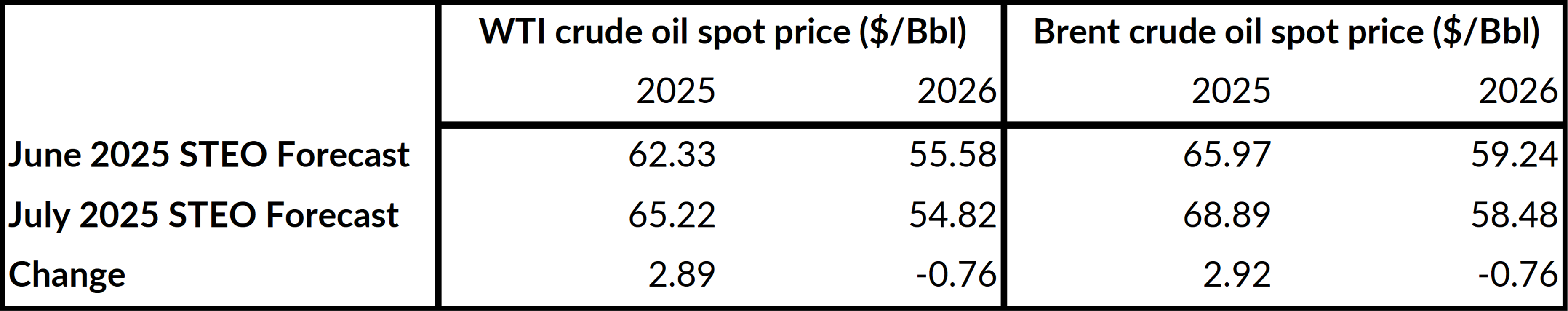

In their latest EIA Short-Term Energy Outlook (STEO), the agency raised its near-term oil price forecasts. The WTI price is now forecast to average $65.22/Bbl in 2025, $2,89 higher than last month’s STEO. The EIA attributes the price increase to the geopolitical risk premium introduced into the market by the Israel-Iran conflict.

However, the agency has decreased its WTI price average for 2026 by $0.76 to $54.82/Bbl. The EIA expects significant builds to global oil inventories to put downward pressure on oil prices. Notably, the latest STEO does not include the larger-than-expected OPEC+ production quota hike for the month of August. Their target was lower than OPEC+’s announced quota targets when compiling the July STEO outlook.

OECD Inventories

A combination of relatively weak oil demand and robust global oil supply growth is expected to increase OECD commercial inventories. The EIA estimates OECD commercial inventories averaged 61 days of supply in 1H25, will increase to an average of 62 days in 2H25 before reaching 66 days by the end of 2026. (Days of supply measures how long current crude inventories would last if refineries kept running at their current rate with no new supply.)

