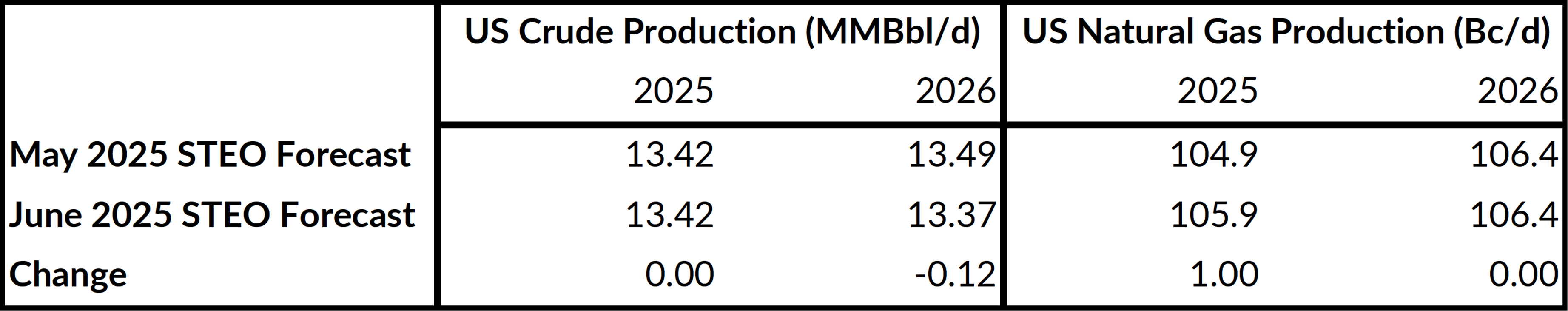

The U.S. Energy Information Administration is now forecasting a decline in U.S. crude production in 2026, marking a notable shift from last month’s outlook, which still projected growth into next year. However, the EIA’s outlook, released on June 10, was based on data gathered before the Israel-Iran conflict and reflects pre-conflict market conditions.

In its June 2025 Short-Term Energy Outlook (STEO), the agency lowered its 2026 forecast to 13.37 MMBbl/d, down from 13.49 MMBbl/d in May. While 2025 output is still expected to average 13.42 MMBbl/d, the revision signals a loss of momentum in U.S. supply growth for the first time in years.

While not unprecedented, production declines in the post-shale era have typically followed major market dislocations, such as the 2014–2016 price collapse, driven by OPEC’s decision to maintain production levels amid a surge in U.S. shale output, or the 2020 COVID shock. This time, the pullback is more structural: a response to oversupply, softer prices, and shrinking reinvestment across the Lower 48.

