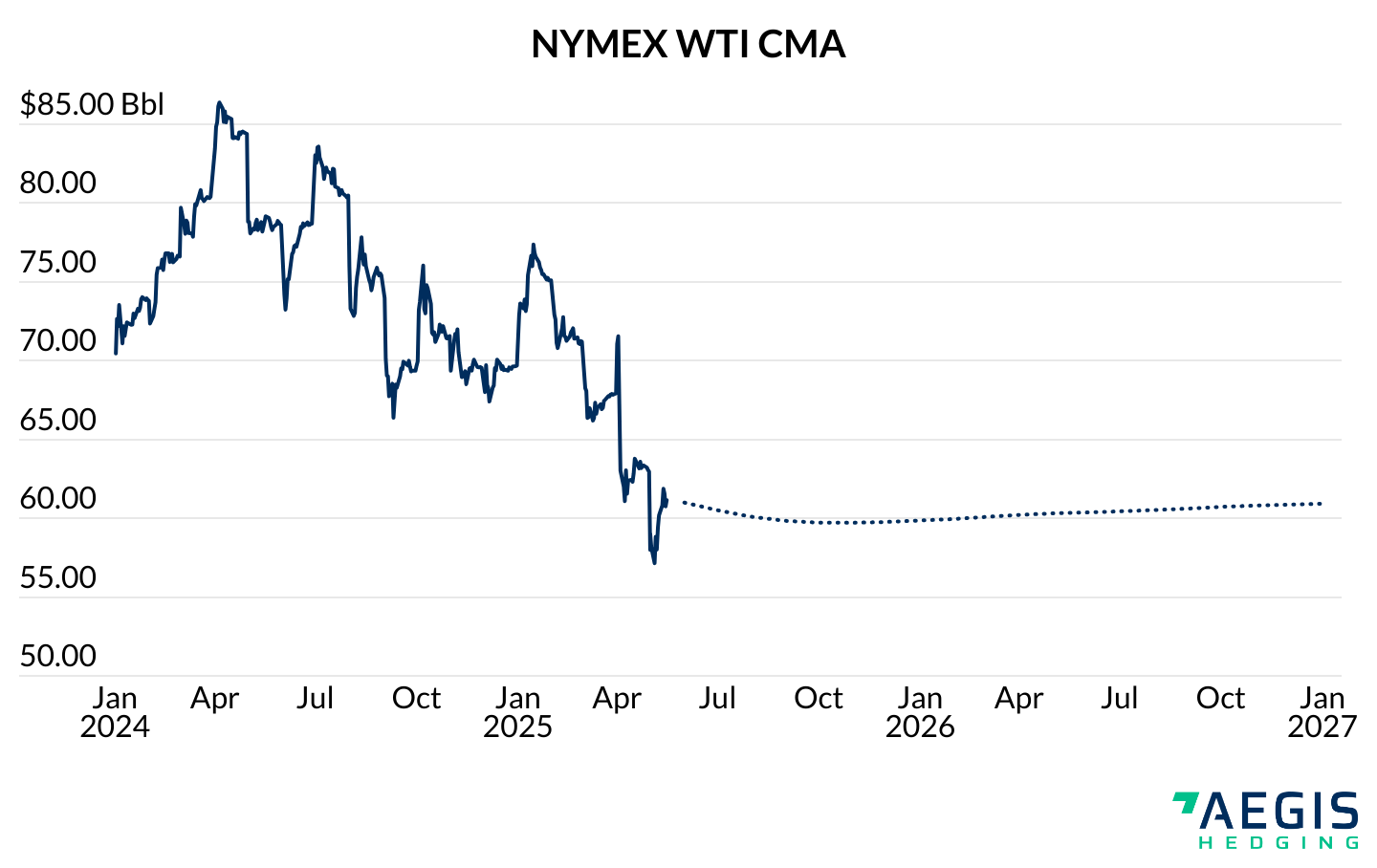

Oil prices have continued to decline in 2025, fueling growing concerns that U.S. crude oil production may have already peaked. A global trade war has sharply reduced oil demand growth forecasts, increasing the likelihood of a more pronounced oversupply in both 2025 and 2026. Both Brent and WTI have responded to the deteriorating outlook, with WTI currently trading near $60/Bbl.