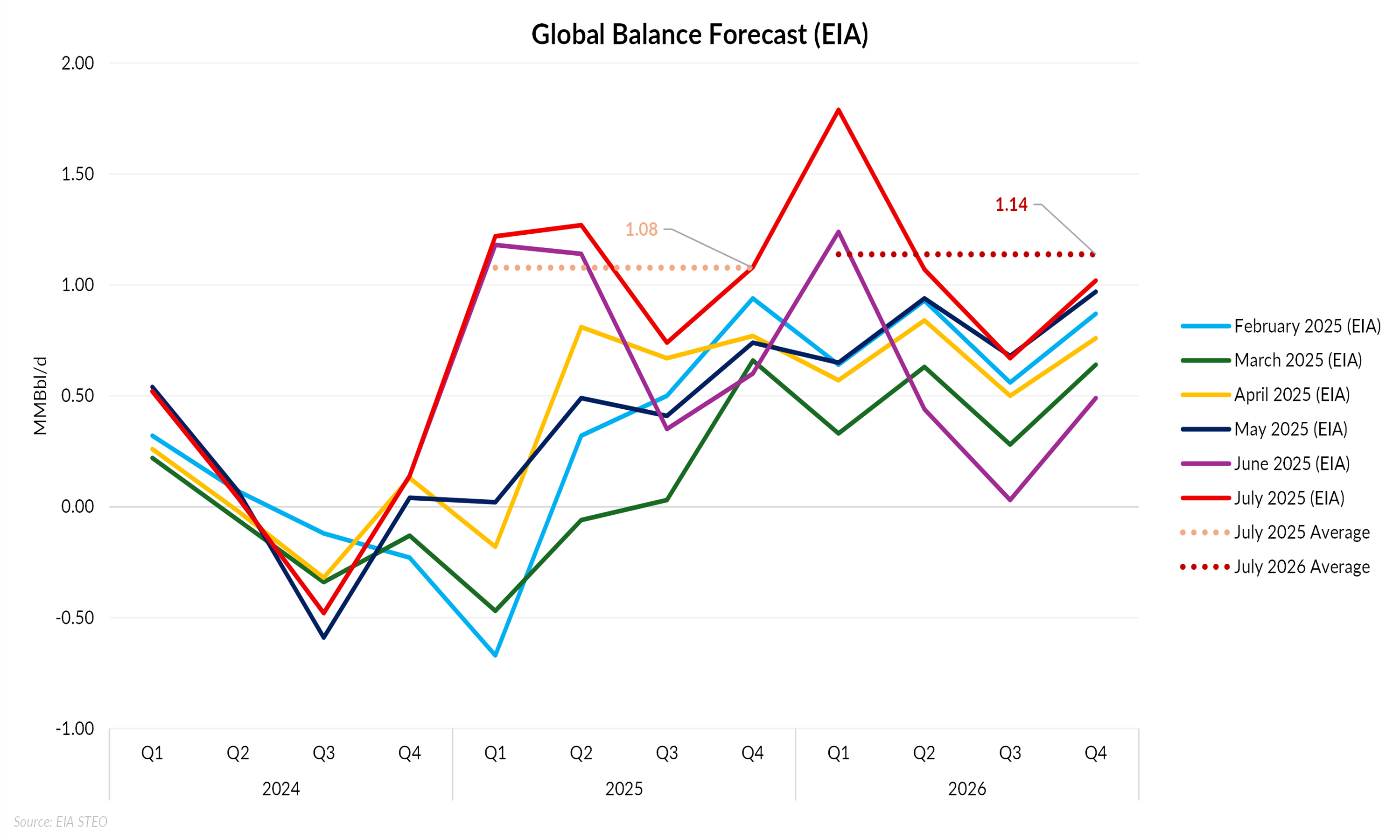

The chart above presents monthly EIA forecasts of the global oil supply-demand balance across STEO vintages.