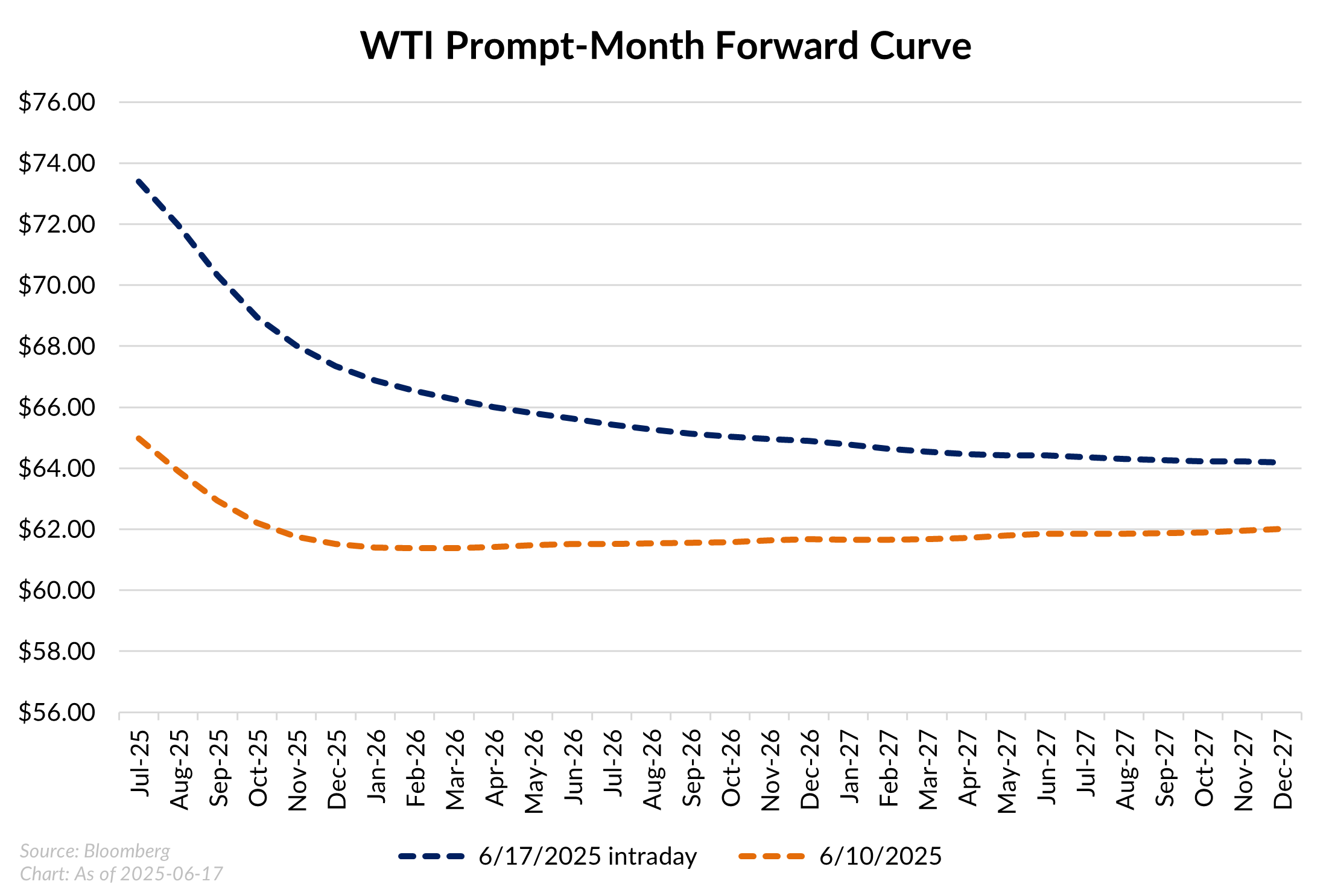

The EIA attributes the projected production decline to expectations of oversupply and weaker prices through next year. While the agency highlights a potential market surplus, producers are reacting to price signals, not global balances. WTI spot prices are now forecast to average $62.33/Bbl in 2025 and just $55.58/Bbl in 2026, down sharply from $76.60/Bbl in 2024. The sustained downturn is weighing on drilling economics. Since December, the U.S. oil rig count has fallen by more than 60 rigs, according to Baker Hughes, signaling reduced appetite for reinvestment despite elevated production.

