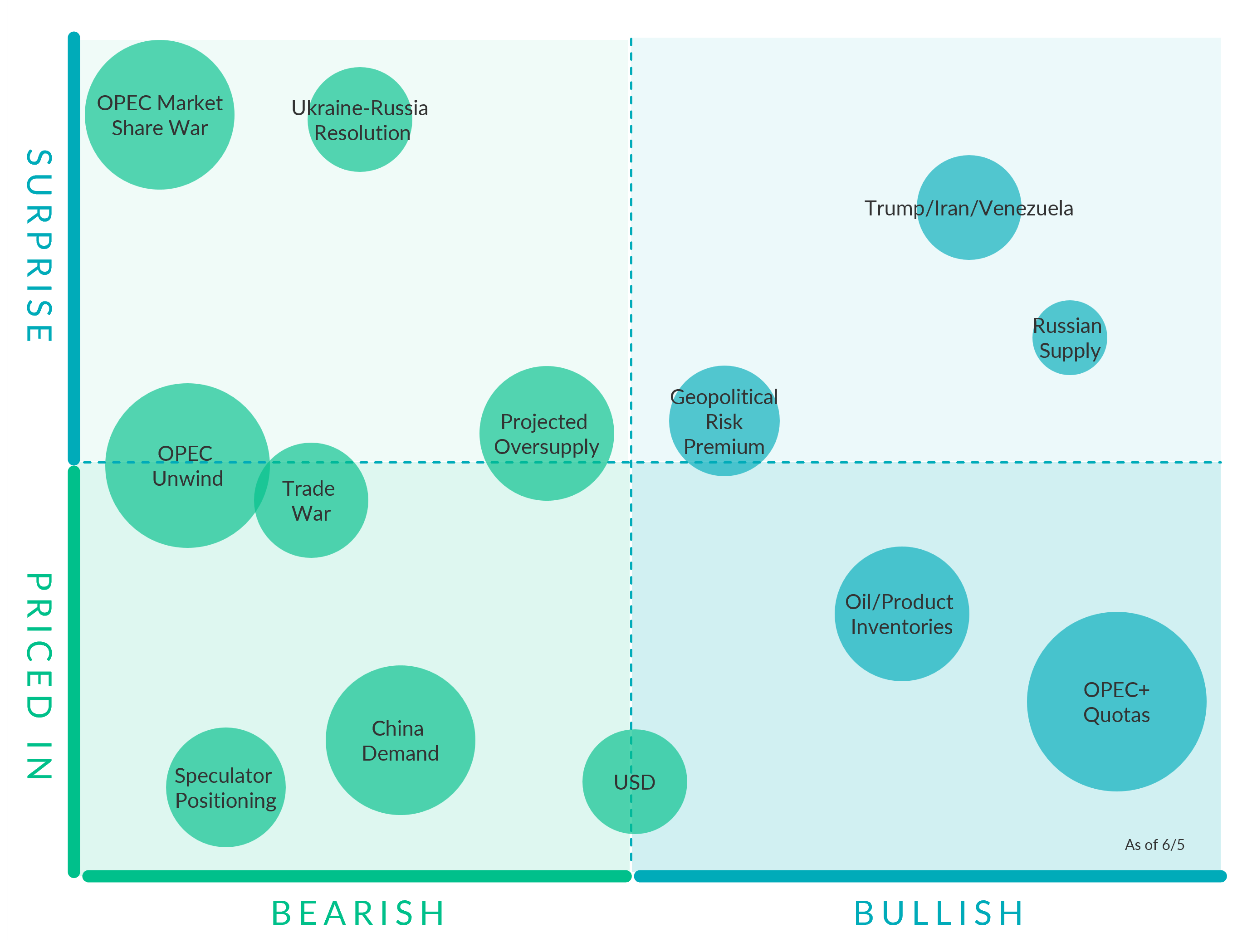

Crude Oil Factors

Geopolitical Risk Premium. (Bullish, Surprise) Oil markets swiftly repriced geopolitical risk after Israeli military strikes on Iran, flipping the futures curve into backwardation. The attacks heightened concerns over potential supply disruptions through the Strait of Hormuz and the risk of broader conflict in the Middle East. Although Iran reported no damage to oil infrastructure, traders rushed to hedge against further escalation.

Speculator Positioning (Bearish, Priced In) Managed money or speculator positioning is at the most bearish level since 2023. According to CFTC data, speculators hold a net-long position of about 100k contracts in WTI, down from 250k in January. Speculators are almost always net long on WTI, although at times this position will fall to very low levels, indicating bearish sentiment. This factor could also be looked at as a bullish surprise, given that any bullish catalyst would likely see speculators pile back into the market.

OPEC Market Share War. (Bearish, Surprise) The possibility exists, albeit a small one, that should OPEC's efforts to bolster oil prices through production cuts prove unsuccessful, the cartel could potentially flood the market with additional barrels as a strategy to reset. The probability of this has increased in 2025, as OPEC rhetoric seems to be less focused on price.

