WTI lifts from five-month low, but bears still in control amid supply glut

WTI edged up slightly from a five-month low on Friday, with the November contract closing $0.08 higher at $57.62/bbl after three straight days of losses tied to concerns over a deepening supply glut. The modest rebound did little to change the broader trend, as supply growth continued to outpace demand and renewed trade tensions clouded the global outlook.

The supply narrative remained dominant. According to OPEC’s October Monthly Oil Market Report, the group has lifted production by roughly 1.99 MMBbl/d through September since beginning its supply unwind, though nearly 470 MBbl/d of pledged barrels have yet to return. Despite OPEC’s slower-than-promised output recovery, the broader supply picture remains heavy.

The IEA’s latest Oil Market Report projects global crude supply to exceed demand by about 4 MMBbl/d in 2026, reflecting the combined effect of a steady OPEC+ recovery and sustained non-OPEC growth. Together, agency forecasts point toward a persistent oversupply extending well into next year.

In the US, fundamentals painted a similarly soft picture. Commercial crude inventories rose by 3.5 MMBbl last week, marking the third consecutive build and pushing stocks to their highest level since early September. Domestic crude production climbed to a new record of 13.64 MMBbl/d, up 7 MBbl/d from the prior week, even as the number of active oil rigs declined for a second straight week. Overall, the data reaffirm a market where production momentum continues to outpace demand recovery.

The geopolitical backdrop further influenced sentiment. As US–China tensions persist, President Trump signaled a potential softening in trade policy, calling high tariffs “not viable.” He also announced plans to meet Russian President Vladimir Putin “within weeks,” raising speculation that renewed dialogue could eventually pave the way for additional Russian supply to re-enter global markets. Meanwhile, India may soon reassess sourcing after Trump claimed Prime Minister Modi vowed to halt Russian purchases, a move that could redirect flows toward Middle Eastern barrels.

Taken together, this week’s data and developments underscore a market still struggling to find balance. Production growth across OPEC+ and the US remains robust, inventories are trending higher, and forward fundamentals point to a sustained surplus into 2026. Temporary draws in China and maintenance-related declines at Cushing offer little relief against the broader supply overhang. While geopolitical uncertainty may inject bouts of volatility, the structural imbalance remains intact. AEGIS maintains a bearish outlook.

