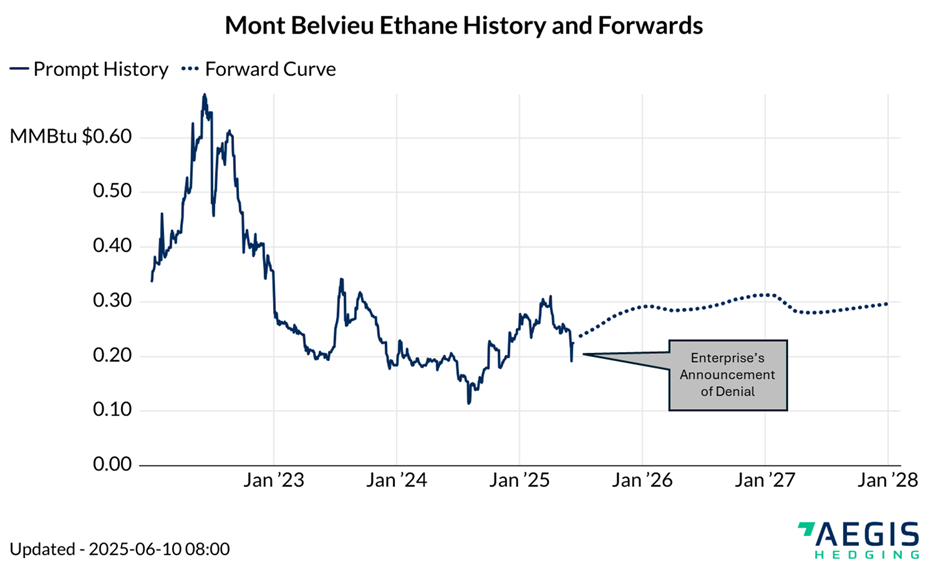

Mont Belvieu ethane prices plunged on Wednesday, June 4, after the US government notified Enterprise Product Partners that they would be denied permission to export three ethane cargoes to China. The news sent ripples through the ethane forward curve, with ethane trading below natural gas through the remainder of 2025 on a MMBtu-equivalent basis—an uncommon occurrence.

Since May 23, flows of U.S. ethane to China have been in question following a new licensing regime imposed by the Trump administration, which now requires special export licenses for ethane and butane shipments to China. More on this later.

Unusual Market Dynamics: Ethane Trading Below Gas

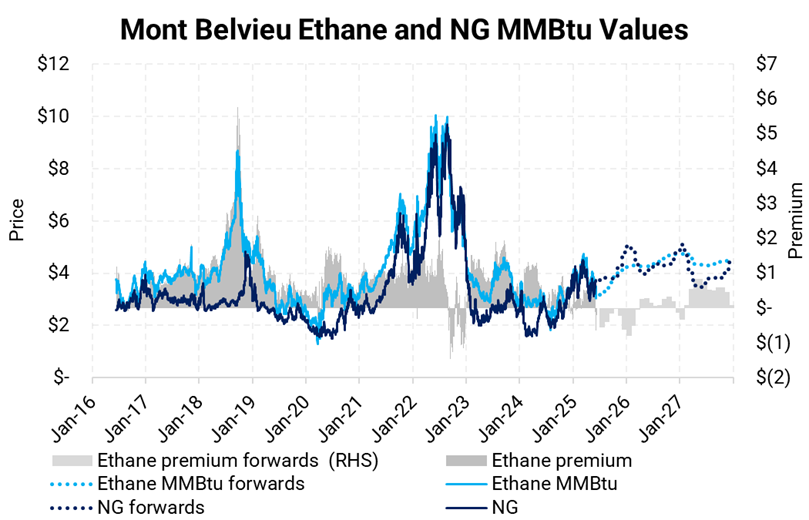

The chart below shows Henry Hub natural gas prices and Mont Belvieu ethane prices converted to MMBtu. Historically, natural gas acts as a floor for ethane prices. When the spot ethane price falls too low, more ethane is rejected into the (residue) natural gas stream, tightening ethane supply. As such, ethane has typically traded at a premium to gas, reflected in the positive spread (grey area). As of June 6, that future spread had turned negative through 2025—largely due to uncertainty around Chinese exports.

