The International Energy Agency’s (IEA) June 2025 Oil Market Report points to a loosening global oil balance through 2026, as softer demand and resilient non-OPEC supply continue to pressure fundamentals. While the Israel–Iran conflict added a layer of geopolitical risk, the agency maintains that the market remains well-supplied.

Demand

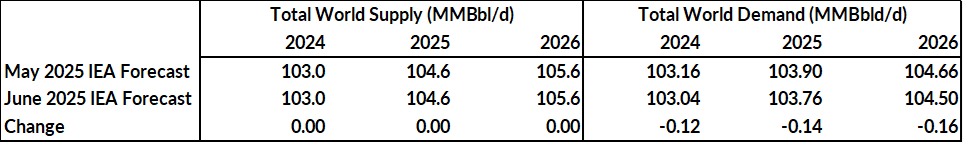

The IEA revised its 2025 global oil demand growth estimate slightly lower, from 740 MBbl/d to 720 MBbl/d, citing softer Q2 demand in China and the United States. Still, demand is expected to reach 103.8 MMBbl/d in 2025 and 104.5 MMBbl/d in 2026, with all net growth concentrated in non-OECD economies.

Supply

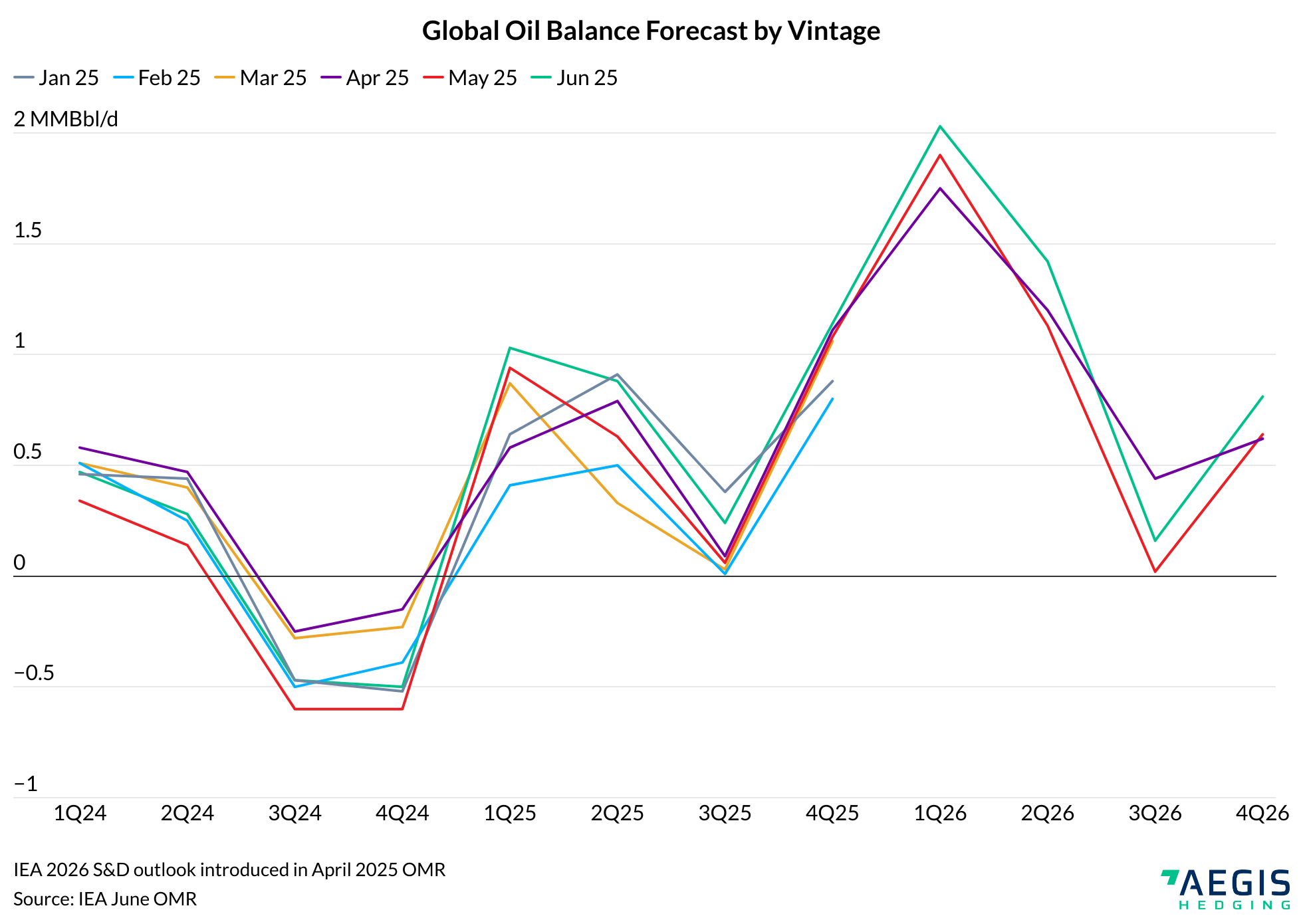

On the supply side, the IEA left its 2025 production forecast unchanged from last month. Liquids supply is projected to rise by 1.6 MMBbl/d in 2025 and by another 1 MMBbl/d in 2026, supported by growth from non-OPEC producers, who are forecast to expand by 1.3 MMBbl/d this year and 820 MBbl/d next year. As a result, the agency now sees a surplus of 800 MBbl/d in 2025 and 1.1 MMBbl/d in 2026, a shift from previously tighter balance.

