The US Energy Information Agency released its latest Short-Term Energy Outlook, which includes several notable changes compared to last month's outlook. Heightened uncertainty resulting from the recent increase in US tariff rates has affected global crude markets, and the EIA’s new forecasts reflect this. While forecasted US crude production was one of the most significant changes, other adjustments were made to forecasts for items such as natural gas and coal production. Price forecasts also saw substantial modifications.

Oil prices and production growth revised lower

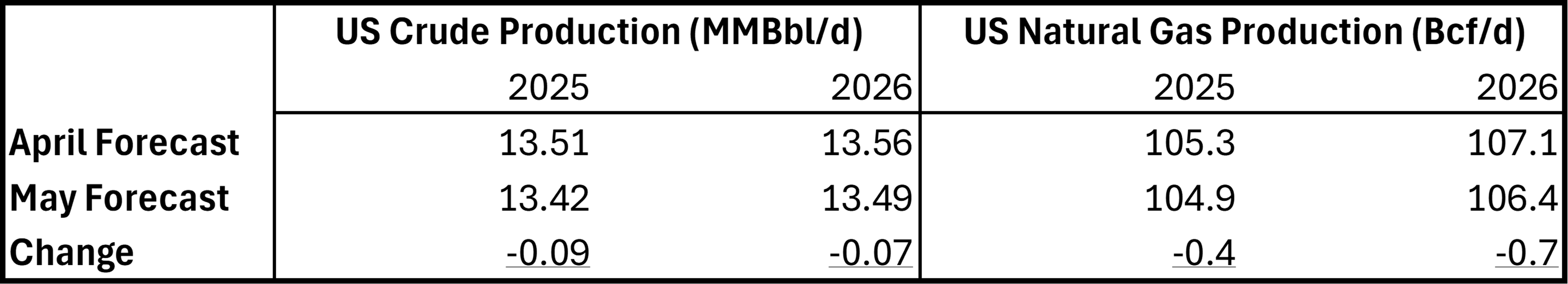

While the April EIA STEO saw global oil demand expectations reduced due to higher trade barriers, US crude production was one of the most notable changes in the May outlook. The agency sees US crude output rising from 13.21 MMBbl/d in 2024 to 13.42 MMBbl/d in 2025, and just 13.49 MMBbl/d in 2026. While growth is still anticipated, these changes represent a -0.7% downward revision to the 2025 forecast and a -0.5% modification to 2026. The primary driver of these changes has been the decline in WTI prices over the past month and the expectation that continued oversupply in global markets will lead to more inventory builds and subsequently lower prices, hampering investment into production growth. WTI spot prices are anticipated to average $61.81/Bbl in 2025 and $55.24/Bbl in 2026, a -3.2% and -3.9% change from the April outlook. The EIA did note that “significant uncertainty” remains in the price forecast, with the effect that new or additional tariffs could have being highly uncertain.

Lower oil production could reduce natural gas supply growth

The EIA lowered its forecast for natural gas production growth, saying “a drop in crude oil prices over the past three months has reduced our expectations for U.S. crude oil production growth, and we now expect less associated natural gas production than we did in January.” Last month's Lower 48 gas output forecast was for 105.3 Bcf/d in 2025 and 107.1 Bcf/d in 2026. These forecasts were cut by -0.4% and -0.6% respectively, to 104.9 Bcf/d and 106.4 Bcf/d. While the Henry Hub spot price forecast for 2025 was cut by -3.6% to $4.12/MMbtu, the 2026 forecast was raised by 4.4% to $4.80/MMbtu. Despite the lower revision in 2025 Henry Hub forecasted prices, it remains higher than the EIA’s January report.

If the EIA’s estimate for natural gas production is correct, we estimate the market could be undersupplied by a wide margin. Dry gas production will likely need to be closer to 108 Bcf/d by the end of 2025 to keep the market balanced to year-prior levels. It could be a challenge finding enough supply to meet demand growth between now and the end of 2026; slower growth in associated gas production could exacerbate this.