Hedging oil, gas, or NGL production can feel counterintuitive when prices are depressed. Finance teams often hesitate, worried about locking in the bottom. But being unhedged in a falling market can be far more damaging. The objective isn’t to time the market perfectly, it’s to protect cash flow and minimize price risk.

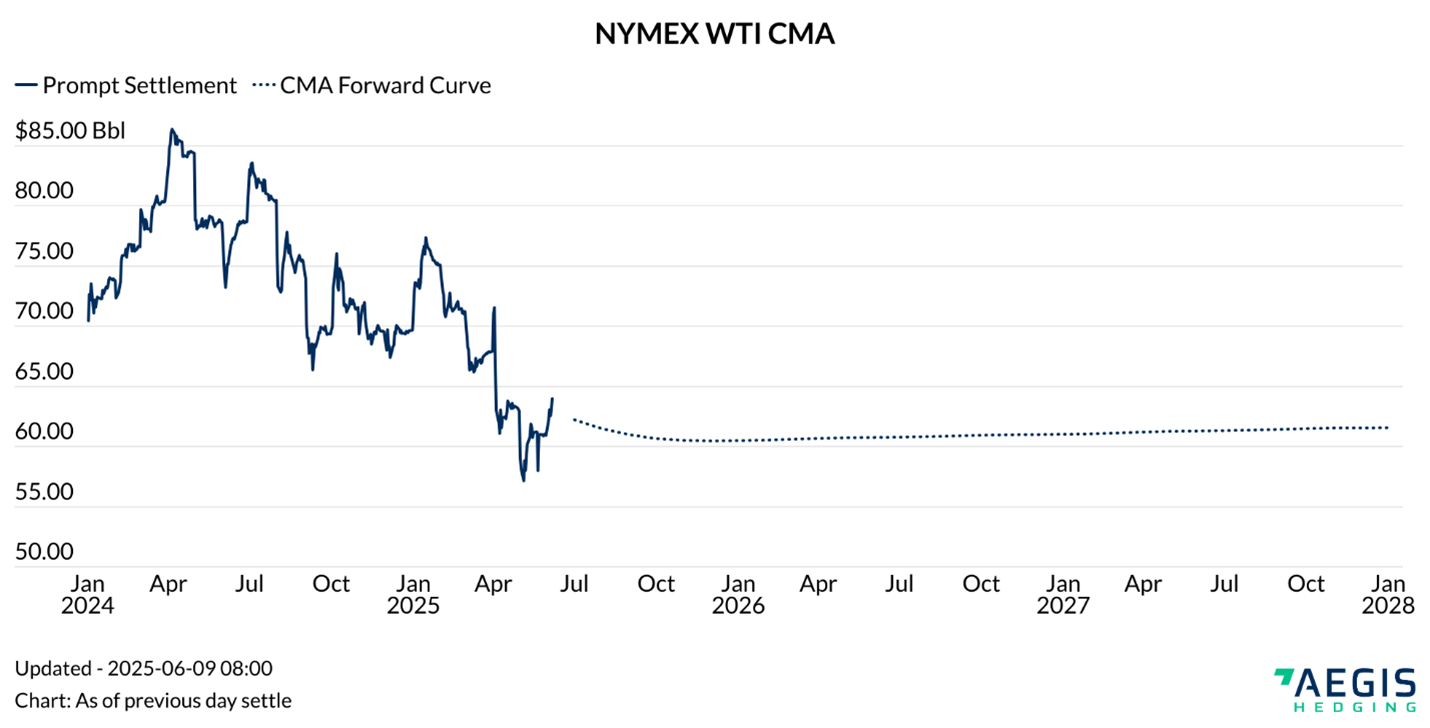

Most producers are apathetic about the current WTI forward curve, as shown in the chart below. But a softening global supply-demand balance looms over the market. A further decrease in prices would put additional financial strain on many US producers.

One key concern with hedging in a low-price environment is missing a rebound. Consider revising your budget, goals, and market expectations so that you do not hesitate to participate in price rallies. Set cash flow targets aligned with revised budgets, and hedge only the volumes needed to meet key financial obligations.

AEGIS customer data show that this is a very common approach across many types of oil producers. While enthusiasm for oil hedges does increase when prices are high, AEGIS customers are also active when there is a sudden price rally, even when prices are subdued. They are often using their AEGIS traders and technology to hedge better prices than the recent, trailing average. If you would like a deeper discussion on peer hedging habits and best practices, please reach out to your AEGIS trader.

Hedging regret often stems from inaction. If current forward pricing is high enough to support your goals (whether original or revised), then hedging may still be worthwhile to avoid worse price outcomes. Create a plan and follow through when previously established triggers are met. Below is a quick checklist of potential (not exhaustive) areas of focus:

When establishing a revised hedge plan, keep it simple. Avoid overly complex derivatives and stick with widely accepted and liquid products. Not only will this help with price discovery but will keep additional optionality in your hands and not the counterparty’s. Widely accepted and proven tools for upstream producers include swaps, puts, collars, and (sometimes) three-way collars. These strategies are easy to understand, easy to communicate, and widely endorsed by boards and counterparties.

Options hedges have another advantage. They can simultaneously give the hedger a floor price and some upside if prices do rally.

In times of higher volatility, it may be advantageous to sell options. Selling options (typically selling call options, or price caps) can help offset some of the cost of hedging. However, this can introduce some additional risk. Selling call options will cap upside exposure, while selling puts removes some protection against lower prices. Only sell options with clear board approval and well-defined parameters.

In our experience, selling options as a means to uplift pricing works better for natural gas than it does for crude oil. The natural gas curve is often in contango (upward sloping) when near-term prices are low, so hedges can be struck at higher prices into the future. Further, natural gas implied volatility (options value) is typically much higher in winter tenors. Combine those two features, and gas hedging provides more choices in selling options. Crude oil, unfortunately, typically has a flat curve when prices are low, and volatility (especially for call options) is low, too.

Remember, hedging isn’t about beating the market, it’s about ensuring stability when volatility arises. A disciplined, pre-approved strategy reduces risk and preserves flexibility, no matter where prices go next.