China is the destination for 50–70% of U.S. ethane exports, according to data from the EIA. There are few viable alternatives for China receiving ethane and the US exporting ethane. The lack of substitute markets makes the U.S.-China ethane relationship especially vulnerable to policy disruptions.

Source: AEGIS, as of June 6.

How Low Could Ethane Go?

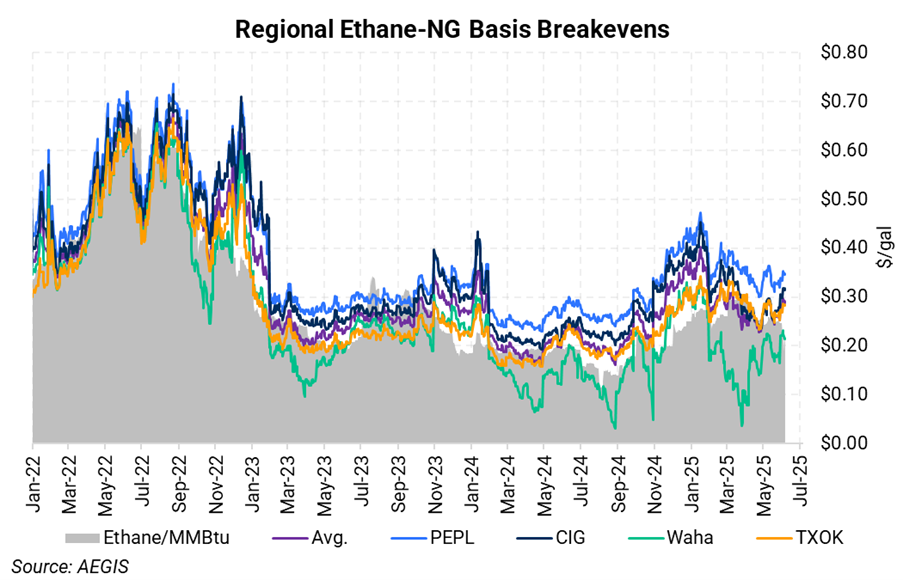

The third chart shows AEGIS’s estimate of ethane recovery economics by basin. It compares local basis hubs converted to ethane-equivalent $/gal, including representative transportation and fractionation (T&F) costs, against the minimum price needed to incentivize recovery.

In a tightening scenario, currently, ethane would need to rise to at least $0.30/gal to encourage more recovery in East Texas (NGPL-TXOK, gold line) or the Rockies (CIG, navy line). Today’s situation is the opposite—potential oversupply due to export risk. In this case, ethane needs to fall low enough to encourage rejection - specifically below Waha basis levels in the Permian.

Our high-level model suggests that this has already happened. Waha pricing appears to have set a soft floor for ethane, signaling possible rejection from Permian processing plants.

The Policy Trigger: Enterprise Cargo Denials

The immediate catalyst for the selloff came on June 3, when Enterprise Products Partners (EPD) announced that the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) issued a “notice of intent to deny” three emergency cargo export requests to China. The denials would become final unless the BIS reverses course within a 45-day window.

This action follows the May 23 BIS letter requiring ethane and butane exporters to China to obtain a special license. In an 8-K filing on May 29, EPD said the BIS cited concerns about “unacceptable risk of use in or diversion to a ‘military end use’” in China, particularly within the framework of China’s military-civil fusion strategy.

Why This Matters

Exports are critical to clearing excess U.S. ethane supply. The U.S. is the world’s dominant ethane exporter, and China lacks a substitute. Conversely, the U.S. has no meaningful alternative market to absorb the entirety of that volume. Both countries are deeply intertwined in the ethane trade.

Some analysts suggest the new restrictions are tied to broader trade negotiations, with Washington using ethane as leverage. As OPIS has reported, the current restrictions may be more tactical than permanent.