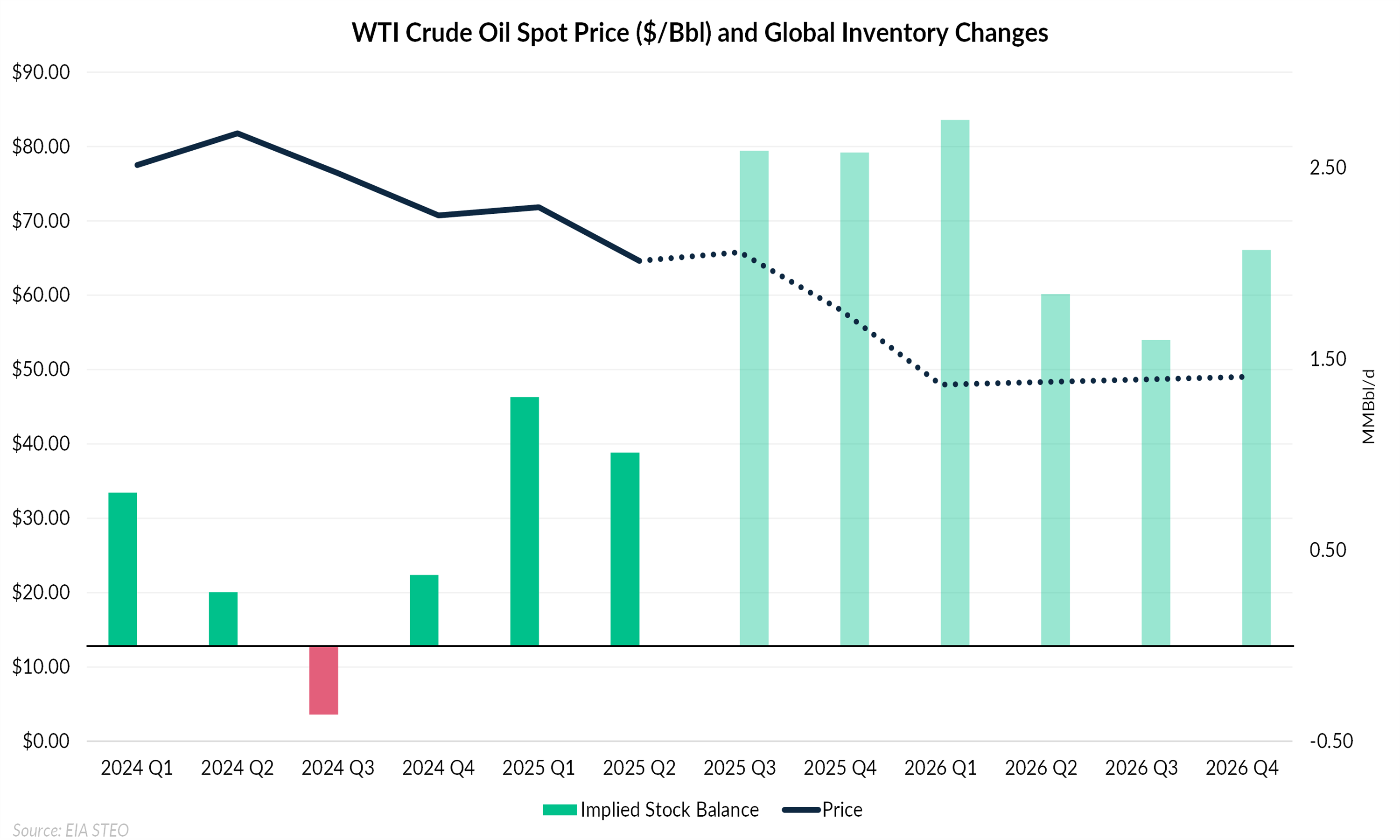

Global oil inventories are projected to continue rising through 2026, according to the EIA’s October Short-Term Energy Outlook, highlighting a persistent imbalance between supply and demand. The agency estimates that global oil stocks have increased by 1.9 MMBbl/d since May and expects builds to average 2.1 MMBbl/d next year, with the steepest gains, more than 2.7 MMBbl/d, occurring in the first quarter of 2026. These are among the largest sustained builds since the pandemic recovery period and mark a clear return to surplus conditions.

As inventories accumulate, the EIA expects prices to weaken. The WTI spot price is forecast to average $58.05/Bbl in 4Q25 and decline further to $48.50/Bbl in 2026, reflecting the impact of rising storage costs and a growing surplus of unabsorbed barrels. The chart below shows that as implied stock builds accelerate, price expectations trend lower, underscoring the market’s transition toward contango and weaker prompt values.

Despite steady inventory accumulation, prices have remained relatively stable in recent months, a trend the EIA attributes largely to China’s strategic crude stockpiling. Import and refining data suggest that Beijing has quietly absorbed surplus barrels, temporarily supporting balances and dampening visible storage builds. The agency cautions that if Chinese purchases slow, excess volumes would begin appearing in reported inventories, intensifying the downward pressure on global prices. Rising storage volumes may also push traders toward floating storage, where higher costs could further weaken prompt values and steepen contango.

