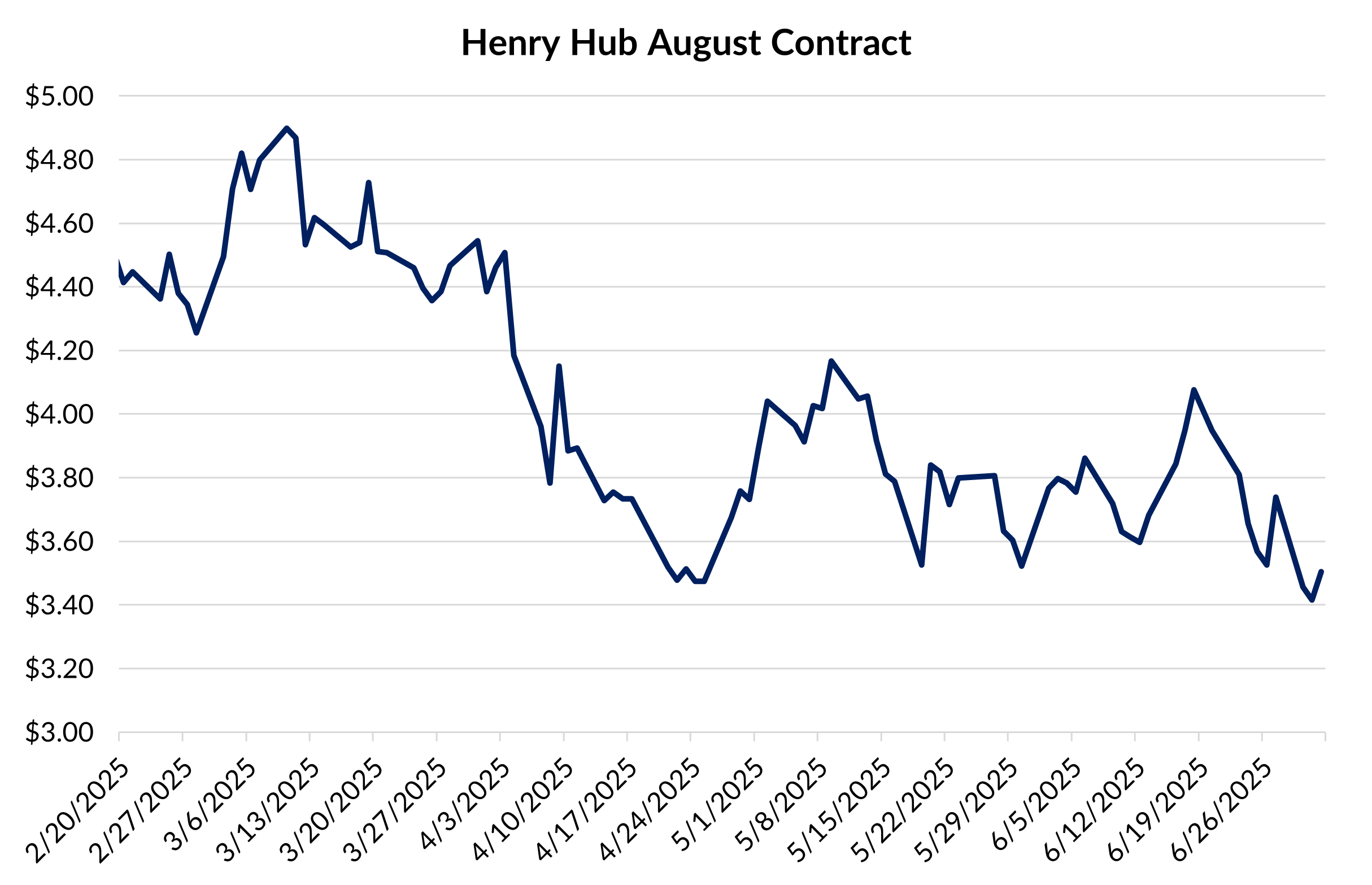

Natural gas prices have materially declined since their peak back in February. The August contract shown below is well off 1Q highs of nearly $5.00/MMbtu. A well supplied gas market is to blame, and the result has been a rapid increase in underground storage. The cause is a multitude of factors such as bearish weather, ample production, trade flow, ext.

