Prompt Henry Hub prices have fallen more than 60c from June highs; meanwhile, several basis locations have improved. There is often an inverse relationship between Henry Hub and basis prices, with this providing an opportunity for hedgers to lock in improved basis. Gains can be found in most regions, but Northeast and Gulf Coast hubs, such as TETCO M2, Dom South, and NGPL-TXOK increased sharply.

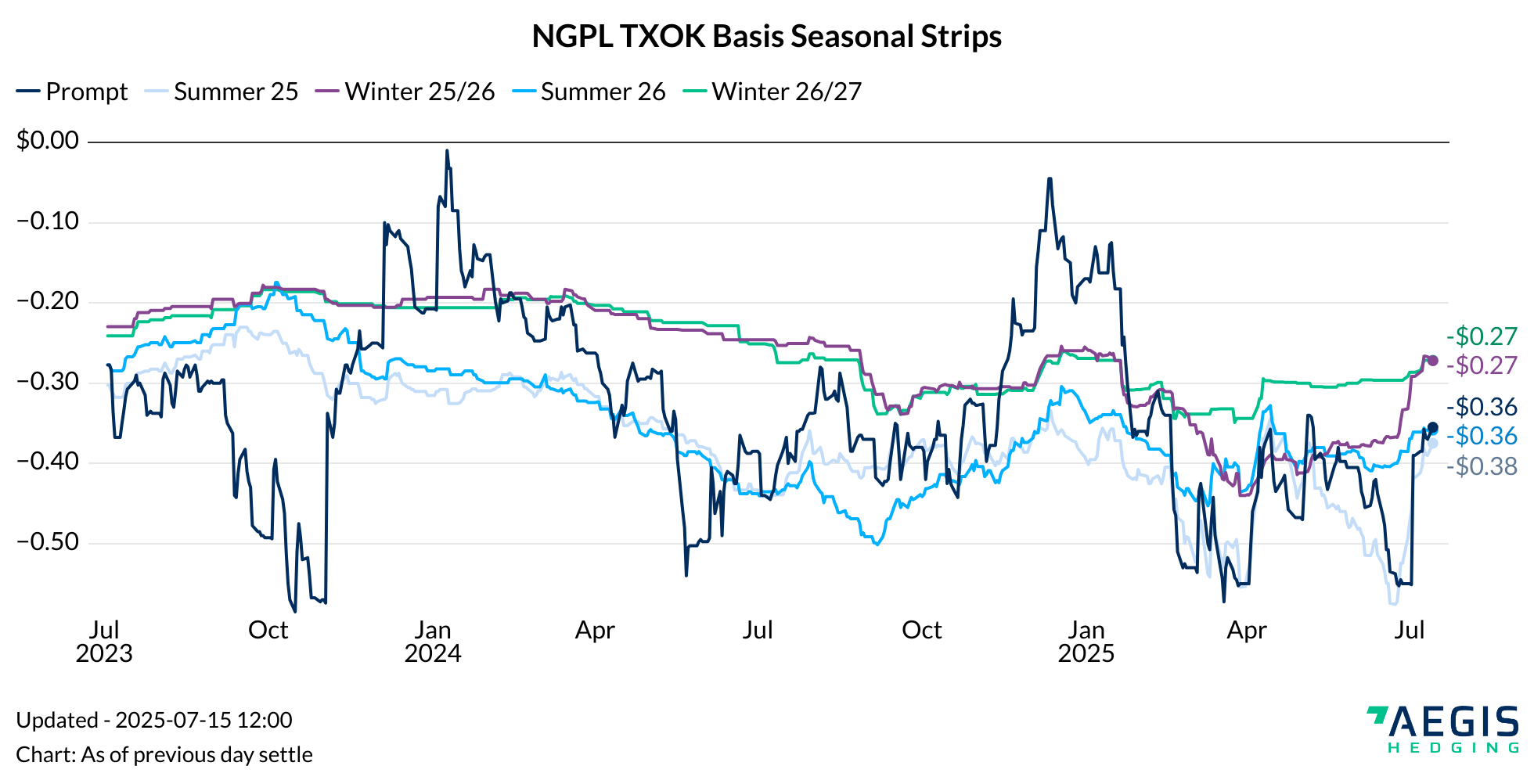

The chart above shows the evolution of the rolling prompt month and the next few seasonal strips for NGPL-TXOK basis. Improvements have not just been limited to the prompt contract, as Winter ‘25/’26 has also gained 10c since June 24, rising to a year-to-date high of -$0.27/MMBtu. Summer ’26 and Winter ‘26/’27 have also improved, with prices now at the highest level in several months. NGPL-TXOK is just one example, but several other Gulf Coast basis markets have also moved higher.

