OPEC+ is in the process of bringing back over 2 MM barrels of additional production at a time when global balances forecast a surplus through 2026. However, the headline number does not accurately portray the changes to global supply.

OPEC+ Production Hikes

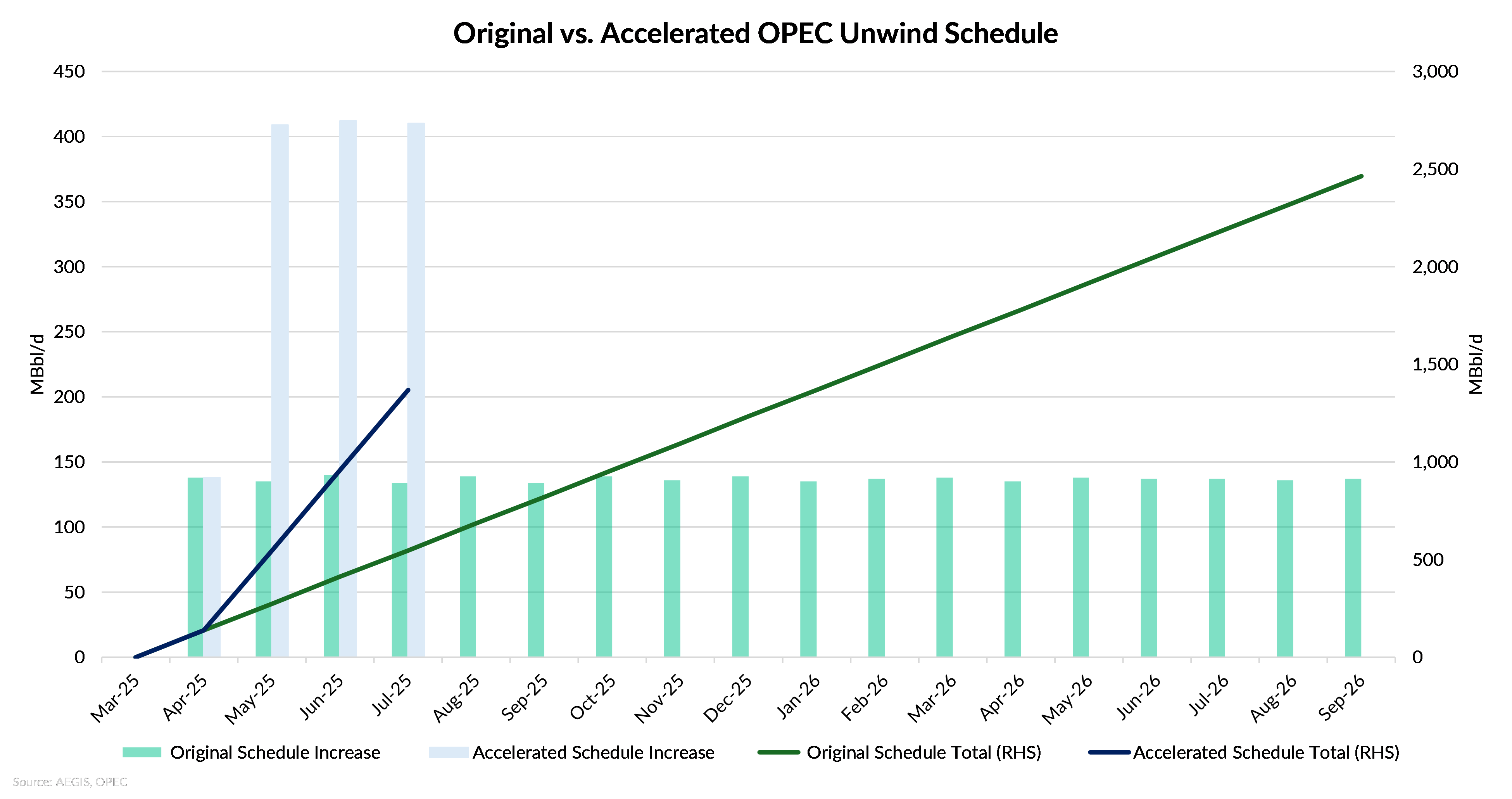

OPEC+ began unwinding supply cuts in April 2025. The plan includes a total of 2,200 MBbl/d from the broader group, along with a 300 MBbl/d increase in the UAE’s production target, bringing the combined planned return to 2.5 MMBbl/d.

The original schedule envisioned steady monthly average increases of around 136 MBbl/d. The April hike followed the original schedule, however the cartel decided to individually triple the production hike for the three following months. As a result, more than half (1,369 MBbl/d) of the planned barrels have now been reinstated on paper.

Compensation Cuts

Eight countries pledged compensatory cuts to offset earlier overproduction. When these are factored in, the total scheduled increase by July decreases from 1.369 MMBbl/d to 1.113 MMBbl/d, a reduction of over 250 MBbl/d. Accounting for these adjustments provides a clearer picture of actual production commitments.