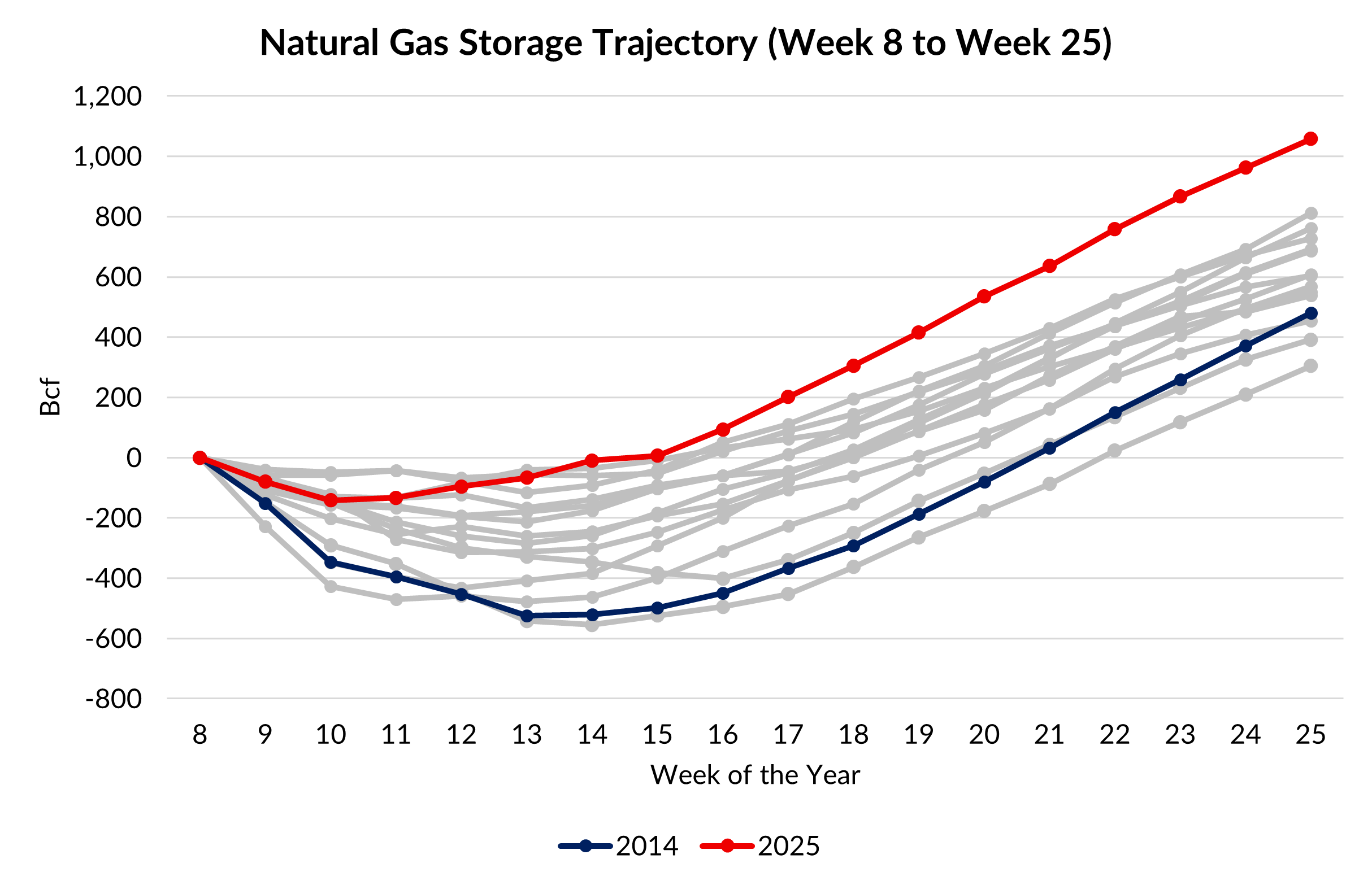

This spring, natural gas inventories have soared. There were a string of triple digit builds from late April to early June, tying the record set in 2014. The chart below shows the storage path starting in late February (week 8) to late June (week 25).

Source: AEGIS, EIA

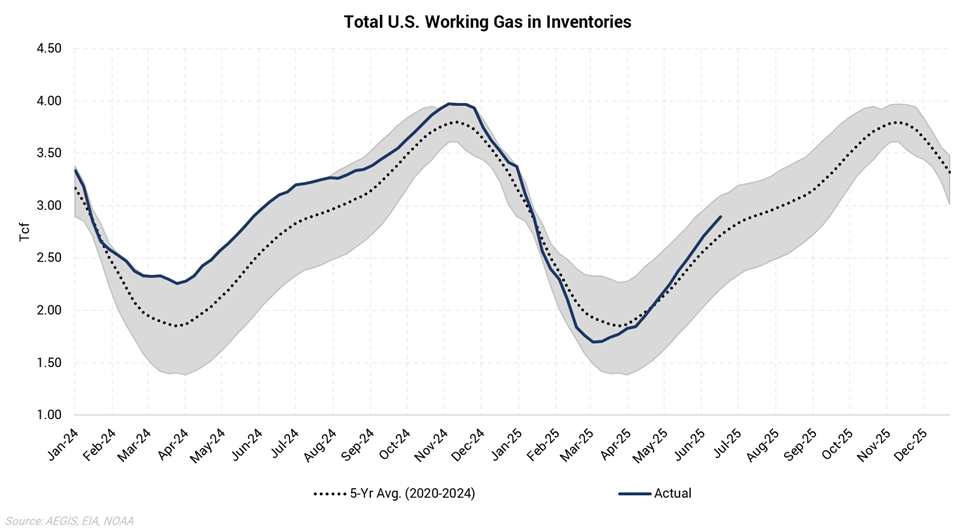

A rise is the storage level relative to the five-year average has historically meant falling prices. As the chart below shows, inventories in February/March of 2025 were 200 Bcf below the five-year average – about the same time prices were at their peak. As of late June, Inventories had ballooned to 179 Bcf over the five-year average.

Despite the rapid build in inventories and subsequent drop in price, most analysts remain bullish about the future, including us. Gas demand growth is expected to outpace supply heading into next year and should put upward pressure on prices.