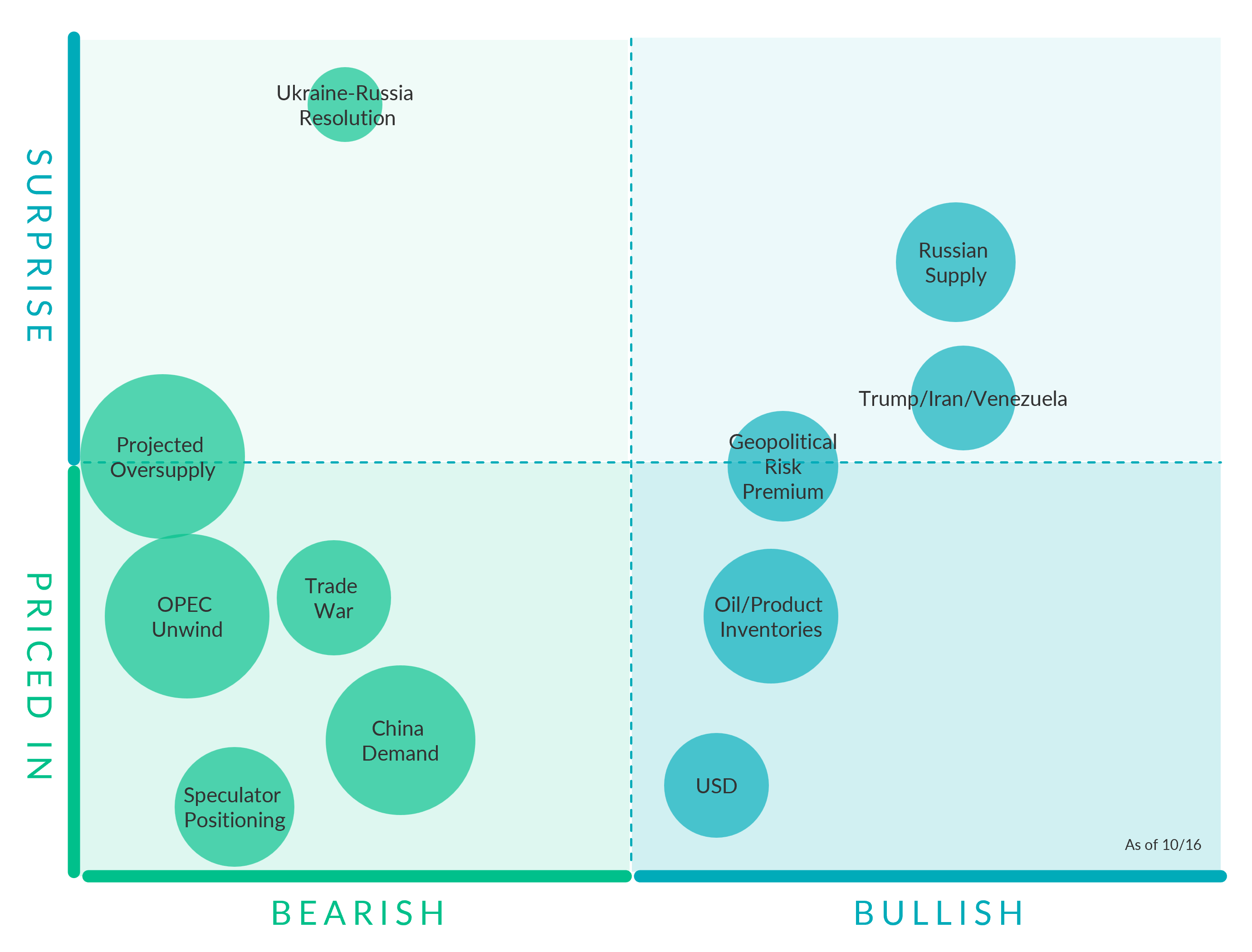

Crude Oil Factors

Geopolitical Risk Premium. (Bullish, Mostly Priced In) The risk premium cooled as Israel and Hamas agreed to a truce that includes the release of all remaining hostages, marking a significant step toward ending a two-year conflict that has unsettled the Middle East and stoked global protests.

Speculator Positioning (Bearish, Priced In) The latest CFTC data show that as of August 12, money managers reduced their net long in CME’s flagship NYMEX WTI contract to just 48,865 contracts, the smallest bullish position since April 2009. Meanwhile, trades of WTI done on the ICE exchange show money managers holding a net short of about 53,000 contracts. When the two venues are combined, overall positioning in WTI has slipped into net short territory for the first time on record.

Oil/Product Inventories. (Bullish, Priced In) The EIA reported a 3.53 MMBbl build in US commercial crude inventories last week. The build marks the third consecutive weekly build, the first such streak since April, bringing total nationwide inventories to about 423.8 MMBbls.

OPEC+ Quotas. (Bullish, Priced In) On June 2, OPEC+ announced its extension of 3.66 MMBbl/d cuts through December 2025. Additionally, the 2.2 MMBbl/d voluntary cuts from eight member countries will continue into Q3 2024 but will start to be reversed in October at a rate of 0.18 MMBbl/d per month. OPEC+ members agreed on September 5 to delay a planned gradual 2.2 MMBbl/d supply hike by two months, shifting the start to December. The group will add 0.19 MMBbl/d in December and 0.21 MMBbl/d from January onwards, with an option to adjust or pause these hikes depending on market conditions. The cartel also reaffirmed its compensation cuts of 0.2 MMBbl/d per month through November 2025, as members such as Iraq, Russia, and Kazakhstan have struggled to meet their original production quotas.

AEGIS notes that the global crude market would quickly build inventories without OPEC's support in reducing supply.

OPEC Unwind. (Bearish, Mostly Priced in) OPEC+ opted for a smaller-than-expected production increase o, easing concerns that the group might accelerate its supply recovery into an increasingly fragile market. The alliance agreed to raise its collective quota by 137 MBbl/d for the month of November, continuing the gradual unwind of its 1.66 MMBbl/d voluntary cuts through early 2026.

China Demand. (Bearish, Priced In) China’s onshore crude inventories declined to 1.17 billion barrels this week, down from a record 1.20 billion barrels in mid-August, according to data from Kayrros. The draws came from commercial stockpiles, partially reversing the country’s earlier stockpiling surge, a key factor that has supported global oil prices even as the broader market faces record oversupply.

USD (Bullish, Priced In) The Federal Reserve cut its benchmark interest rate by 25 basis points, the first cut since December 2024, and signaled that another 50 basis point cut could be coming by then end of 2025. If markets expect rate cuts or looser monetary conditions, the dollar tends to weaken. Oil is priced in dollars, so a weaker dollar lowers the “real” cost of oil for buyers using other currencies. This often boosts demand at the margin and supports prices.

Ukraine-Russia Resolution. (Bearish, Surprise) Trump announced plans to meet with Russian President Vladimir Putin “within two weeks or so” to discuss ending the war in Ukraine, a development that could pave the way for additional Russian supply returning to market

Trade War. (Bearish, Mostly Priced In) There has been an increase in tit-for-tat trade tension between the US and China, with China sanctioning the US unit of Hanwha Ocean Co., a South Korean shipping major, and warned of additional retaliatory actions against the industry. However, President Trump said high tariffs on China were “not viable,” suggesting potential for de-escalation even as broader tensions remain elevated.

Projected Oversupply. (Bearish, Mostly Surprise) The IEA’s latest Oil Market Report projects global crude supply to outpace demand by nearly 4 MMBbl/d next year. The forecasted overhang is about 18% larger than last month’s estimate, reflecting OPEC+’s ongoing supply revival.

Trump/Iran/Venezuela. (Bullish, Surprise) The US government has sent several ships off the coast of Venezuela prompting speculation that the Trump administration may be seeking to push Venezuelan President Nicolas Maduro from power. Tensions rose after the US sent fighter jets to the Carribean after two Venezuelan military aricraft flew over an American naval vessel in the area.

Russian Supply. (Bullish, Surprise) President Trump said Indian Prime Minister Narendra Modi had vowed to halt purchases of Russian barrels. India currently buys roughly three times more oil from Russia than from the United States and would need to seek replacements from Middle Eastern suppliers if it fully ends those purchases. Additionally, US Treasury Secretary Scott Bessent told Japanese Finance Minister Katsunobu Kato that Washington expects Japan to stop importing Russian energy. Japan, however, has said it will maintain Russian LNG purchases for energy-security reasons; about 8% of its LNG imports came from Russia last year.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as “edge,” “advantage,” ‘opportunity,” “believe,” or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.