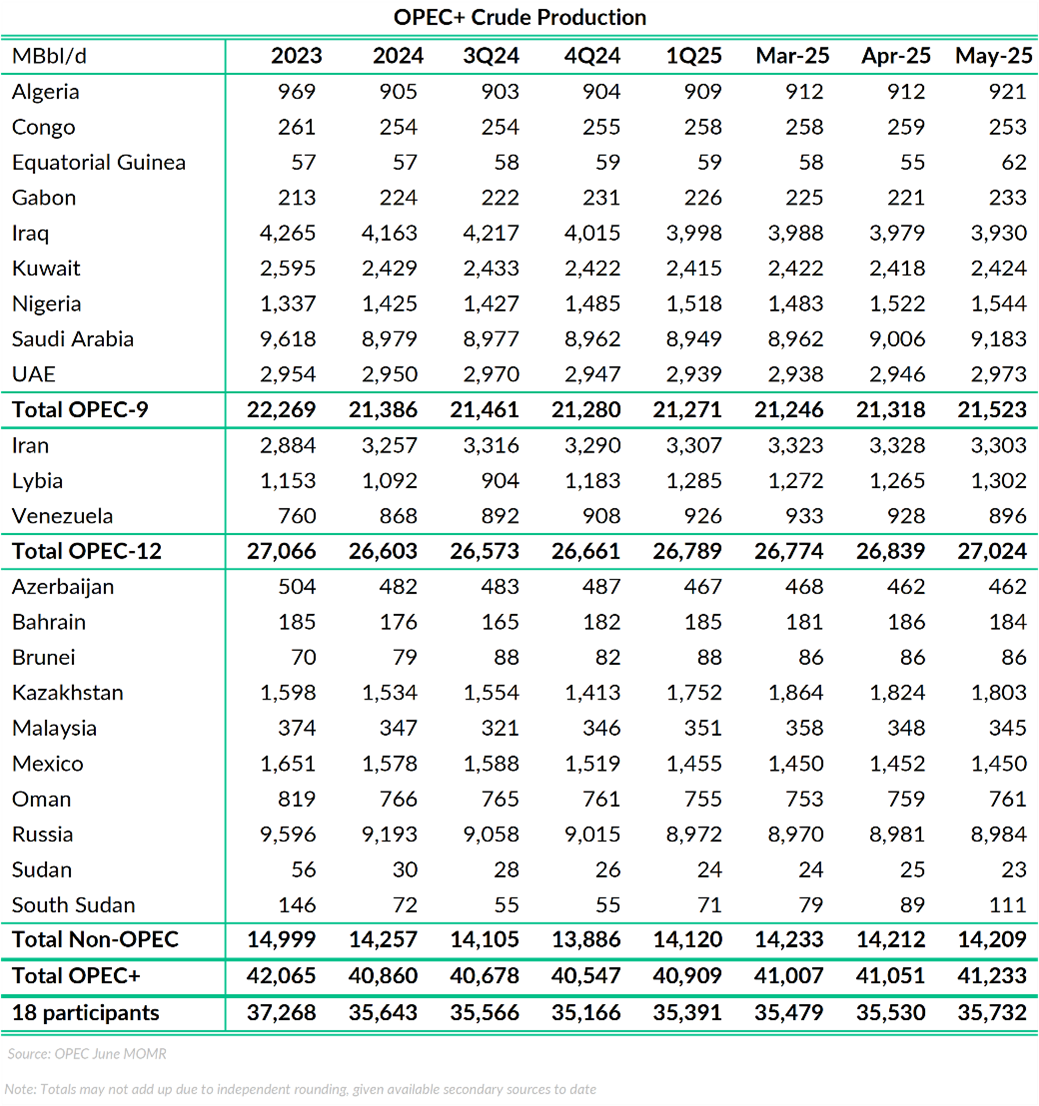

Kazakhstan, a consistent quota violator, produced 1.803 MMBbl/d in May, more than 400 MBbl/d above its quota, despite modest cuts in recent months.

Production data across agencies such as the IEA and OPEC differ due to variations in methodology and source inputs.

Production data across agencies such as the IEA and OPEC differ due to variations in methodology and source inputs.

Real Output vs. Targets

Despite accelerated scheduled hikes, real output increases have been modest. According to OPEC, production from the 18 participating countries (excluding Iran, Lybia, and Venezuela which are not subject to quotas) rose from 35.479 MMBbl/d in March to 35.732 MMBbl/d in May, an increase of 253 MBbl/d.

This contrasts with the 547 MBbl/d of scheduled target increases for the same period, indicating that less than half of the planned additions have materialized in reported volumes through May.

One exception has been Saudi Arabia, which raised output from 8.962 MMBbl/d in March to 9.183 MMBbl/d in May, a gain of 221 MBbl/d. This accounts for most of the group's net increase over the same period, reinforcing Saudi Arabia’s role as the key driver of observed production growth.

Conclusion

While OPEC+ has accelerated its scheduled production increases, actual output data through May indicates slower realization of these gains. Saudi Arabia has substantially driven the incremental supply growth, while several key producers remain constrained or non-compliant with compensatory cuts.

Looking forward to OPEC+’s July 6 meeting, the group is set to consider another large hike. Future production data will clarify if the large production hikes push the supply and demand balance further into surplus or if actual production continues to lag.