schedule and is planned to come online in mid-2026. The project will increase capacity for GCX by 570 MMcf/d from the Permian Basin to South Texas. The expansion will come online about the same time as a major greenfield pipe (Blackcomb) leaving the Permian. The Permian could find itself in an overbuild situation by early 2027 as nearly 4.5 Bcf/d of extra egress comes online.

|

|

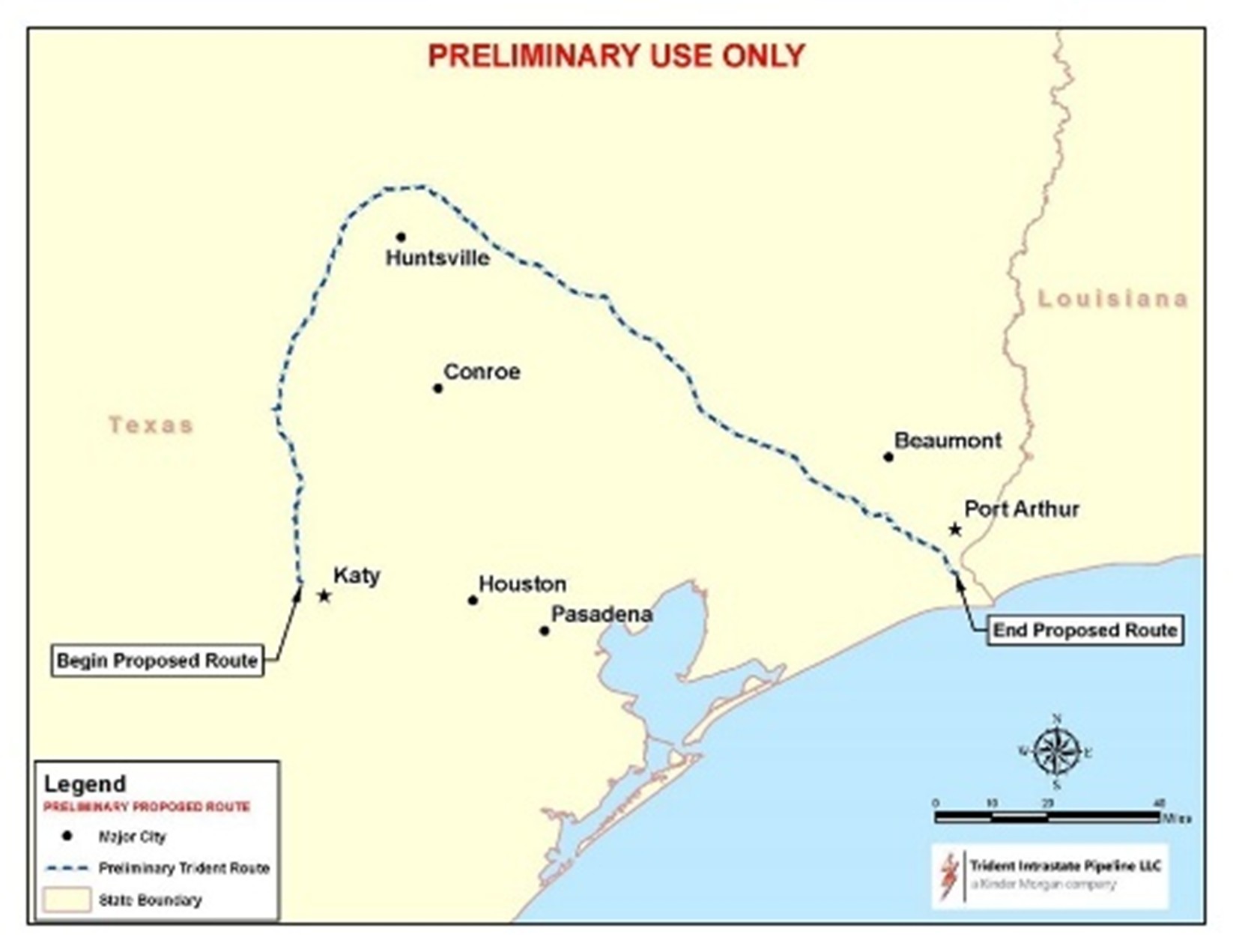

Trident Intrastate

|

Kinder announced an increase in capacity for Trident from 1.5 Bcf/d to 2 Bcf/d. The increase comes after the company said it secured a new commitment from an undisclosed LNG customer. The pipeline will take gas over 200 miles from Katy, Texas to near Port Arthur, Texas. The project will terminate at the Golden Pass LNG export facility. Kinder expects the project to come online in 1Q 2027. Additional capacity from the Katy/HSC area to demand centers near the Texas/Louisiana border should improve prices on the Texas Gulf Coast including Katy, HSC, and even Agua Dulce in South Texas. Trident would help move supply away from these hubs that are receiving more gas from the Permian. |

|

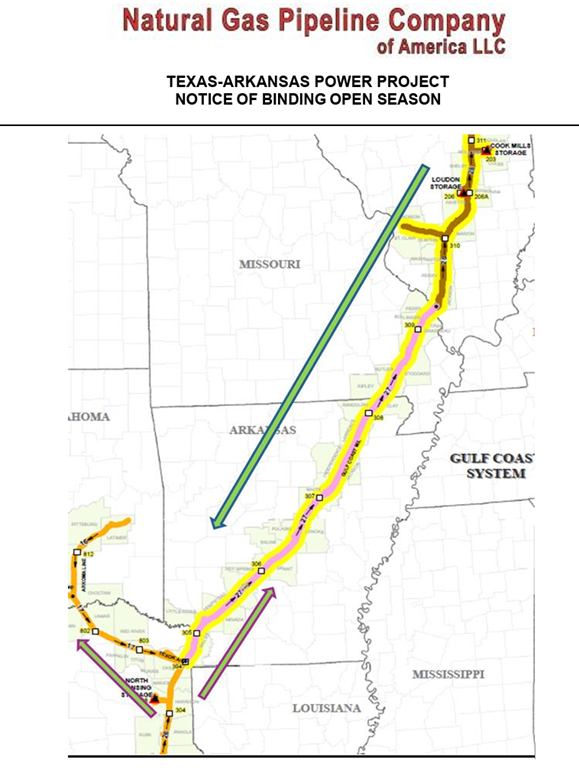

Texas Arkansas Power Project

|

The company announced that it signed a new binding agreement with a third-party shipper to support the project. The project would expand the capacity from the TexOk and Iowa-Illinois Receipt Zones to new interconnects in Texas and Arkansas. The $250 million project will expand up to 488 MMcf/d of capacity on Kinder’s NGPL pipeline. |

|

Texas Access Project (TAP)

Following an Open Season Kinder held in May 2025, the company announced that the Kinder Morgan Louisiana Pipeline secured new contracts for 1 Bcf/d of firm transport. The project is scheduled to come online in 4Q 2028 and provide gas from East Texas to existing and new markets in South Louisiana.

As one of the largest midstream companies in the US, Kinder Morgan is heavily followed by the natural gas industry. Infrastructure shifts are key to understanding future gas flows and their effect on local gas basis prices. See our reference pages for everything Haynesville, Permian, Rockies, and Appalachian gas.