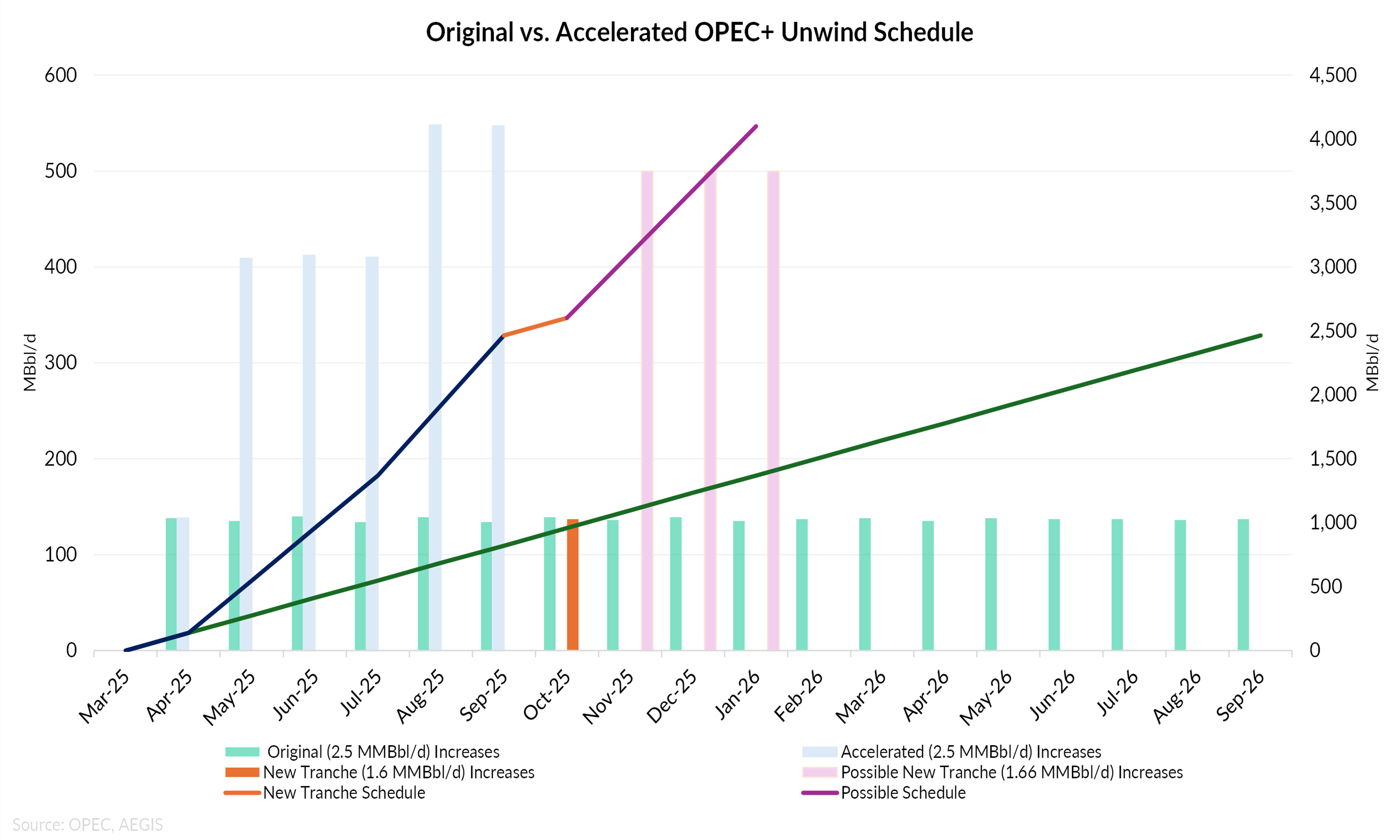

OPEC+ will meet on October 5 to debate whether to accelerate the return of 1.66 MMBbl/d of voluntary cuts. One proposal under review is to raise output by roughly 500 MBbl/d per month over three months, far faster than the 137 MBbl/d increase already scheduled for October. As the chart below shows, the orange bar reflects that October hike, marking the first step in reviving the new tranche, while the three purple bars represent the possible 500 MBbl/d additions now under consideration. The option highlights Saudi Arabia’s determination to claw back market share from US shale and other non-OPEC suppliers even as balances already point to significant oversupply ahead.

