The US Energy Information Administration’s (EIA) November 2025 Short-Term Energy Outlook (STEO) the agency raised its crude oil price forecasts for 2026, even as it projects that global oil supply will outpace demand by a wider margin than previously anticipated. This month’s report highlights the increasingly complex interplay of supply growth, demand trends, inventory builds, and geopolitical factors shaping the market outlook.

Surplus Widens

The EIA now expects global supplies to increase by 2.8 MMBbl/d in 2025 and by another 1.4 MMBbl/d in 2026. This is an upward revision from last month, reflecting stronger-than-expected output from Brazil, the United States, Guyana, and Canada. OPEC+ production is also set to rise, though the agency anticipates actual output will fall short of official targets.

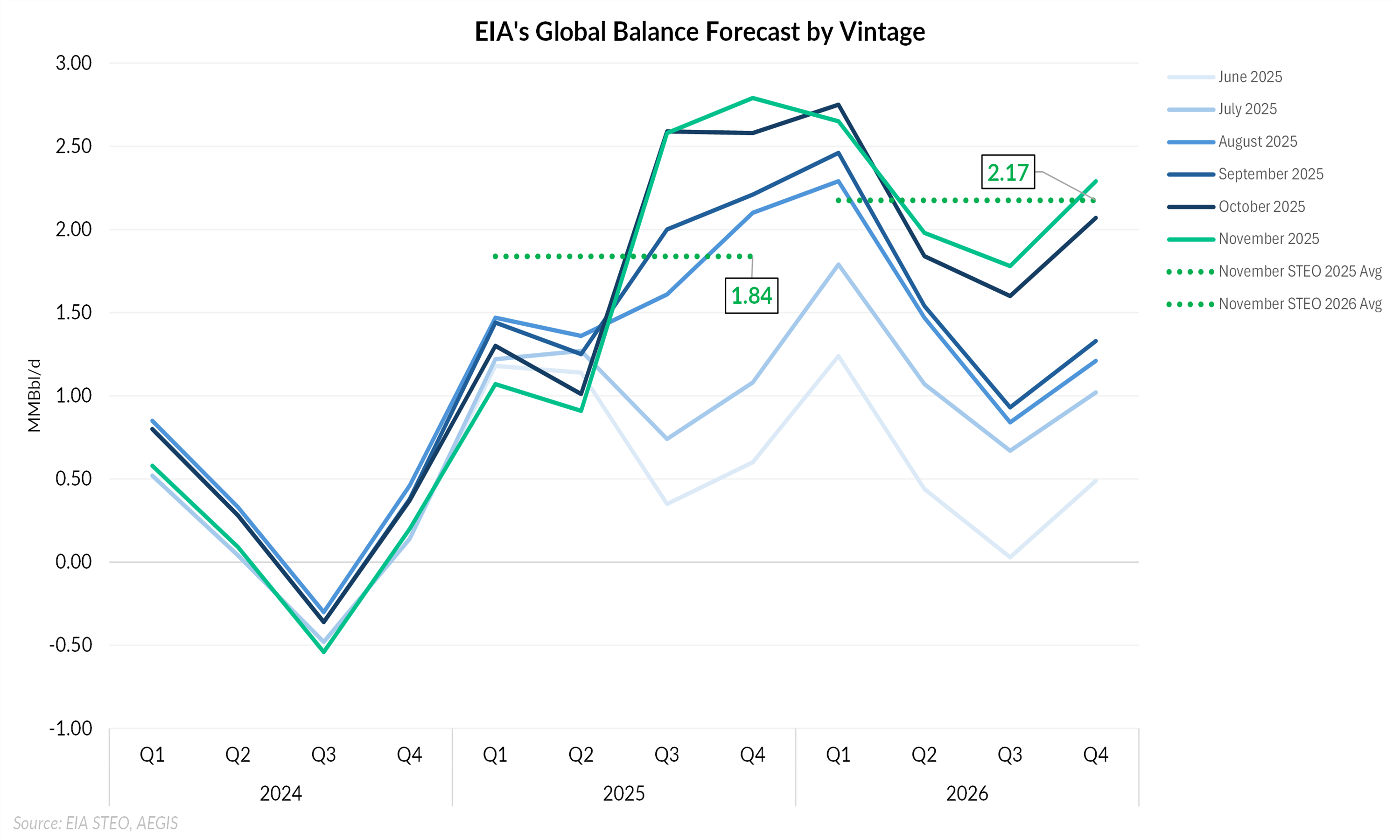

On the demand side, global consumption is forecast to rise by 1.0 million b/d in 2025 and 1.1 million b/d in 2026, with most of the growth coming from non-OECD countries, particularly China and India. As a result, the global supply surplus is now projected to reach 2.17 MMBbl/d in 2026, which is 100 MBbl/d higher than last month’s outlook. For 2025, the surplus is expected to be 1.84 MMBbl/d. This widening gap reflects the upward revisions to supply and only modest changes to the demand outlook.