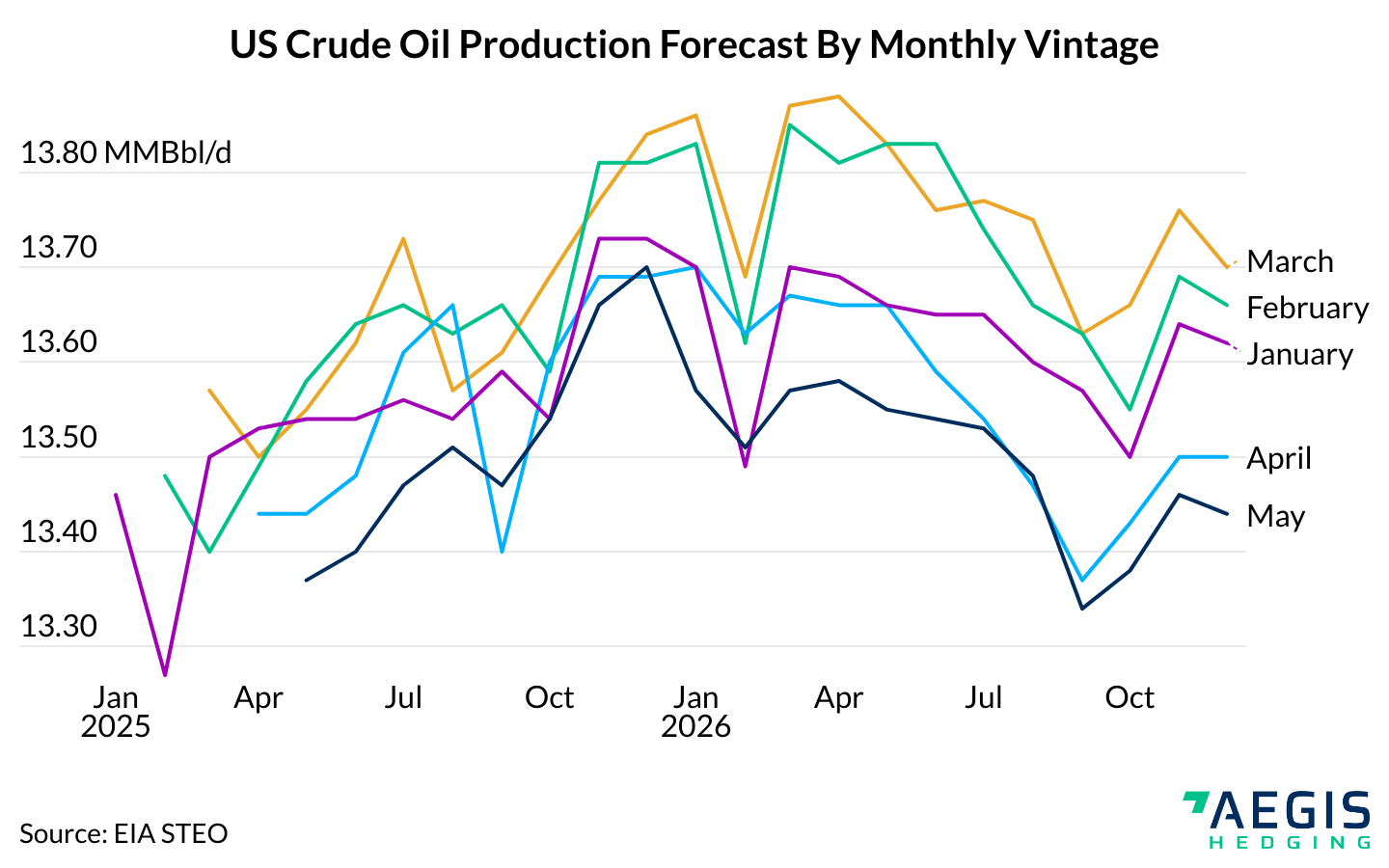

At these levels, many analysts expect U.S. supply growth to slow meaningfully—or stall altogether. The Energy Information Administration (EIA) has revised its U.S. crude production forecast downward multiple times since the start of the year. The agency's latest May outlook shows U.S. production peaking around 13.7 million barrels per day (MMBbl/d) in late 2025. Average production is projected at 13.41 MMBbl/d in 2025 and 13.49 MMBbl/d in 2026, representing a modest year-over-year gain of just 80,000 Bbl/d.

Producers have begun to echo this sentiment. On Diamondback Energy’s 1Q25 earnings call, Chairman and CEO Travis Stice remarked, “As a result of the activity cuts, it is likely that U.S. onshore oil production has peaked and will begin to decline this quarter.” His comments highlight the distinction between onshore and offshore supply, with modest gains still expected from Gulf of America projects as longer-cycle investments come online.

Historically, the U.S. has driven the bulk of non-OPEC supply growth. With production now stagnating, the implications for the global supply-demand balance are significant. Current fundamentals suggest the WTI forward curve will remain near $60/Bbl or below, limiting the economic incentive for U.S. producers to pursue material supply growth.