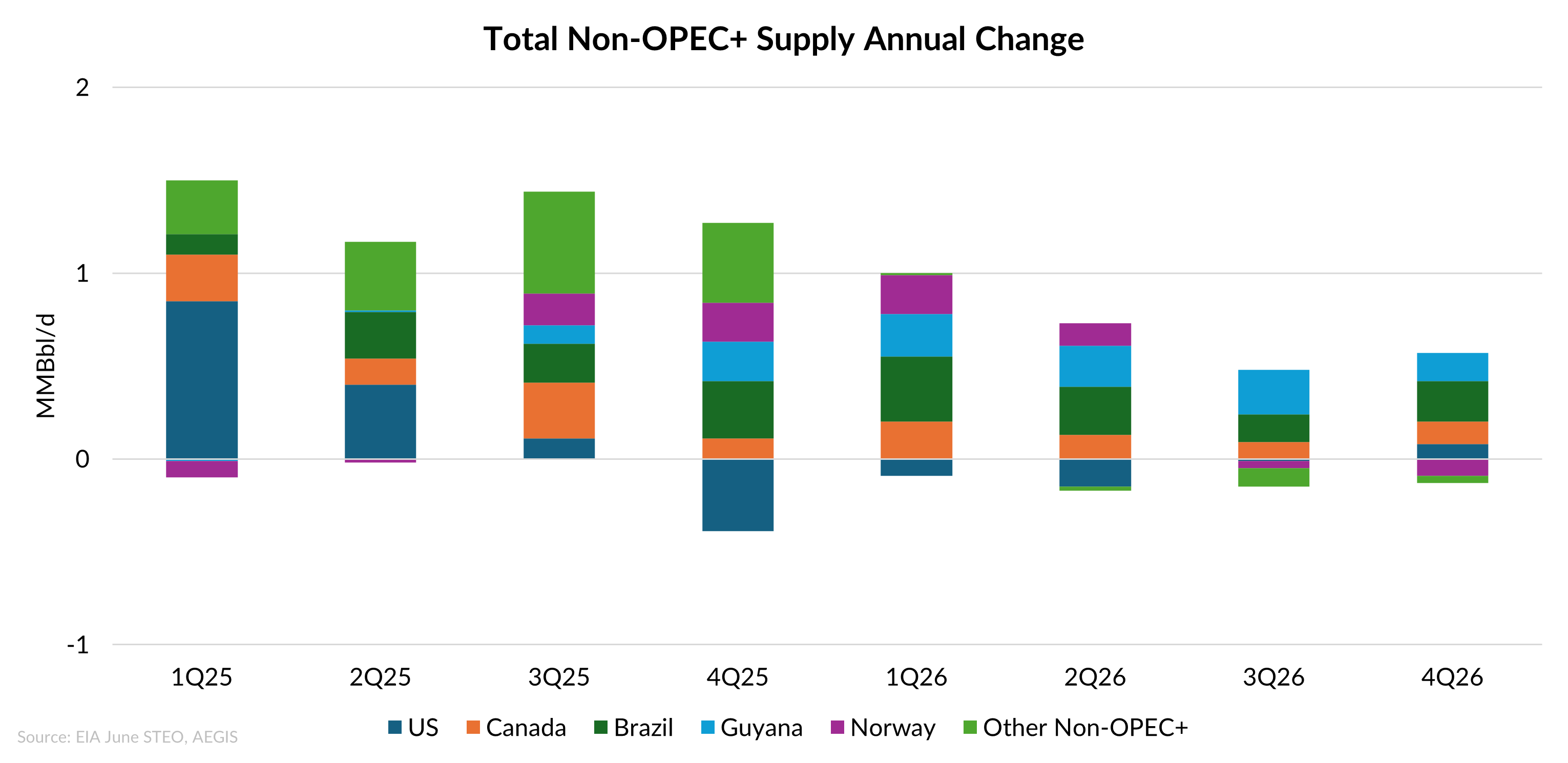

While WTI front-month prices have strengthened in recent sessions, the back of the curve remains broadly stable. The steepening at the front end reflects renewed near-term volatility, driven in part by rising geopolitical tensions, while deferred prices have edged only modestly higher. This disconnect is consistent with the EIA’s outlook for a persistently loose market, including a projected 0.8 MMBbl/d surplus in 2025 and a 0.6 MMBbl/d inventory build in 2026. The imbalance is driven by rising output from OPEC+ and non-OPEC producers like Brazil, Guyana, and Canada, continuing to outpace demand growth.

Natural Gas Output Faces Pressure as Oil-Linked Supply Flattens

The flattening of U.S. crude production in 2026 also has implications for the natural gas market, particularly associated gas, a key source of U.S. supply growth over the past decade. With oil-directed drilling expected to slow, especially in liquids-rich regions like the Permian Basin, the volume of associated gas is likely to stagnate or decline. This shift places more burden on dry gas basins, such as the Haynesville and Marcellus, to meet growing demand.

The EIA’s June STEO raised its 2025 dry gas production forecast from 104.9 Bcf/d to 105.9 Bcf/d, reflecting an expectation that producers will accelerate completions or DUC drawdowns in the near term. However, the 2026 forecast remains flat at 106.4 Bcf/d, implying a significant maintenance wedge, the volume of new supply needed just to hold production steady.

This front-loaded supply response may help meet rising short-term demand, but it also increases the volume that must be replaced in 2026 as legacy wells decline. With 2–3 Bcf/d of new LNG feedgas demand expected to come online next year the natural gas market could tighten quickly if drilling activity doesn’t keep pace. As a result, the risk of a gas supply shortfall grows, particularly if oil-linked production underperforms or if dry gas growth underwhelms.

Global Implications

The EIA’s forecast marks a turning point, with U.S. oil production expected to flatten in 2026. This shift carries downstream implications, not just for crude markets, but also for natural gas and NGLs, which have long been supported by oil-linked output growth. A slowdown in U.S. drilling could tighten gas balances and limit NGL supply if dry gas basins are unable to compensate.

Meanwhile, if demand fails to absorb new barrels from non-OPEC+ producers and an accelerated OPEC+ schedule, the risk of another market-share battle rises. While far from certain, the potential for a more competitive, supply-driven market looms.

Bonus: Ethane Exports Take a Hit

While most headlines focused on crude and macro balances, one of the largest downward revisions in the STEO came in U.S. ethane exports. The EIA slashed its 2025 export forecast by 24% following the U.S. government’s denial of export licenses to China, a country that receives nearly all its ethane from the U.S. With no immediate alternative outlet, the EIA also cut expected ethane production, citing reduced incentives to separate ethane from the natural gas stream.

For a full breakdown of the ethane export policy shift and market implications, read our analysis here.