Oil prices experienced a volatile swing following escalating tensions in the Middle East that evolved into direct conflict involving Israel, Iran, and the United States. Despite predictions of oil surging to $100-$130 per barrel, West Texas Intermediate (WTI) crude returned to its pre-war levels. How could prices revert despite U.S. and Israeli military actions against Iran?

The straightforward answer: no actual oil supplies were disrupted. Initially, markets priced in a significant risk premium—approximately $10 per barrel—to account for potential supply interruptions. However, as the likelihood of supply disruptions diminished by June 26, prices reverted fully. Thus, WTI crude was trading at nearly the same price as on June 10, just before hostilities commenced.

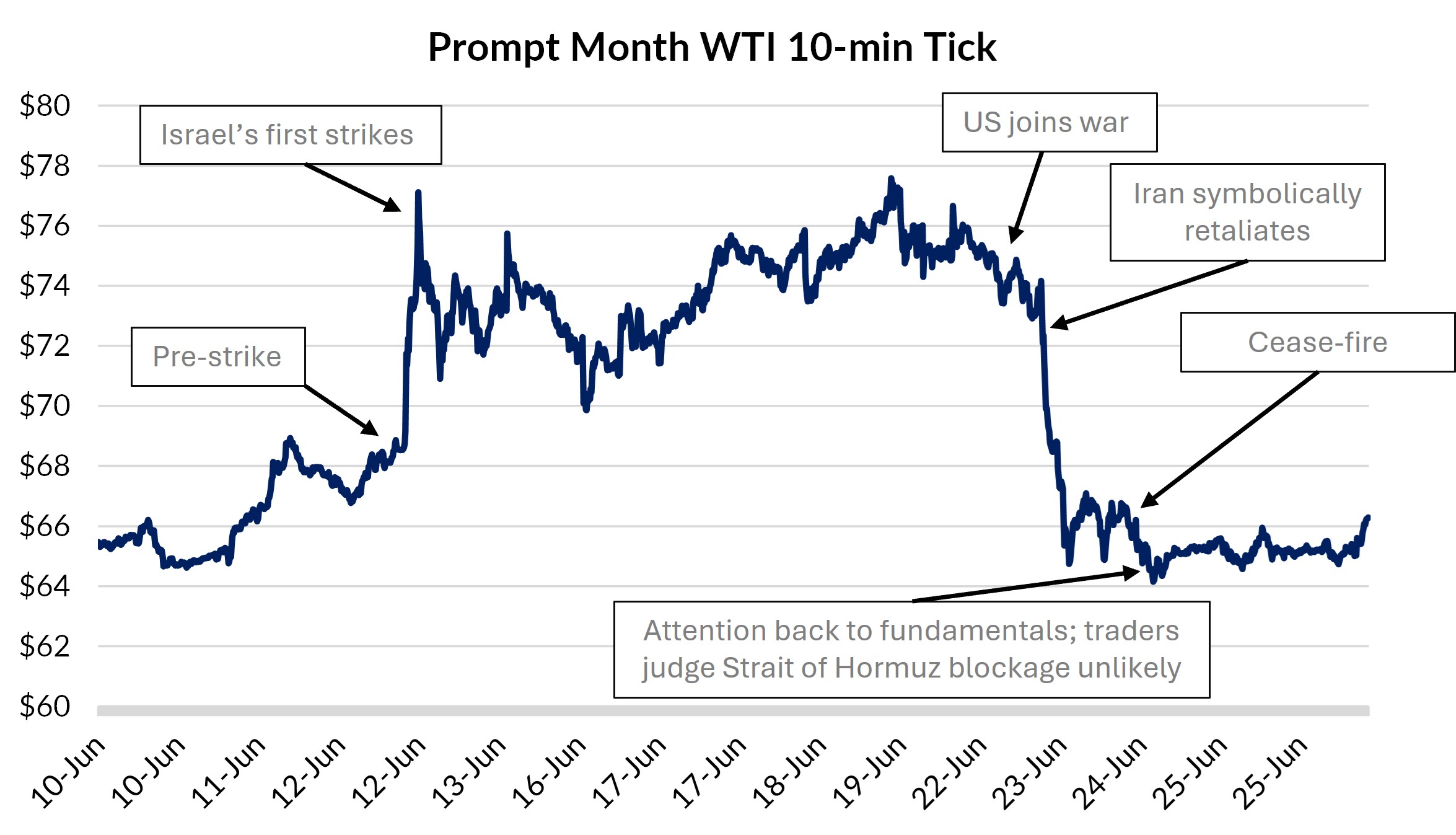

WTI oil traded between $66-$68 per barrel before Israel's initial strikes on June 12. Market participants quickly added a substantial geopolitical risk premium. Over subsequent days, despite exchanges of hostilities between Israel and Iran, prices remained stable due to the careful avoidance of energy infrastructure.

Source: AEGIS, Bloomberg

On June 22, the U.S. intervened with Operation “Midnight Hammer,” targeting several Iranian nuclear facilities. Initial market reaction on Sunday evening was bullish, anticipating possible Iranian escalation and potential threats to the Strait of Hormuz—a critical chokepoint for 20% of global oil traffic.

