OPEC+ is rapidly restoring crude supply into a weakening market, raising output by 411 MBbl/d in June following a similar increase in May. While the move is framed as an effort to enforce quota discipline, it comes on the heels of President Trump’s public calls for lower oil prices, even as global demand shows signs of softening.

OPEC+ Accelerates Output Return

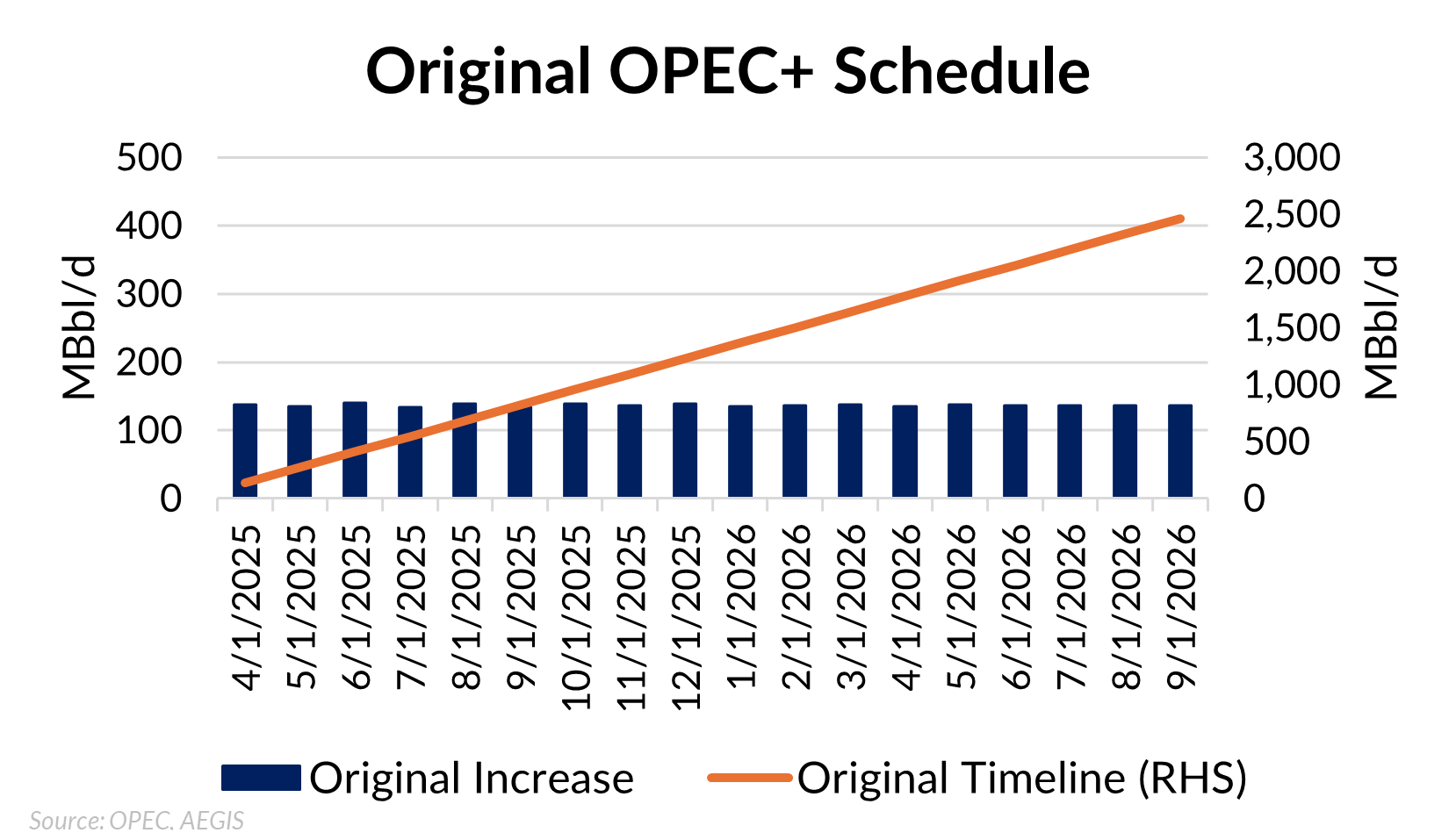

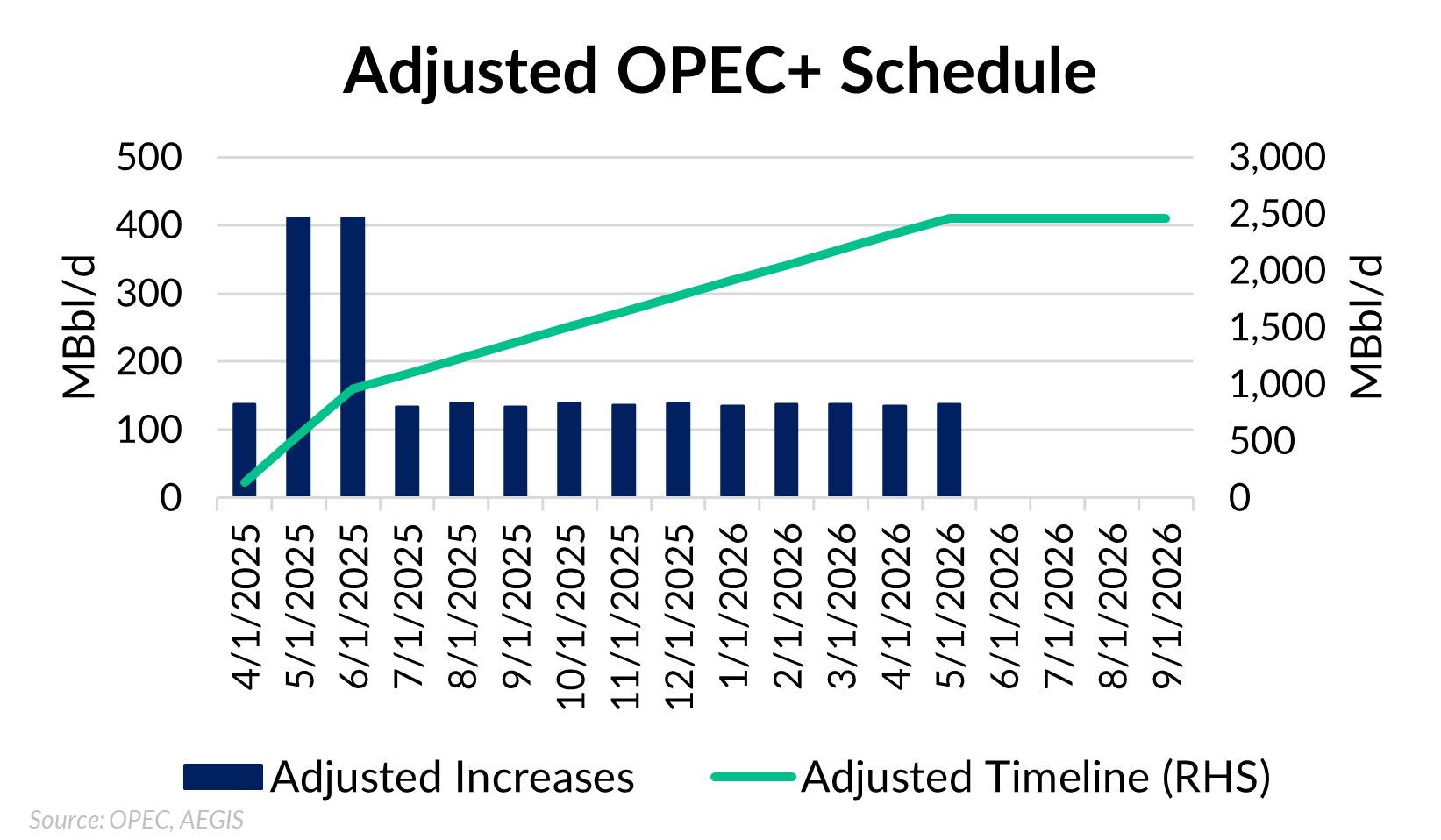

OPEC+ is in the process of reversing its 2.2 MMBbl/d in voluntary production cuts and allowing the UAE to increase its quota over time. The original schedule (first chart) called for gradual monthly increases of 0.138 MMBbl/d from April 2025 through September 2026. However, the group has accelerated the timeline, implementing 0.411 MMBbl/d hikes in both May and June this year. As shown in the updated schedule (second chart), the group is on track to restore nearly 1 MMBbl/d of voluntary cuts in just three months.

In the chart, the plan includes a total of 2,200 MBbl/d from OPEC+, and 300 MBbl/d increase in the UAE's production target over the same period.

Despite the announcement, it is not entirely clear to the analyst community how fast or how much actual supply may arrive. For example, analysts at Macquarie expect OPEC+’s July production to increase by an additional 100-400 MBbl/d.

Quota Breaches Undermine Strategy

Despite pledges to improve compliance, several OPEC+ members continue to overproduce according to Bloomberg:

Source: BloombergNEF, “OPEC+ April Output Tops Quotas as Supply Hikes Begin,” May 2025.