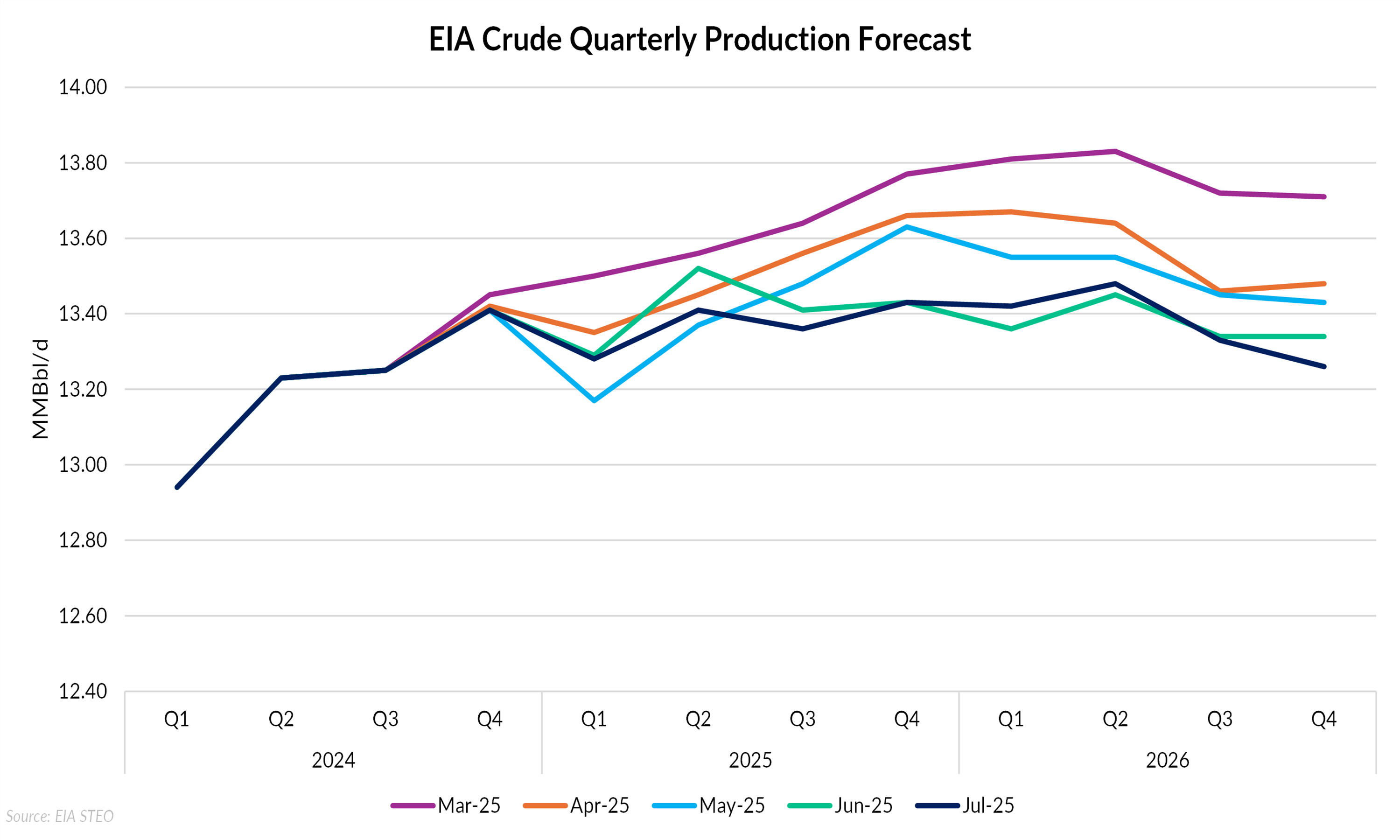

U.S. Crude Oil Production

The EIA has also revised its average annual U.S. crude production forecast down 50 MBbl/d to 13.37 MMBBl/d for 2025. The average annual production for 2026 was practically unchanged from last month’s STEO at 13.37 MMBBl/d. The decline in U.S. crude oil production reflects expectations of a sustained decrease in WTI spot prices through 2026, which is likely to reduce drilling and well completions by U.S. producers.

Ethane Exports Outlook Rebounds

After slashing forecasts last month, the EIA sharply increased its ethane export projections in the July STEO following a policy reversal. On July 2, the U.S. Department of Commerce lifted restrictions on ethane shipments to China, a key buyer of U.S. ethane. As a result, the EIA raised its 2025 export forecast by 100 MBbl/d to over 500 MBbl/d, and more than doubled the 2026 projection to 640 MBbl/d.

Conclusion

The latest STEO reflects a post-conflict market still pricing in geopolitical volatility following the Israel-Iran escalation. While short-term prices are lifted by risk premiums, the EIA maintains a bearish longer-term outlook, projecting a supply surplus in 2026. Even as U.S. drilling slows, global production growth, from OPEC+ and non-OPEC producers, is expected to outpace demand.