However, the situation quickly de-escalated on Monday, June 23, when Iran launched largely symbolic missile strikes toward U.S. installations in Qatar, reportedly providing advance notice. This measured response, coupled with President Trump's subsequent announcement of a cease-fire, significantly reduced geopolitical tensions. Consequently, oil prices fell sharply by 7% that same day, fully reversing earlier gains. By June 25, WTI was trading at around $66 per barrel, effectively returning to pre-conflict levels.

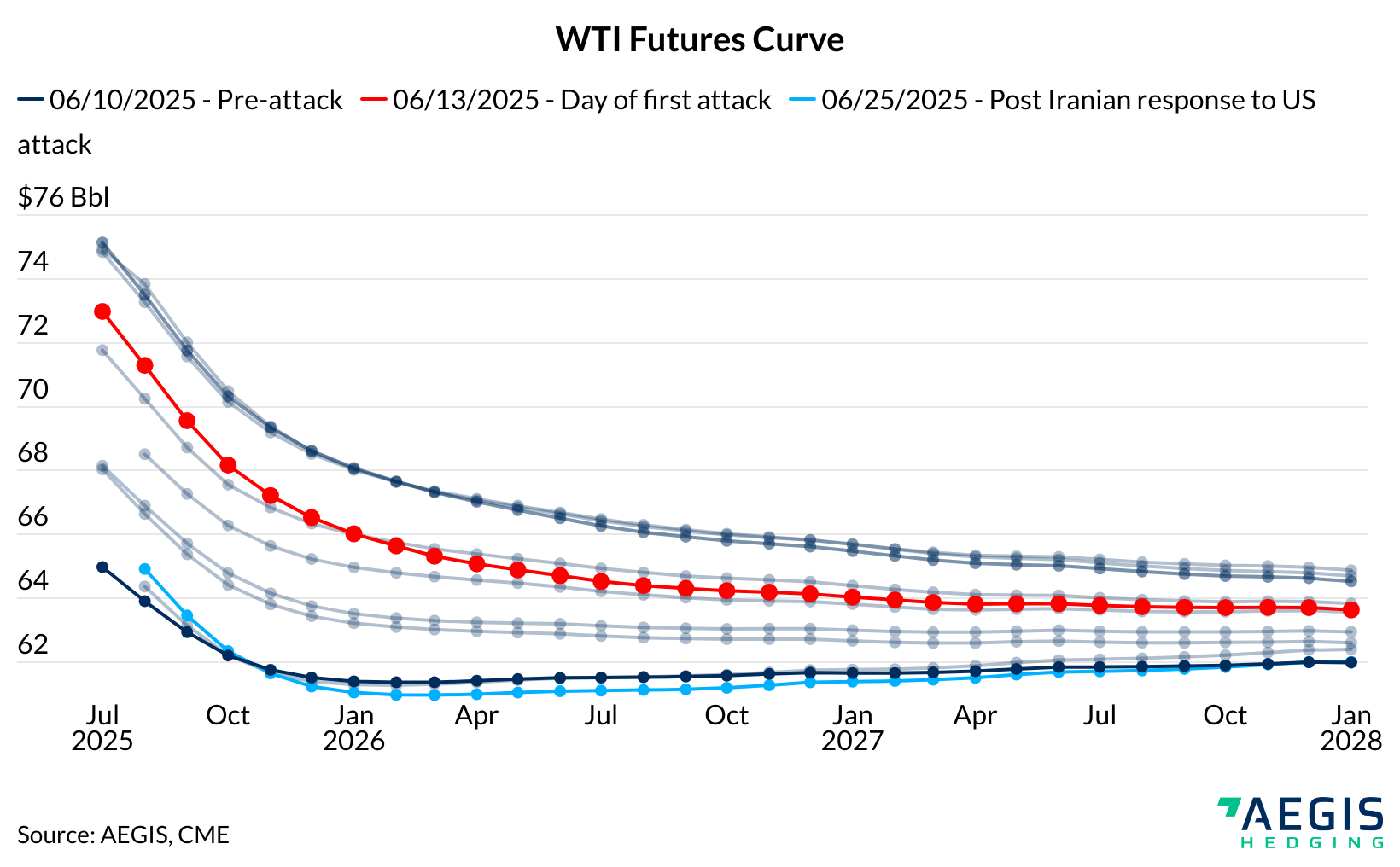

Producers were presented with favorable hedging opportunities during this brief market spike. Before the attacks, the WTI futures curve featured prompt prices around $65 per barrel, with subsequent calendar strips averaging approximately $61 per barrel.

Following the June 13 spike triggered by geopolitical risks, the entire WTI curve shifted significantly higher. Producers saw a substantial uplift: $6.40 per barrel increase for the remainder of 2025 and $3.28 per barrel for 2026. AEGIS recorded record trading volumes on this day, as producers capitalized on this sudden price elevation despite an otherwise bearish fundamental outlook. Check out some of our commentary about that day here, and here.

As geopolitical risk premiums evaporated, the WTI curve shape on June 26 closely mirrored its pre-attack configuration, confirming a full-circle return to market stability.