A Growing Surplus Risk

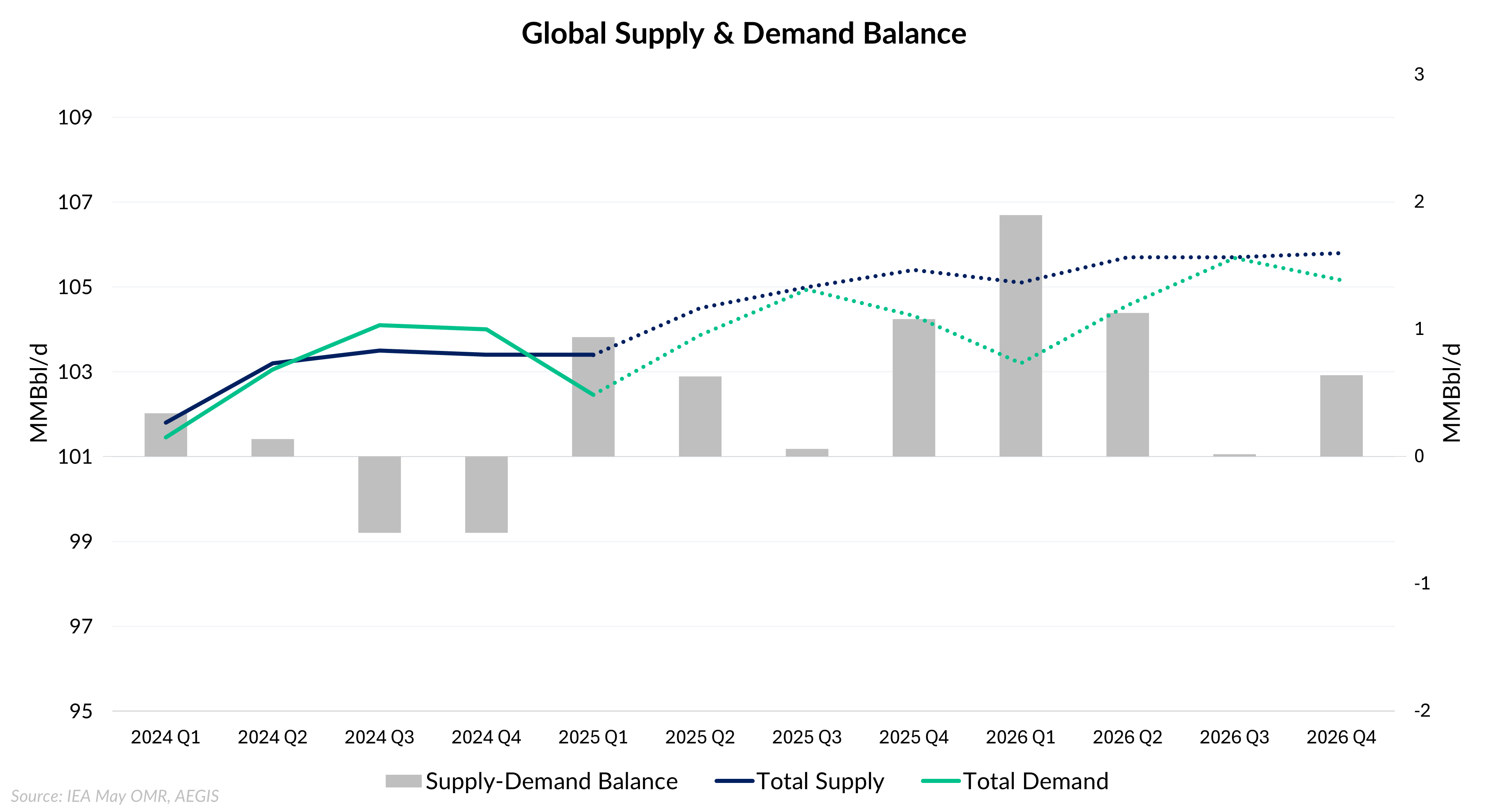

The current supply trajectory risks tipping the oil market into sustained oversupply by the second half of 2025. With inventories projected to build and demand failing to keep pace, OPEC+’s output hikes are adding barrels into an increasingly saturated market, deepening the imbalance visible in recent forecasts.

The chart below highlights the growing disconnect between global oil supply and demand. The IEA expects global supply to outpace demand this year and next year. The oversupply would be the most acute in 1Q 2026, when they project inventories to build by nearly 2 MMBbl/d.

The decision to accelerate output increases comes amid broader geopolitical developments, including President Trump’s recent visit to the region and ongoing U.S.–Iran nuclear negotiations.

OPEC+ is scheduled to meet again on June 1 to determine July production levels. Unless major overproducers rein in output, Saudi officials have signaled that additional supply could be released. With the IEA projecting a persistent supply surplus through 2026, especially in early 2026 when inventories are expected to build sharply, no clear enforcement mechanism in place, the group risks pushing the market into a structurally oversupplied environment, testing how much crude the global economy can realistically absorb.