Upward Revision Defies Fundamentals

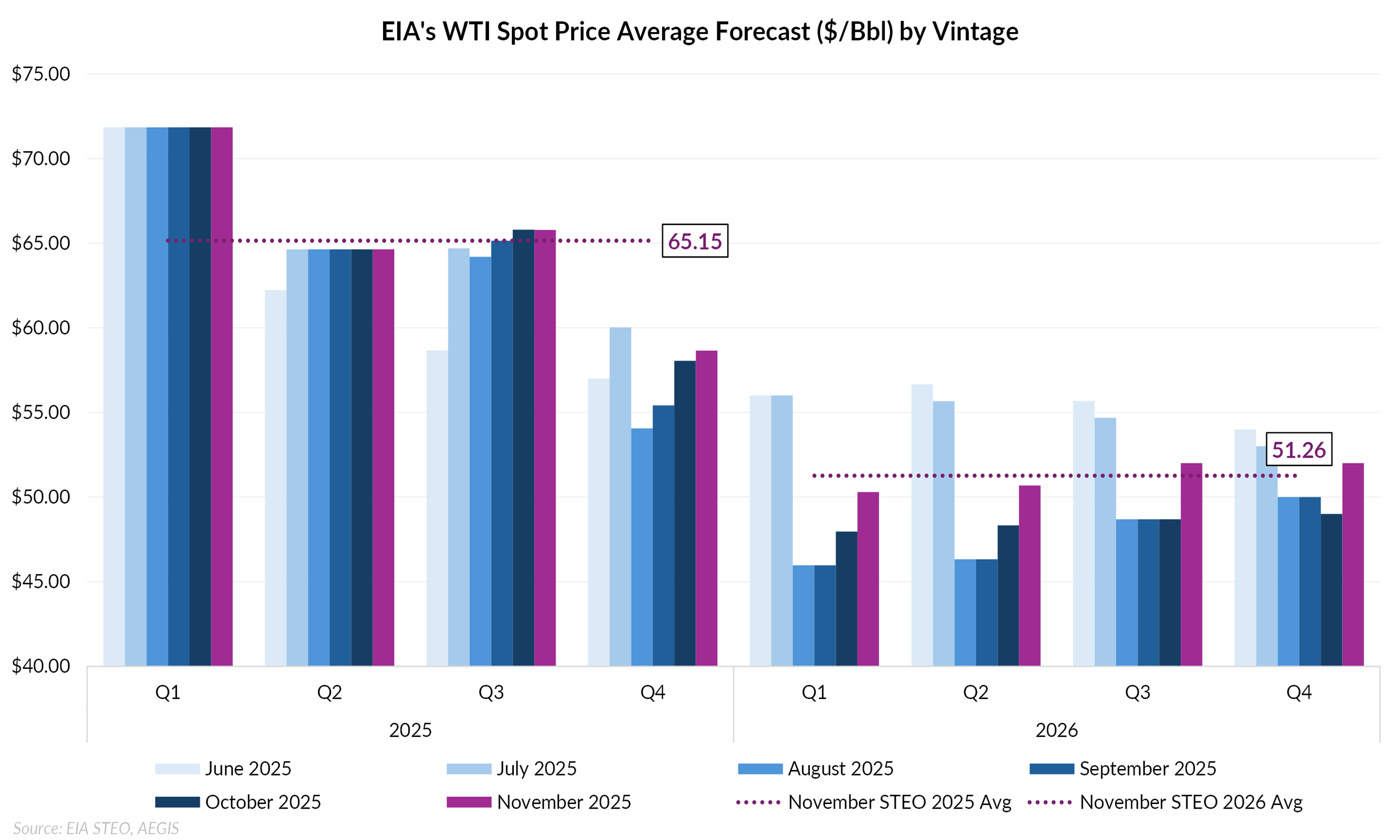

Despite the more bearish supply-demand outlook, the EIA has revised its price forecasts higher. WTI spot prices are now expected to average $51.26 per barrel in 2026, up nearly $3 from last month’s forecast, while the 2025 forecast is essentially unchanged. The EIA points to ongoing strategic stockpiling by China and the impact of new sanctions on Russia’s oil sector as key factors supporting prices. The agency believes that China’s continued purchases for its strategic reserves and the potential for lower Russian output are helping to offset what would otherwise be strong downward pressure on prices.