Stocks

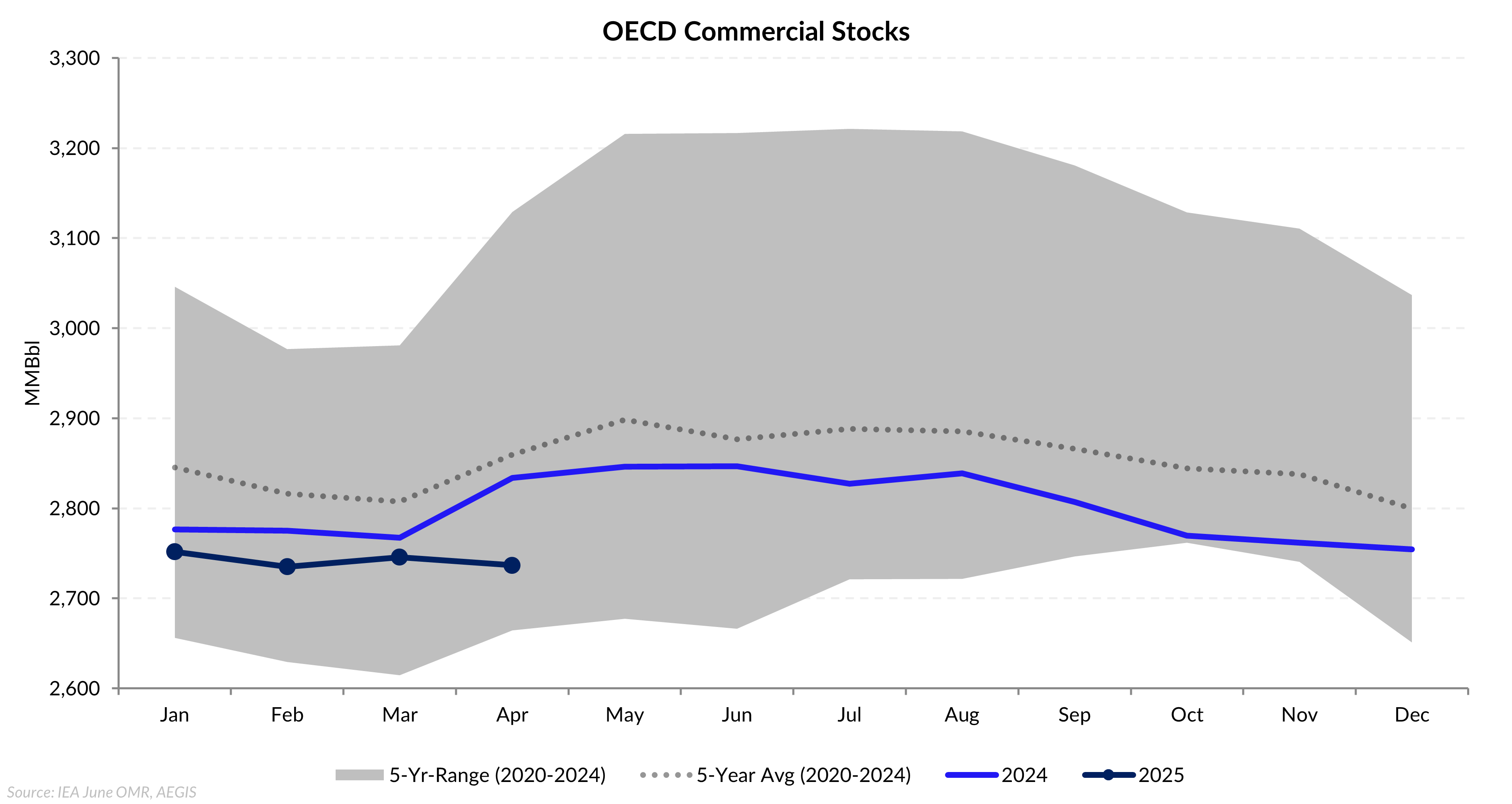

Preliminary figures show global oil stocks rose by 93 million barrels in May. However, OECD inventories fell by 9.1 million barrels in April to 2,736.6 million. The decline reflects not only changes in crude and refined products, but also shifts in NGLs, refinery feedstocks, and other hydrocarbons. Within the OECD, crude stocks edged up by just over 1 million barrels to 1,056.6 million, while refined product inventories fell by 12.4 million barrels, driven by declines in gasoline and middle distillates.

With tensions in the Middle East easing, Iranian crude exports remain steady and there has been no disruption to physical oil flows.

Overall, the IEA’s June report reinforces a growing surplus outlook. With resilient non-OPEC supply and softer-than-expected demand, the market’s trajectory will be strongly influenced by how OPEC chooses to respond to a potentially prolonged imbalance.