Oil/Product Inventories. (Bullish, Priced In) Crude inventories in the US remain low, although stocks have risen this year in-line with seasonal trends. Crude data is usually on a several-month lag. According to the April IEA report, OECD inventories were nearly 200 MMBbl below the five-year average as of February.

OPEC+ Quotas. (Bullish, Priced In) On June 2, OPEC+ announced its extension of 3.66 MMBbl/d cuts through December 2025. Additionally, the 2.2 MMBbl/d voluntary cuts from eight member countries will continue into Q3 2024 but will start to be reversed in October at a rate of 0.18 MMBbl/d per month. OPEC+ members agreed on September 5 to delay a planned gradual 2.2 MMBbl/d supply hike by two months, shifting the start to December. The group will add 0.19 MMBbl/d in December and 0.21 MMBbl/d from January onwards, with an option to adjust or pause these hikes depending on market conditions. The cartel also reaffirmed its compensation cuts of 0.2 MMBbl/d per month through November 2025, as members such as Iraq, Russia, and Kazakhstan have struggled to meet their original production quotas.

AEGIS notes that the global crude market would quickly build inventories without OPEC's support in reducing supply.

OPEC Unwind/Compliance. (Bearish, Surprise) The new voluntary OPEC+ production cuts put member nations' adherence to quotas under scrutiny. Any deviation, such as halting, reversing, or exceeding their quotas, could end up being one of the surprise bearish factors weighing on the market. OPEC announced recently that it plans to begin restoring production in April. This decision took the market by surprise as OPEC has delayed this plan several times, citing weak market conditions. OPEC's current plan is to bring back about 140 MBbl/d each month until all 2.2 MMBbl/d is restored.

China Demand. (Bearish, Priced In) China's oil demand has been severely affected by a combination of economic weakness and electrification trends within the country. Continued weakness in China's real estate sector has led to slower economic growth. The Chinese government has responded with interest rate cuts and multiple stimulus packages. Electrification trends have also dampened oil demand growth, with the buildout of high-speed rail and LNG-powered trucks and busses impacting diesel demand. China is one of the most prolific adopters of electric vehicles, impacting gasoline demand. Some estimates show demand for transportation fuels in China peaking, but oil demand from China's petrochemical sector should continue for the next few decades.

USD (Bullish, Surprise) The US dollar index surged to multi-year highs toward the end of 2024. The dollar has since erased all post-election gains despite tariff fears being realized. Typically, a stronger dollar will have a negative impact on crude prices, while a weakening dollar will support prices.

Non-OPEC Production. (Bearish, Priced-In) Non-OPEC production remains a bearish risk to the market, as strong output from the US, South America, or Africa could result in more supply coming to the market than expected. Strong non-OPEC growth has been seen over the past few years, driven by the US, Brazil, and Guyana.

Ukraine-Russia Resolution. (Bearish, Surprise) Russia has intensified drone strikes in an effort to pressure Ukraine into accepting its terms for a resolution. Meanwhile, the European Union is proposing a new sanctions package, including a ban on the Nord Stream pipelines and a reduction of the oil price cap to $45/Bbl, to increase pressure on Moscow. While the prospect of a resolution is bearish for crude, additional sanctions could provide offsetting price support.

Fed Policy. (Bearish/Bullish, Surprise) The Federal Reserve is not expected to be as aggressive with cutting interest rates in 2025, given recent stickiness in inflation. The weakness in equity markets has led to the bond market pricing in an additional rate cut in 2025, with a total of three cuts expected. Rate cuts should be supportive of oil prices by fostering economic growth and weakening the US dollar.

Trade War. (Bearish, Surprise) Following two days of high-level talks in London, the U.S. and China have agreed on a preliminary framework to implement the Geneva consensus, aimed at restoring the flow of sensitive goods. The deal, pending final approval from Presidents Trump and Xi, includes China’s pledge to expedite rare earth shipments and a U.S. commitment to ease select export controls. Markets reacted positively to the progress, which could help avert a demand-led global recession. However, any breakdown in future negotiations could reverse sentiment and weigh on prices.

Projected Oversupply. (Bearish, Surprise) The IEA continues to anticipate an oversupplied market in 2025, although the level of oversupply has been moderated a bit in its latest outlook. Around the end of 2024, the IEA was anticipating about 1 MMbbl/d of oversupply, which has now fallen to about 0.4 MMBbl/d.

Trump/Iran/Venezuela. (Bullish, Surprise) Following the Israeli strikes, President Trump is urged Iran to return to the table for nuclear negotiations. The U.S. granted Chevron a limited license to maintain its presence in Venezuela, allowing preservation of assets and joint ventures, but prohibiting oil production, exports, or expansion. Any escalation that curtails Iranian or Venezuelan supply could add upward pressure to crude prices.

Global Refining. (Bearish, Priced in) Refining margins have weakened in Europe and Asia, reducing run rates. This factor can hurt oil prices but is priced in.

Russian Supply. (Bullish, Surprise) Aggressive US sanctions targetting Russia's energy sector were announced earlier this year, leading to fears that a significant volume of oil could be removed from the market. Prior sanctions targeting Russia failed to remove any supply from the market, although Russia's revenues have been negatively impacted.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.