Saudi Overproduction Casts Uncertainty on OPEC+ Supply Path

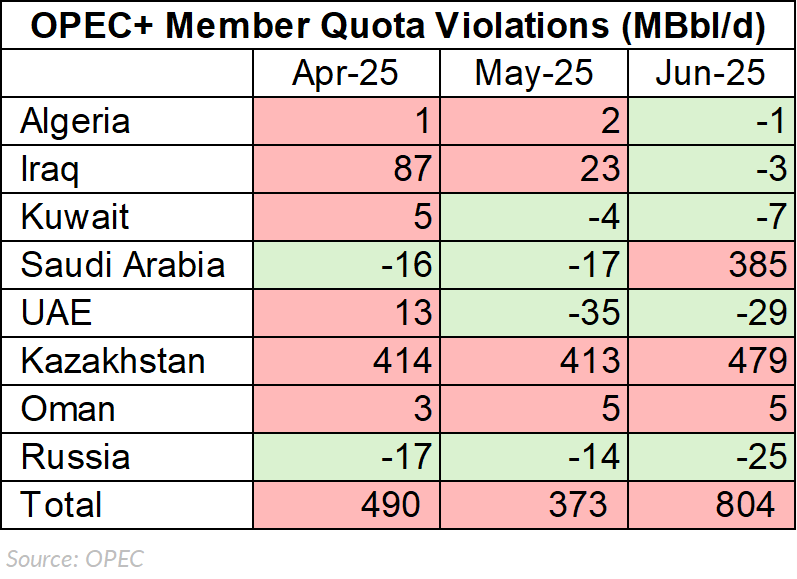

In their latest July monthly oil market report (MOMR), OPEC reported that Saudi Arabia produced 385 MBbl/d above its quota in June, a development that could be more than just a short-term compliance issue. It could influence how the OPEC+ supply path unfolds throughout the rest of 2025.

The table above shows monthly quota violations by core OPEC+ producers. Positive values indicate overproduction, while negative values reflect undercompliance. Kazakhstan has consistently overproduced, while Saudi Arabia, previously in compliance, shifted to a major breach in June, contributing to the group’s largest monthly violation in recent months.

A Breach with Possible Consequences

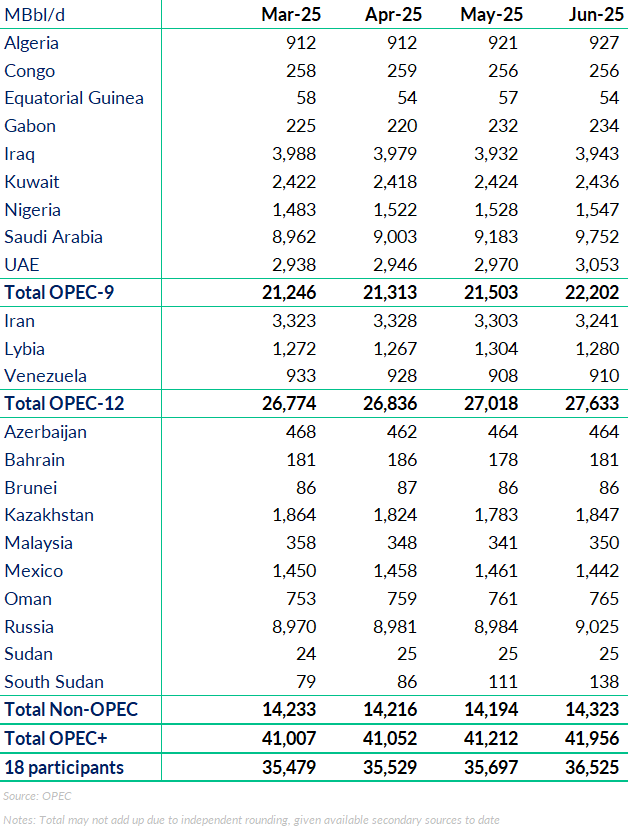

Saudi Arabia reported to the OPEC Secretariat that it produced 9.752 MMBbl/d June, well above its official limit under the OPEC+ Declaration of Cooperation. The kingdom justified the move as a response to regional tensions, with excess barrels reportedly sent to offshore storage to guard against potential disruptions in the Strait of Hormuz.

Yet OPEC’s published figure for Saudi output, 9.356 MMBbl/d, reflects what is called “supply to market,” effectively excluding stored barrels from the production count. This accounting maneuver has raised concern among observers who rely on secondary source data to assess quota compliance.

Historically, OPEC+ has demanded compensation cuts from members that exceed targets. Whether Saudi Arabia follows through will shape market expectations about the credibility of the OPEC+ agreement itself.

OPEC Production through June

The July MOMR now has production rising by 1.045 MMBbl/d from March to June 2025, a striking increase from March to May when production increased by 218 MBbl/d. In the last month alone, OPEC+ has significantly increased production by 827 MBbl/d. The bulk of the new increase in production comes from Saudi Arabia and Kazakhstan, the two biggest overproducers in the cartel. Kazakhstan, a frequent quota violator, exceeded its target by 479 MBbl/d in June, the largest overproduction among all participating OPEC+ members.

Looking Ahead

As OPEC+ enters the most aggressive phase of its scheduled production unwind, the behavior of key members like Saudi Arabia and Kazakhstan will determine how closely the group adheres to its stated targets. If Saudi Arabia reins in output to offset June’s breach while Kazakhstan maintains current levels, the group could realign with its target path by August. However, if overproduction persists, or spreads to other members, the result may be a materially looser market than previously expected.