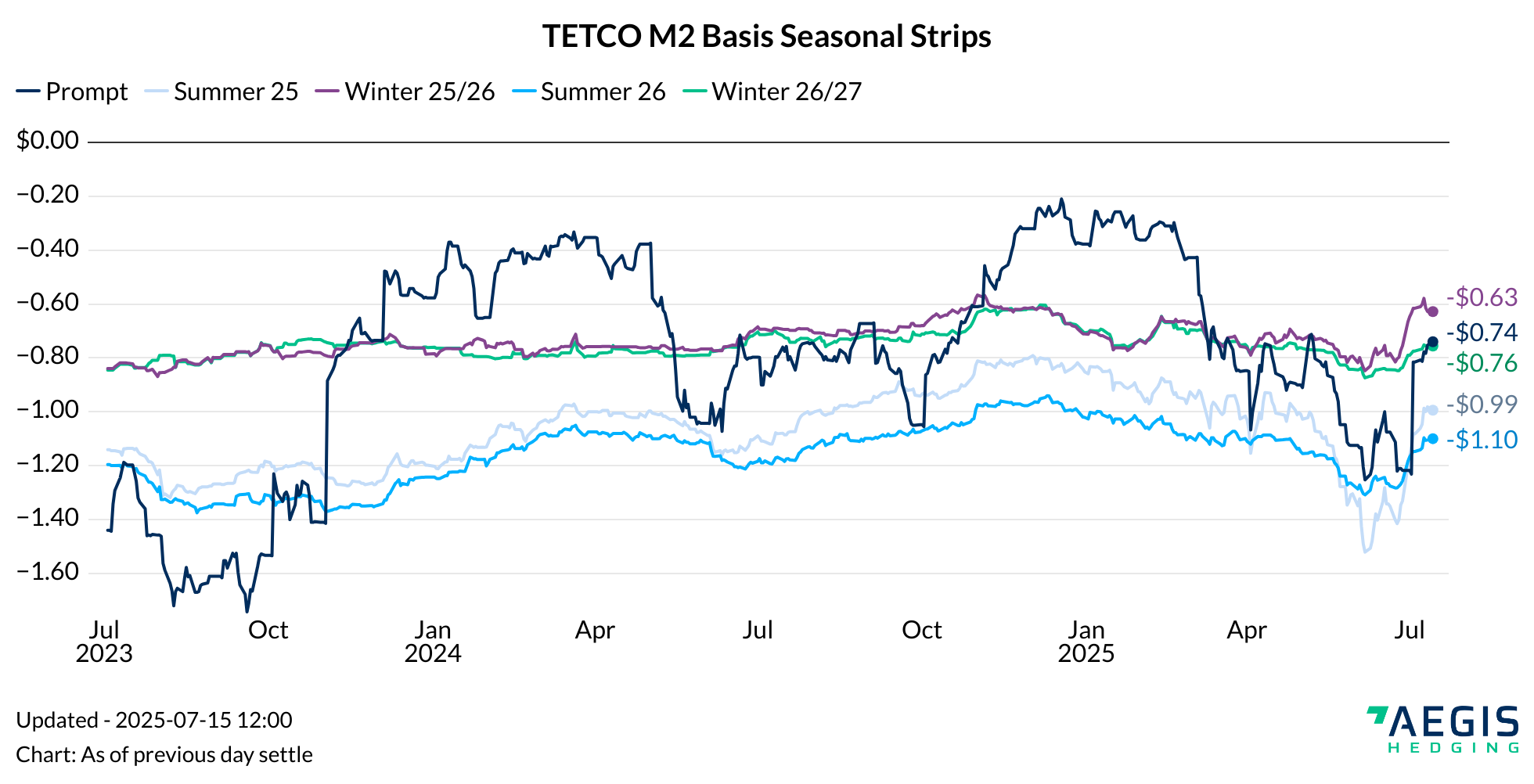

Northeast and Appalachian hubs have also traded higher, with the chart above showing the seasonal strips for TETCO M2. Winter ‘25/’26 has gained nearly 20c since June 24, with the rest of the forward curve also being pulled higher. In addition to a drop in Henry Hub prices, northeast basis is likely being further supported by a drop in Appalachian production, which should prove temporary.

While spreads to Henry Hub have tightened, fixed price M2 or NGPL-TXOK have been mostly flat over this period. This goes to show the impact that price moves in Henry Hub can have on basis, although regional supply-demand dynamics like changes to production or local demand will also drive price action. Many hedgers opt to trade both the Henry Hub leg and the basis at the same time, but for producers who trade them separately this could be an opportune time to take advantage of the inverse relationship between basis and Henry Hub.