LNG feedgas demand continues to be the main driver of the gas story going forward, as well as an impactful factor on current supply-demand balances. So far in 2025, feedgas demand has been stronger on a year-over-year basis but is still plagued by seasonal factors and maintenance in the summer. Looking ahead to the next few years, LNG exports are set to expand significantly, with more projects and expansions having been recently announced.

Current State of LNG Feedgas Demand

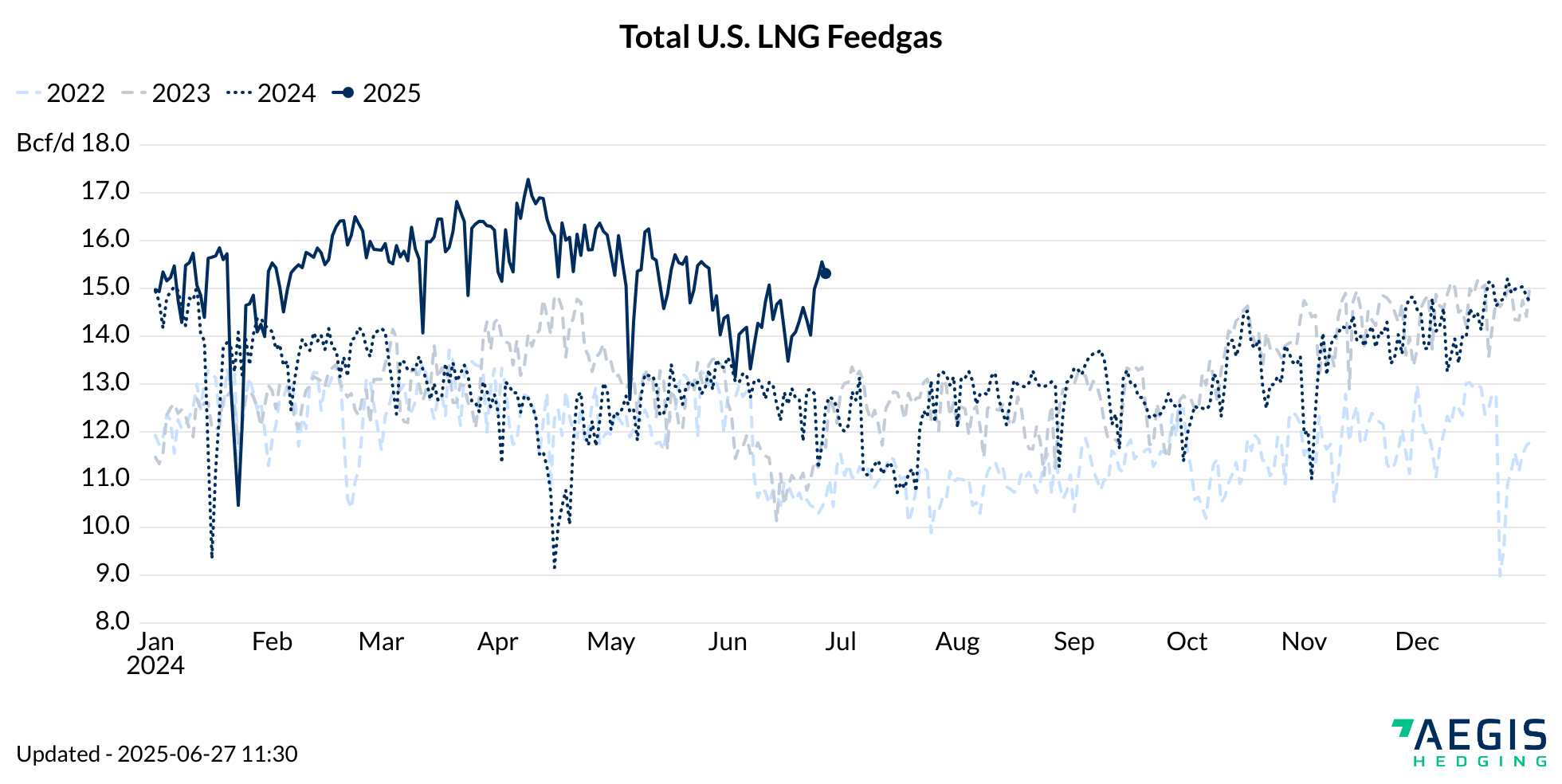

Inflows into US export plants have been consistently higher this year, due to the startup of Venture Global’s Plaquemines LNG plant. Total US feedgas demand has averaged 15.58 Bcf/d in 2025 compared to an average of 13.19 Bcf/d in 2024. Volumes reached an all-time high in April of more than 17 Bcf/d, before beginning to decline into summer. Lower plant utilization is common during the summer months, especially in June. June often sees the most maintenance and this year was no exception, with Sabine Pass LNG and Cameron LNG both receiving less gas as multiple liquefaction trains were taken offline. This combined with lower plant efficiency, due to higher ambient temperature, reduced total US feedgas volumes to nearly 13 Bcf/d. This relatively low LNG demand may have contributed to the weakness in Henry Hub cash prices in June, which for much of the month traded about $1 below the prompt NYMEX futures contract. Inflows should rise in July but will remain down from the highs seen in April, as the facilities face heat impacts.