Inventories and Market Dynamics

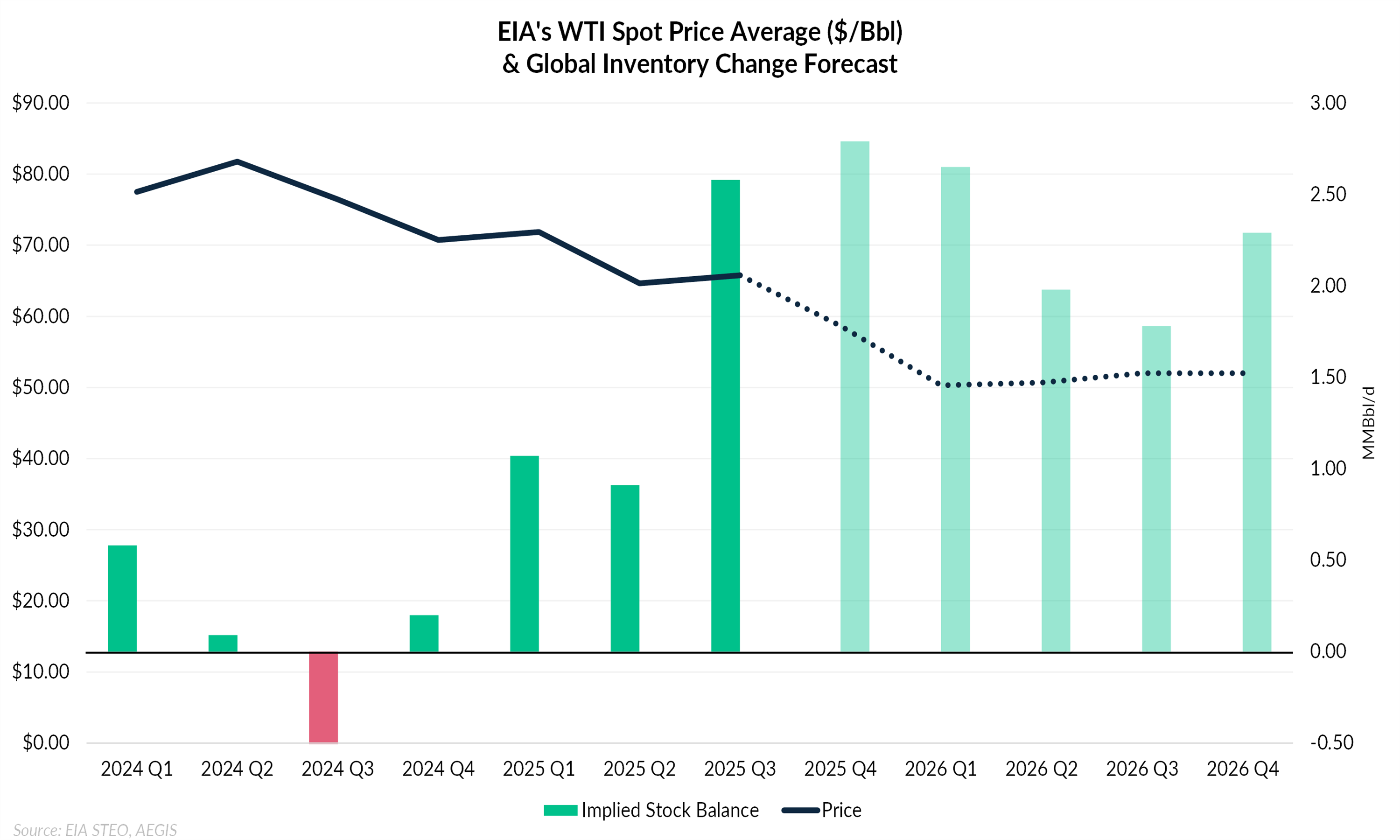

With supply set to outpace demand, inventories are expected to rise sharply. The EIA forecasts that global oil inventories will build at an accelerated pace, with the most significant increases occurring in the fourth quarter of 2025 and the first quarter of 2026. In OECD countries, total commercial crude oil inventories are projected to rise from 2,743 million barrels at the end of 2024 to 3,181 million barrels at the end of 2026. The agency notes that if commercial storage fills, market participants may be forced to turn to more expensive options such as floating storage, which could influence price dynamics. As shown in the chart below, the projected WTI price path reflects the EIA’s own forecast as these inventory builds continue into 2026.

Conclusion

The November 2025 STEO underscores the complexity of the current oil market environment. Even as the EIA projects a more pronounced supply surplus and faster inventory builds, it has revised its price forecasts higher, reflecting the outsized influence of strategic stockpiling in China and geopolitical risks surrounding Russian supply. While fundamentals point to lower prices, market risks and uncertainties are keeping a floor under the outlook.