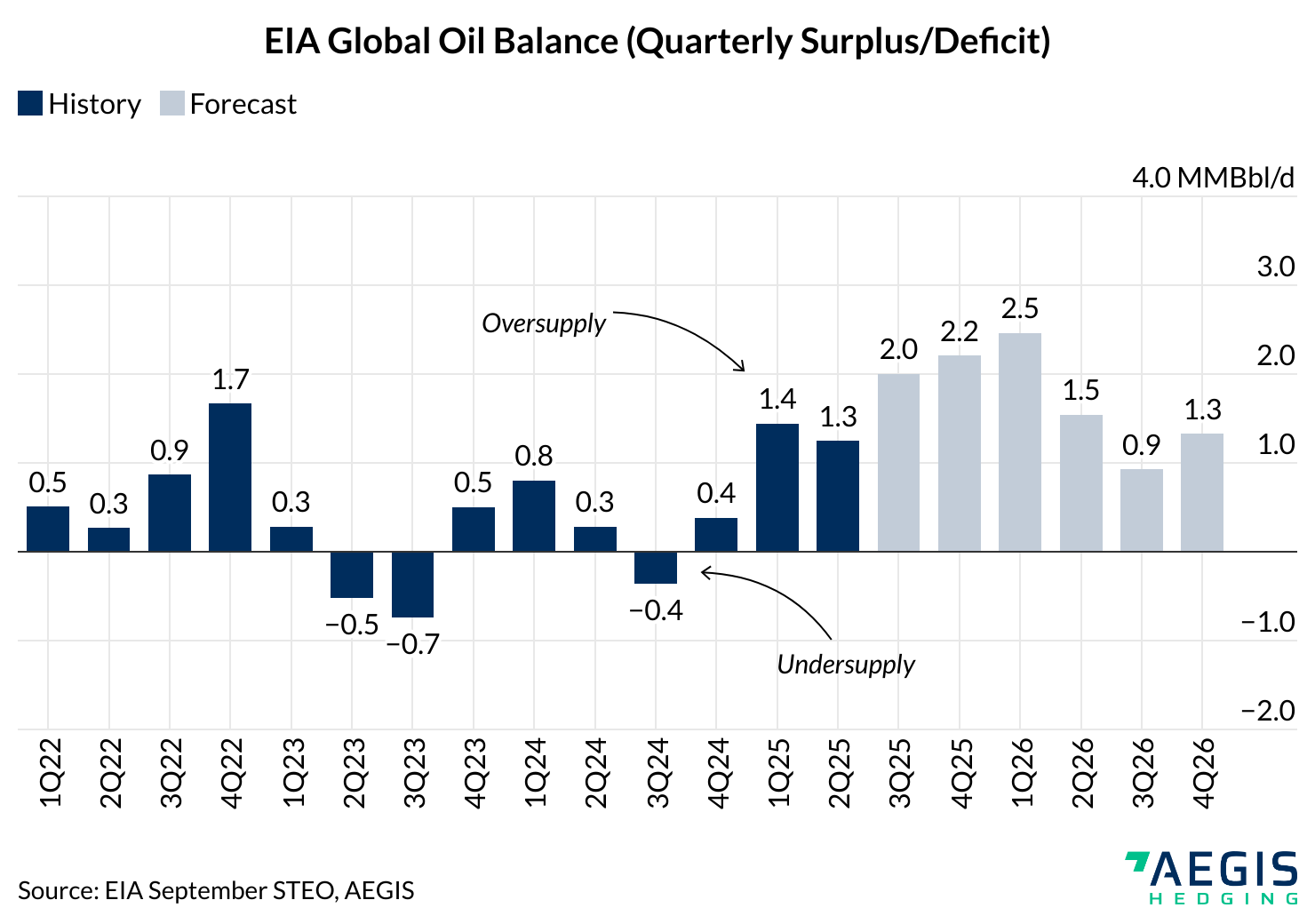

The US Energy Information Administration reinforces this outlook in its latest Short Term Energy Outlook which projects that global oil inventories will rise by an average of 1.7 MMBbl/d in 2025 and 1.6 MMBbl/d in 2026 with the sharpest builds of more than 2 MMBbl/d set to hit late 2025 and early 2026. These forecasts do not yet account for the possibility of faster OPEC+ hikes, meaning the imbalance could prove even larger if the cartel opts to speed the unwind.

Yet more recent EIA survey data adds nuance to that picture. July monthly figures show US total liquids output at a record 21.2 MMBbl/d nearly 500 MBbl/d higher than weekly estimates implied. Crude production reached 13.6 MMBbl/d while natural gas liquids hit 7.6 MMBbl/d. Demand was also revised higher to 21.0 MMBbl/d with gasoline, diesel, and jet fuel consumption all stronger than expected. The revisions suggest US supply has more resilience than assumed while robust consumption has helped limit inventory builds. This could help explain why stocks have not yet swelled in line with surplus projections even as the bearish outlook remains intact. Still, the US may not be the biggest factor helping global balances.

China’s strategic reserve purchases remain another critical swing factor. Analysts note that Beijing’s continued buying spree has shielded OECD markets from visible inventory builds by absorbing excess barrels. ING’s Warren Patterson says that without China stepping in “the surplus would already be showing up more clearly in the West.” Any pullback in Chinese purchases would allow the expected glut to surface more quickly in OECD data, adding pressure on prices.

OPEC+ is now facing a choice between reclaiming market share quickly and avoiding a surplus that forecasters already see as inevitable. Stronger US output and resilient demand have delayed the appearance of stock builds while China’s reserve purchases have further masked the imbalance, but neither factor can be relied on indefinitely. The October 5 decision could shape how quickly the surplus shows up in OECD inventories and ultimately affect prices heading into 2026.