Remainder of 2025

LNG feedgas volumes should rise back towards 17-18 Bcf/d around October or November, with ambient temperatures falling and Venture Global continuing to ramp up flows into Plaquemines. With Plaquemines currently receiving around 2.8 Bcf/d, they should be able to flow an extra 1 Bcf/d by the end of the year, as Phase 2 starts up.

One unknown that remains is the timeline for the startup of Golden Pass LNG. The developers are still guiding for startup in Q4 2025 or Q1 2026 but have recently spoken about the need for an increased workforce in order to finish construction on time.

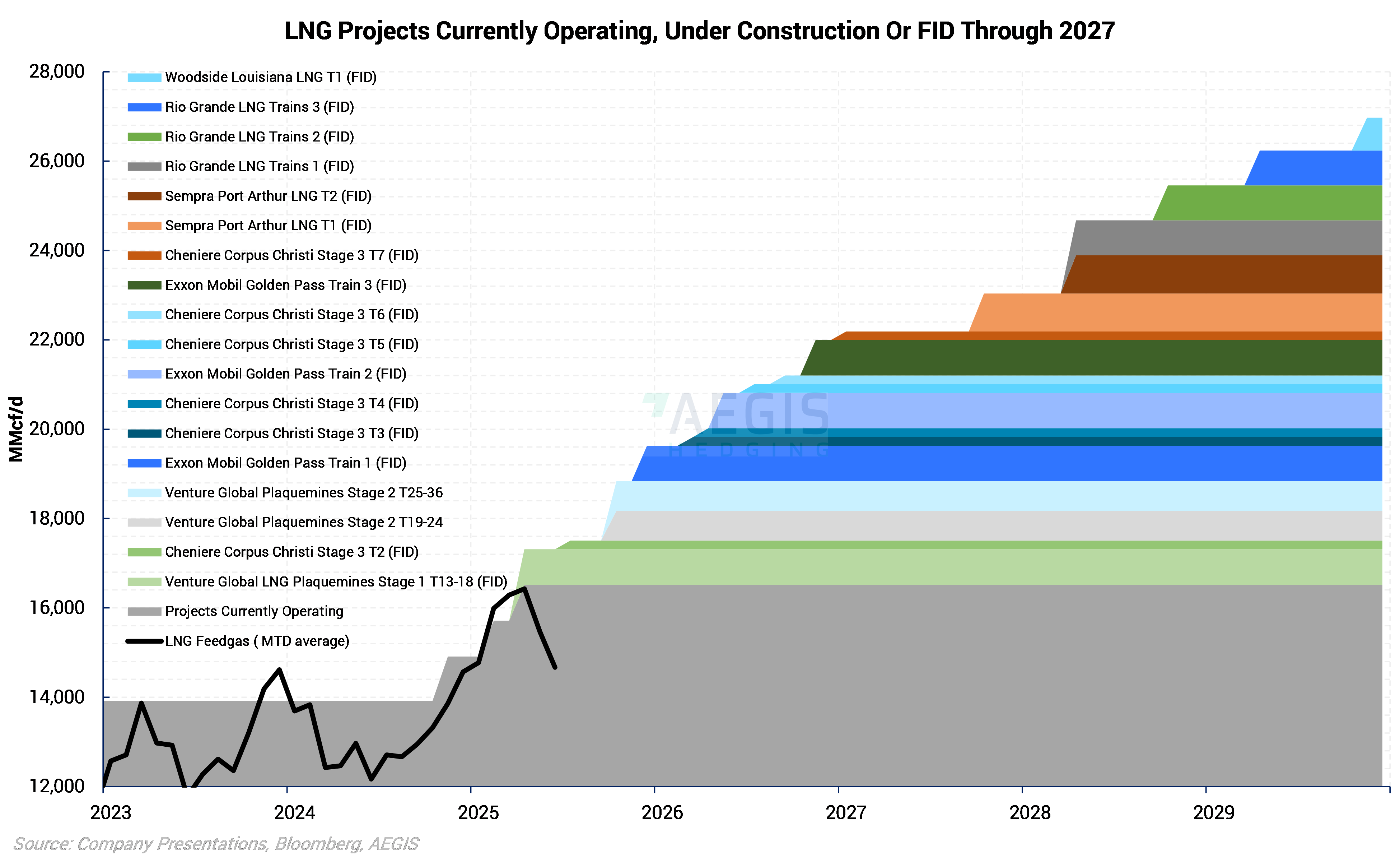

Beyond 2025

2026 should see the continued startup of Golden Pass and more Corpus Christi expansions. Train 1 of Sempra’s Port Arthur LNG is set to start in 2027, while NextDecade’s Rio Grande LNG export plant starts up in 2028. At the end of 2029, Woodside’s Louisiana LNG should be entering service, with this project formerly known as Driftwood LNG when it was being developed by Tellurian. Recently, Cheniere secured a final investment decision for another Corpus Christi expansion, Midscale Trains 8 and 9. This combined with a planned debottlenecking project should increase capacity by about 20% and will be completed by the end of the decade. By the end of the decade, US LNG feedgas demand should approach 27 Bcf/d. This is about 10 Bcf/d more than the current maximum capacity and will require continued strength in supply growth to keep the market balanced. This should be a bullish factor for Henry Hub, although any delays to this timeline could pose a substantial risk to forward prices.