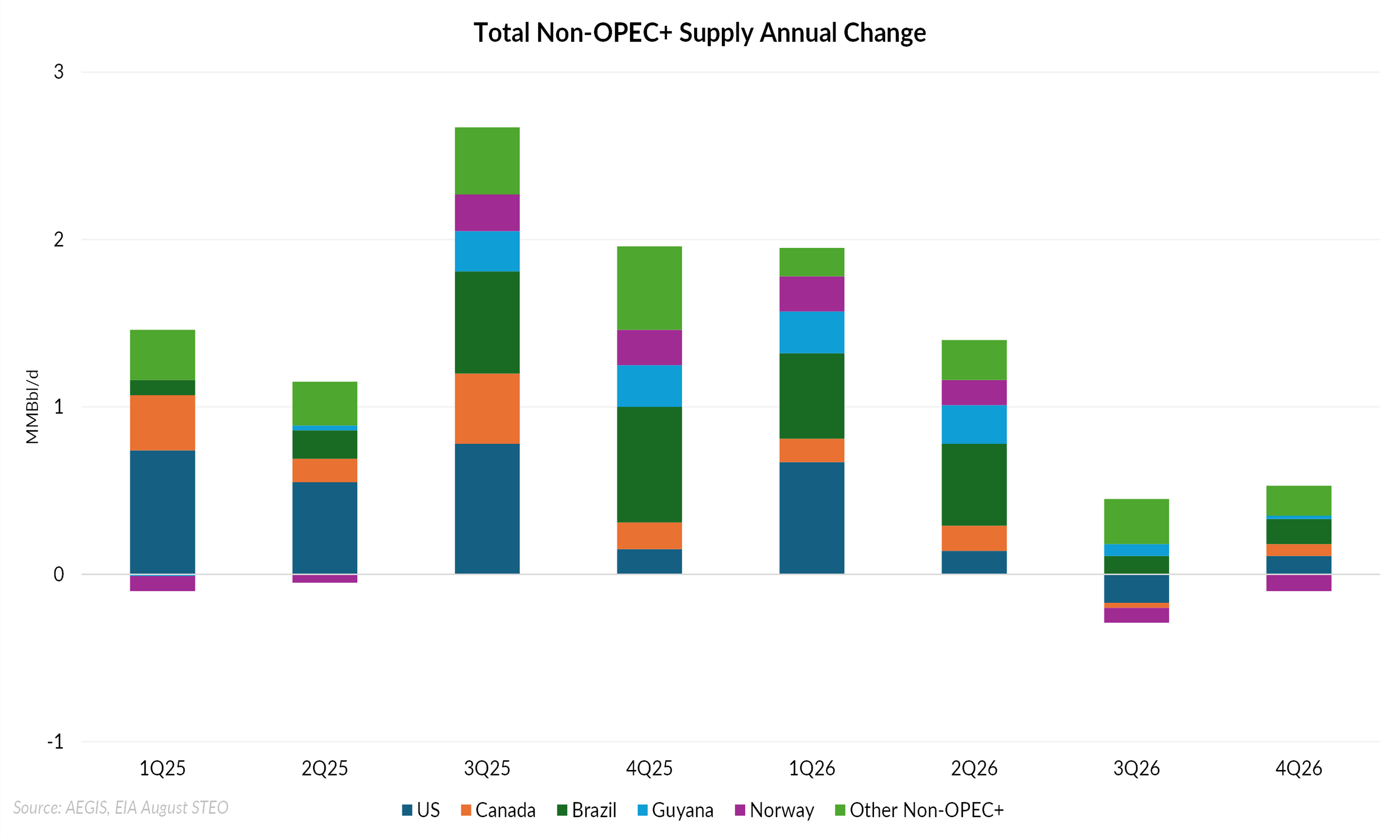

The ongoing inventory builds are driven primarily by expanding global supply. The EIA projects total liquids production will increase by 2.7 MMBbl/d in 2025 and 1.3 MMBbl/d in 2026, led by non-OPEC+ producers such as the United States, Brazil, Canada, and Guyana. Within OPEC+, output is expected to rise 0.5 MMBbl/d next year and 0.6 MMBbl/d in 2026 as the group continues to unwind voluntary cuts. Even so, the agency assumes the alliance will remain below its official targets because of spare-capacity limits and efforts to avoid accelerating the surplus. The forecast was finalized before the October 5 OPEC+ announcement of additional November hikes, implying potential for even greater supply growth than currently modeled.

In the United States, production continues to underpin non-OPEC growth. Output reached a record 13.6 MMBbl/d in July, prompting the EIA to raise its forecast to 13.5 MMBbl/d for both 2025 and 2026, up 0.2 MMBbl/d from last month’s projection.

The October STEO underscores a market entering a period of persistent oversupply. Expanding output from both OPEC+ and non-OPEC producers has outpaced lackluster demand growth, driving inventories higher and signaling continued price softness through 2026.